![]() By Marc Odo, Swan Global Investments

By Marc Odo, Swan Global Investments

Options-based strategies have been growing rapidly over the last decade, both in terms of available solutions as well as assets under management. As of May 31, 2018, there are 176 funds with over $20bn AUM in the Morningstar category “Options Based.” So what makes this options-based strategy so popular?

As part of our ongoing comparison series, we will explore the following:

- What are the drivers of returns in a collar strategy?

- What are the risks in this strategy?

- What role does a collar play within a portfolio?

- How does a collar compare to the Defined Risk Strategy?

The Collar Strategy

With a collar strategy, the manager typically has a long underlying position in a portfolio of stocks. The manager seeks to protect against downside risk by purchasing an out-of-the-money put option. While it is certainly prudent to protect against downside risk, put options obviously cost money.

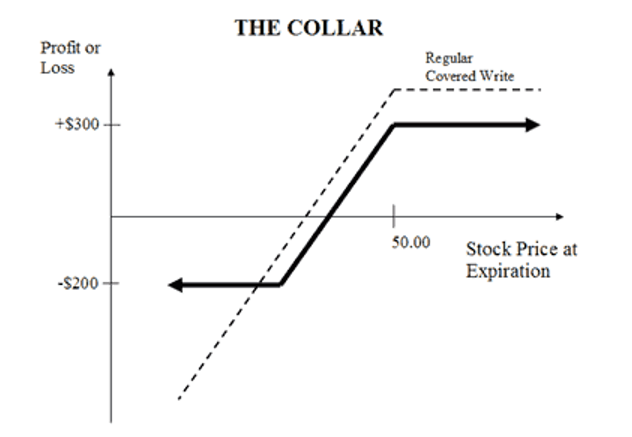

To help offset the cost of the put options, a collar strategy seeks to generate income by writing out-of-the-money calls against their market position. In effect, this caps the upside potential of a collar. This is the fundamental trade-off of a collar strategy: downside protection is purchased in exchange for selling away some of the upside potential.

Components

A collar typically has three components:

- A long, buy-and-hold position in a market

- Long, out-of-the-money puts to protect on the downside

- Short, out-of-the-money calls to help pay for the puts

Below is a graph outlining the return profile of a covered call strategy.

Source: www.theoptionsguide.com

A “Protected” Covered Call

If the above chart looks a bit familiar, it should. The collar strategy is closely related to the covered call. In fact, two of the three legs of the collar are the same as the covered call: the long equity position and the short call position.

With the covered call strategy, we stated that one of the drawbacks is there is no downside protection. One way of thinking of collars is that they are essentially “protected” covered calls: using the premium they generate from the short calls not for income but to purchase downside protection.

Drivers of Returns

The primary driver of the collar strategy’s returns is the movement of the market itself. Not only is the direction of the market important but the degree or magnitude of the market’s move is also significant. It is often said that a collar is a moderately bullish strategy.

The key word is moderately. Since the core of a collar is a long position in a portfolio of equities, the holder obviously hopes that the market goes up. However, the risk is if the market goes up too much, the call options will go from being out-of-the-money to being in-the-money. Under such circumstances, the portfolio manager really only has a few options.

One, they could close out the trade and take a loss on the option trade. Two, the underlying asset could be called away and miss out on the gains. Or three, the portfolio manager could cross their fingers and pray that the market reverses direction and dips back below the strike price before being called. Either way, the collar has effectively sold off its upside potential in a sharply rising market.

Of course, the benefit to the collar strategy is when the market goes down. If the market goes past the put strike and if the collar was implemented correctly, the strategy should be protected from losses beyond a certain point.