By Adam Grossman

THE RIVERFRONT WRITING TEAM

REBECCA FELTON

Senior Market Strategist

ADAM GROSSMAN, CFA

Global Equity CIO | Co-Head of Investment Committee

CHRIS KONSTANTINOS, CFA

Director of Investments | Chief Investment Strategist

KEVIN NICHOLSON, CFA

Global Fixed Income CIO | Co-Head of Investment Committee

DOUG SANDLER, CFA

Head of Global Strategy

ROD SMYTH

Chairman of the Board of Directors

Summary

- We are taking PATTY into consideration when assessing dividends

- With a historical view in mind, we believe dividend yields may be good for return contribution to stocks

- We believe dividend growth strategies will be more important as earnings growth reverts to a lower rate

Not All Dividends are the Same

What was old may be new again, offering possible clues about the bull market’s next stages

As we orient our portfolios for a ‘PATTY’ (Pay Attention To The Yield) environment, a substantial part of our strategy is to lean on dividends from our equity positions. Although a dividend is simply a cash payment to shareholders net of expenses and funds set aside to fund growth, there are a lot of nuances to how the cash was earned. These nuances determine whether the company can continue to pay, or ideally grow that dividend in the future. Today we focus on why dividends can be a useful part of an investment strategy, our principles of dividend investing, and finish with profiles of different types of dividend-paying companies and how we think about allocating to each of those strategies in our portfolios.

