Floating rate asset-back securities (ABS), corporate bonds, and leveraged loans are all priced based on LIBOR, the London Interbank Offered Rate. This rate is set by a consortium of banks in the UK, and it is meant to represent the rate at which one bank would lend to another at various maturities. The ABS floaters generally price off the one-month LIBOR rate, while corporate securities generally use the three-month LIBOR rate as the benchmark. Because it is a rate of interest between banks, LIBOR has a credit component embedded along with pure interest rate considerations. As such, LIBOR rates tend to increase during periods of financial stress, while pure nominal interest rates tend to decline.

Related: ETF Trends Fixed Income Channel

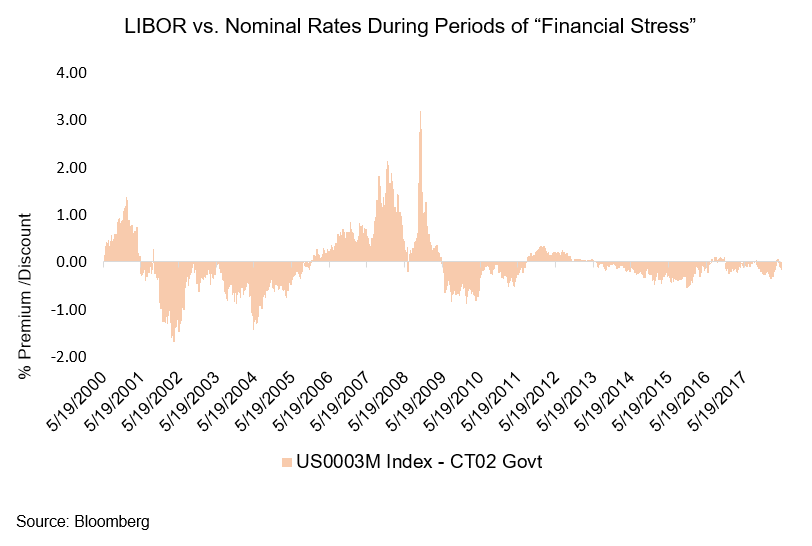

The chart below shows LIBOR versus the two-year U.S. Treasury. During the Dotcom Bubble, the Great Recession of 2008 and, to a lesser extent, during the European Debt Crisis of 2011, LIBOR increased while nominal rates decreased (as is typical in a “risk-off” environment).

![]()

This increase in LIBOR allows the coupon to increase to levels that will insulate bondholders somewhat from the dramatic spikes in both interest rates and credit spreads. The fixed income market has benefitted from a prolonged low-spread and low-rate environment, but there’s reason to believe that may be coming to an end. As credit spreads increase concurrently with rising interest rates, we believe that floating rate bonds and loans are the best place for fixed income investors to achieve positive returns.

This article was written by Ryan O’Malley of Sage Advisory, a participant in the ETF Strategist Channel.