Slowing economic growth may cause some market volatility or even a correction, but we think the real risk to equities is a recession. With little risk of recession on the horizon, many companies can grow revenues and earnings in a slow growth environment, which can support higher stock prices. Historically, equity prices peak about six months before a recession. With minimal risk of a recession in the near-term, our work suggests that equity prices can make new highs.

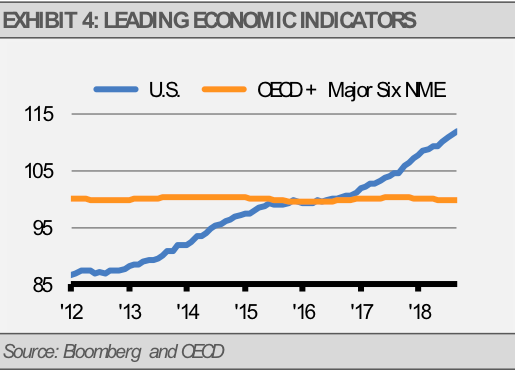

There are some strong fundamental trends that point to continued, albeit slower, economic growth. For example, global leading economic indicators suggest relatively muted global growth. Even though the vast majority of U.S. economic activity is based on the domestic economy, slowing global growth should create a headwind to U.S. growth. Meanwhile, personal income continues to slowly but steadily grow, up almost 5% since last year, along with personal spending. Finally, we expect jobs creation in the U.S. to remain above the approximately 100,000 new jobs per month that is required to keep pace with the estimated growth rate of the U.S. labor force. This should provide a positive feedback loop for consumer income and spending.

The combination of the stock market selloff and positive earnings growth has pushed the forward price-to-earnings ratio for the S&P 500 Index below its 5-year average. We think that this creates a good opportunity to purchase high quality assets, and a shift in Fed policy could provide the impetus for stock price appreciation.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.