Why Dividends Can Be a Useful Part of an Investment Strategy

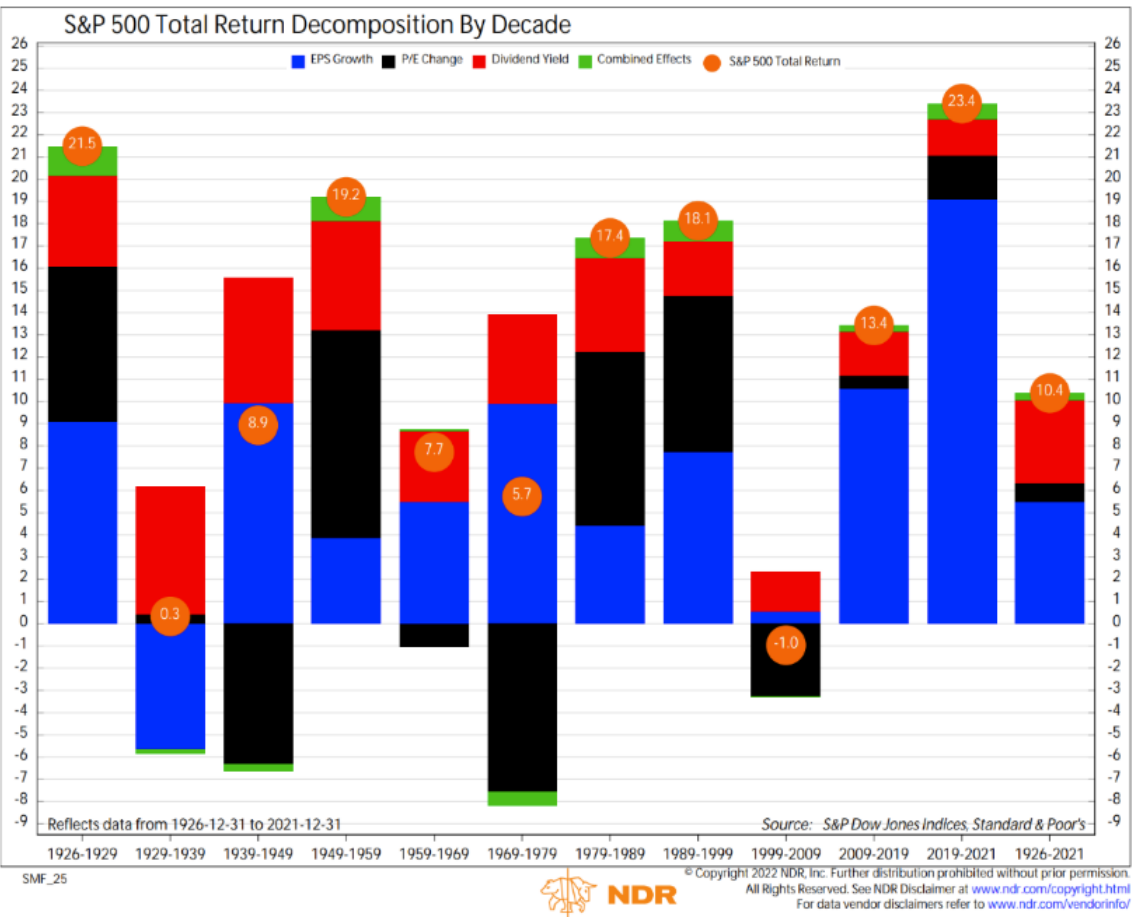

The act of paying dividends is in and of itself a powerful component of shareholder returns. Historically, the compounding of dividends has represented a significant portion of the overall total return of US large-cap stocks. A study by NDR (Ned Davis Research) suggests that, of the approximate 10.4% total annual return of stocks from 1926-2021 (see chart below), approximately 35% of that return came from the dividend (red portions of bar chart), second only to earnings (blue portions of bar chart) in terms of percentage contribution.

In the post-2009 financial crisis era, earnings growth, rather than dividend yield has dominated total return contribution. However, in prior decades such as the 1930s, 1960s and 1970s – eras dominated by greater economic uncertainty and volatility – dividend yield was a much larger portion of the overall return contribution to stocks. During these times, dividends proved a reliable return driver in a world where valuation expansion and/or earnings growth couldn’t be counted on to augment returns. With our current ‘back to the future’ world of economic uncertainty and higher inflation, we believe dividend growth strategies will be more important as earnings growth reverts to a lower, more normalized rate through the next business cycle.

Our View: Three Principles of Dividend Investing

1. Steady dividend payments can be a sign of financial health

For a company to pay a dividend, it must generate more cash than necessary to fund operations, in most instances. Companies that achieve this stage of self-sufficiency typically operate in already well-established markets, have attained a stable market presence, and no longer need significant levels of capital for product development or marketing.

2. You can’t pay out what you don’t earn (at least not for long), and cutting a dividend can be a painful experience for a company

A risk with dividends is that investors punish companies for cutting dividends, which can create a perverse effect whereby companies will borrow just to fund the dividend and essentially spend money they don’t have. This dynamic can turn the “dividends show discipline” argument on its head. This can create corporate risk for companies as they add debt to their balance sheets or forgo necessary investments to pay dividends and/or to avoid cutting a dividend, which investors have learned to take as a sign of distress and lower stock prices accordingly.

3. It’s not just about dividends; we think free cash flow is more important than dividend policy

When researching a company or a theme, RiverFront’s policy is to focus primarily on free cash flow. In our view, free cash flow allows companies the flexibility to make positive capital allocation decisions. Depending on the business model and the maturity of the company, this could involve investing back in the business, or returning cash to shareholders in the form of share buybacks or dividend payments. With these principles in mind, we recognize there are three primary approaches to paying dividends.

Our View: The 3 Broad Types of Dividend-Paying Companies and Their use in Portfolios

1. High Payers / Low growers: paying cash out as it comes in

Generally, there are two types of companies that pay out almost all their earnings in dividends: risky cyclical payers and low growth equities. Risky payers tend to be companies in highly cyclical industries and sectors whose cash flow – and thus dividends – depend on a combination of cyclical earnings and debt. We view these dividend sources as lower quality because of the risks inherent in the industry. These companies frequently become ‘cheap’ because of their inherent risks, prompting us to buy them selectively and tactically. We generally do not use these companies as a large part of a long-term strategy because of their cyclicality and risks of dividend cuts.

