![]()

Source: Swan Global Investments

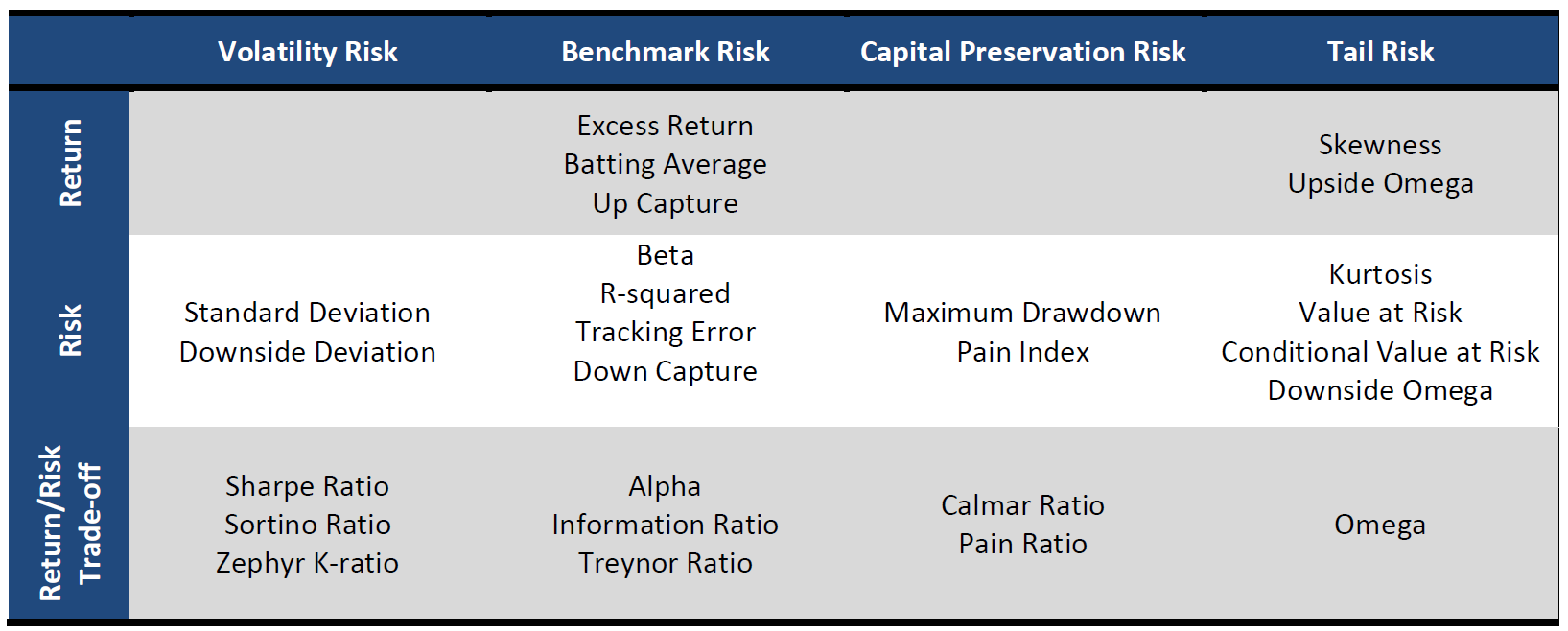

There are certainly more performance metrics out there, but most of them would fit somewhere within this framework.

With this framework, it should be easier for individuals to pick the metric that best suits what they want to specifically measure and compare when looking at different funds’ performances.

While certain metrics like beta are well established and well understood, many of the newer, higher-level statistics could use a bit of explanation. This is especially true of the newer, post-MPT statistics in the “Capital Preservation” and “Tail Risk” columns that are more useful for analyzing hedge funds and liquid alternatives. We have already discussed Pain Index and Pain Ratio, two favorites here at Swan Global Investments. With a focus on measuring alternative investments, some metrics we will discuss in this series are Omega and Zephyr K-Ratio.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.