By Komson Silapachai, Sage Advisory

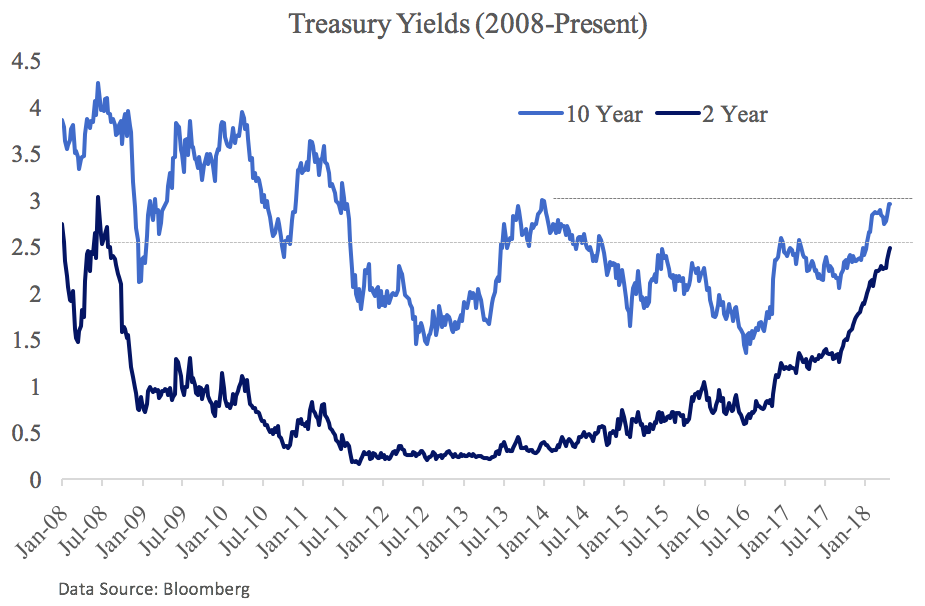

A rising tide lifts all boats, but do rising rates lift all assets? The yield on 10-year Treasury notes rose above 3% last week – the highest it’s been since 2014 – and the yield on two-year Treasury notes hasn’t been this high since the 2008 financial crisis.

![]()

When interest rates rise, many investors fear a negative effect on the economy. A combination of rising inflation, increased bond supply, and the Federal Reserve’s tightening policy have caused the recent increase in yields. In what ways could higher rates lead to lower growth, and more importantly, how should ETF investors position themselves?

Higher Rates – A Risk Factor for The Economy?

Here are how higher interest rates could negatively affect growth:

- Rising interest expense for the corporate sector. Companies that finance their operations with debt incur interest expense, which drives down profit margins. According to JPMorgan, a 100 basis point increase in bond yields typically results in a 1.5% drag on S&P 500 earnings (not including financial services companies, which would see a benefit to earnings). Until recently, rates had remained relatively low since the financial crisis, and the lower interest expense has been a huge driver of corporate profit margins. Increasing rates would in theory reverse that trend. However, the impact of higher rates is mitigated by the fact that corporate debt has generally been issued at longer maturities (an average of 10-plus years) and at fixed rates, so rising interest expense is not an immediate concern at the macro level.

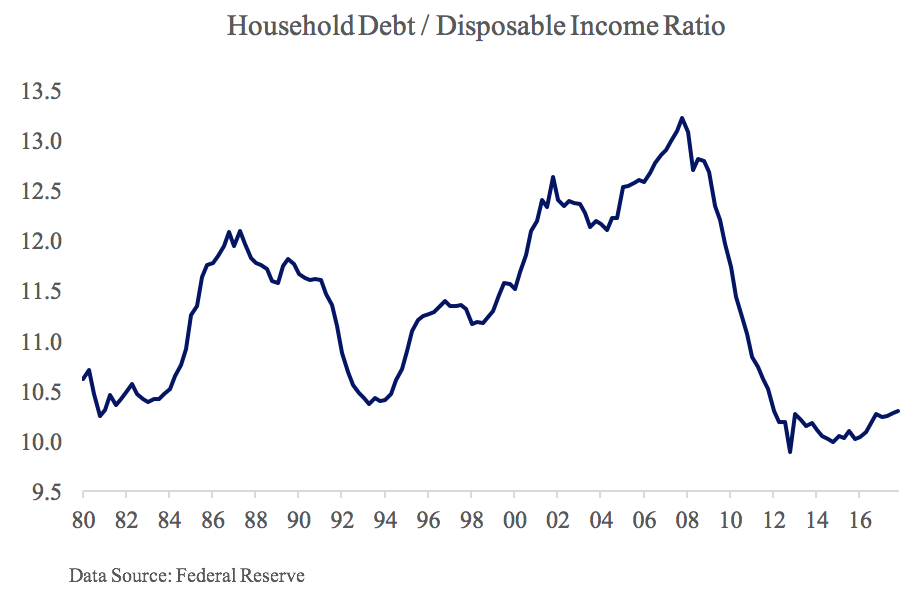

- Lower consumer demand due to rising interest expense for households. Higher interest expense decreases the level of disposable income, which should lower consumption and as a result, reduce GDP growth. This impact is somewhat mitigated as households have deleveraged over the past decade, and household debt service ratios remain at multi-decade lows.