The other type of high-yielding dividend stocks are slow growing, low volatility equities, often in regulated industries. They typically have stable cash flow structures that make changes in earnings less likely than the average company. Their lack of growth prospects means they pay out most of their net profits. We view these types of companies as behaving similarly to fixed income instruments and believe they can be attractive at times in a balanced portfolio to get more income than bonds typically offer, while presenting less downside risk than stocks typically do. The two major factors in buying companies in this category are: not overpaying for them, and being aware of risks to their cost structure, since revenue increases tend to be limited.

2. Dividend Growers: balancing dividends and growth

Companies that balance cash flow growth and dividend payments tend to be more attractive selections to RiverFront. A lot of our selection processes focus more on the free cash flow that is being generated from these companies than on the dividends that are paid, as we recognize that even a company with a small dividend yield (dividends divided by the price) will eventually accumulate healthy amounts of dividends paid through steady growth and the principle of compounding over time. Indeed, many of the highest performing companies in the S&P 500 (Standard & Poor’s Index 500) over the past ten years have paid a portion of their earnings out in dividends. These companies typically use the portion not paid out in dividends for share buybacks and reinvestment in projects, creating a trend of profitable earnings and dividend growth that is attractive to investors.

Two common pitfalls when investing in dividend growers are: overpaying for growth and underestimating the threat of competition. Avoiding overvaluation requires being attentive to the value of a company and comparing it to the earnings it has and what we believe it will generate. Another risk with these companies is long-term loss of the competitive advantage that has allowed these companies to generate earnings. This means that as investors, we must keep track of sources of disruption, even in companies that we might not see as suitable investments.

3. Non-Dividend Paying Companies: reinvesting for the future

Non-dividend paying companies generally fall into two categories, in our view: those with free cash flow and those without. Many of the largest, most profitable companies in the S&P 500 choose to pay no dividends. We are happy to invest in strong free cash flow companies who are reinvesting in their businesses, many of whom also buy back their own shares. By way of example, some mega-cap technology companies have gone through long periods where they did not pay dividends and now do, producing two of the largest dividend payers in dollar terms in the S&P 500.

We tend to avoid companies with unproven earnings or revenue. When researching a stock that doesn’t pay a dividend, it is important to pay attention to the source of the company’s earnings and to attempt to be conservative in any assumptions regarding how long those earnings can persist. This leads us to be skeptical of many non-dividend payers.

Implications For Our Portfolios

As part of our portfolio strategy, we can and will invest in all the different types of companies depending on the stages in the business cycle and the needs of the portfolio. We believe a prudent strategy both for our ETF and individual stock selection is to understand the underlying earnings and dividend generation power of a security, and to compare that value to the price we are paying for it. In the current environment, we prefer to seek income from our fixed income strategies or selective income alternatives. We then balance that with stocks whose yields are lower but where we see greater growth potential.

In Summary

- We think dividends will be an important source of future returns

- While dividends can be a source of financial discipline, they are not something investors should blindly seek

- We believe the best returns ultimately come from companies with strong free cash flow, allowing them to sustain and grow their dividend.

Provided by RiverFront Investment Group.

For more news, information, and strategy, visit the ETF Strategist Channel.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Principal Risks:

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Mega cap is a designation for the largest companies in the investment universe as measured by market capitalization. While the exact thresholds change with market conditions, mega cap generally refers to companies with a market capitalization above $200 billion.

Exchange-traded funds (ETFs) are sold by prospectus. Please consider the investment objectives, risk, charges and expenses carefully before investing. The prospectus and summary prospectus, which contains this and other information, can be obtained by calling your financial advisor. Read it carefully before you invest. As a portfolio manager and a fiduciary for our clients, RiverFront will consider the investment objectives, risks, charges and expenses of a fund carefully before investing our clients’ assets.

Dividends are not guaranteed and are subject to change or elimination.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2390991