By RiverFront Investment Management

Security selection and risk management Increasingly Important

Each quarter we publish a chart pack meant to keep investors apprised of each of the major inputs to our portfolio management process: strategic asset allocation; global macro and tactical outlook; and security selection and risk management. In this edition of the Weekly View we have chosen to focus on security selection and risk management given their elevated importance to portfolio returns during mature bull markets. For the complete Q3 2019 Chart Pack, click here (link for financial advisors only.)

SECURITY SELECTION IMPORTANT AS BULL MARKET MATURES

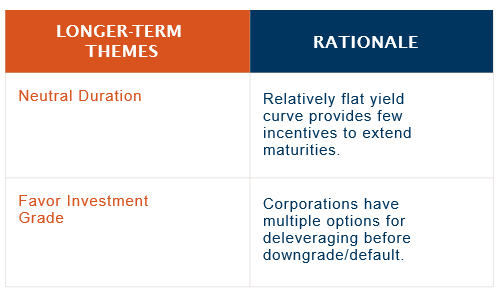

Fixed Income: In a low-interest rate environment, we believe the asset class that appears least attractive / most overvalued is fixed income; with 10-year Treasury yields well-below 2%.

Source: RiverFront. Opinions are as of date shown above and subject to change. Not intended as investment recommendations.

Therefore, we think security selection in the bond market is even more important than security selection in the stock market. For example, in the US many bonds fail to offer positive yields after accounting for normal levels of inflation. Overseas, the prospects are even dimmer with sovereign bonds offering negative yields throughout the developed world.

Because we expect that inflation will remain below the Fed’s target of 2% and 10-year Treasury yields will remain between 1.5% and 2.0%, we don’t expect a bear market in bonds. Therefore, our fixed income positioning is structured to dampen volatility, especially in our shorter-time horizon portfolios.

International Equities: While we believe international equities as an asset class are more attractively valued than US equities, the heightened geo-political uncertainty warrants the need for greater selectivity in foreign stocks. There are two issues we have tried to mitigate. First, with the trade war still simmering, we see earnings under pressure in export-oriented economies, especially emerging markets. Second, we expect earnings to be further pressured in parts of Europe, particularly the UK, as companies forego hiring and spending until Brexit is resolved.

Source: RiverFront. Opinions are as of date shown above and subject to change. Not intended as investment recommendations.

Unlike the US, whose economy has remained relatively stable thanks to the US consumer, overseas consumer and business sentiment surveys remain poor. As can be seen in the table on page 1, we have sought to limit our exposure to those regions most impacted by trade and European politics.

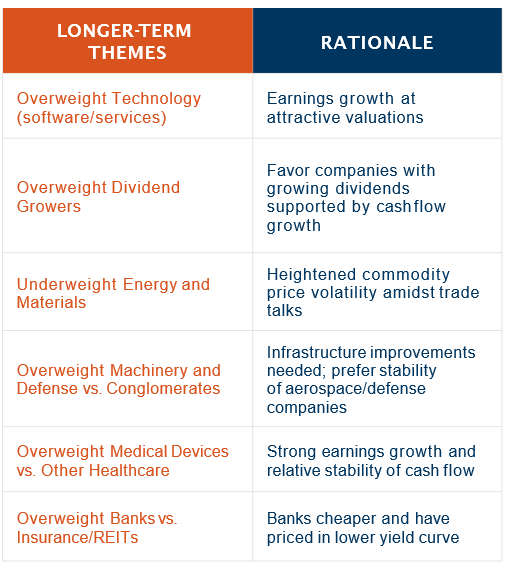

US Equity: ‘A rising tide lifts all boats’ seems to have been the theme for US equity markets since the Great Recession ended in 2009. However, after a decade of strong equity returns, the likelihood of above-average returns has decreased, in our view. We therefore expect security selection to play a growing role in portfolio performance, similar to the latter stages of previous bull markets. Our current security selection favors themes and companies that share the following characteristics:

- Ability to grow revenue in a slow economic environment.

- Possess efficient and prudent capital structures to weather economic hiccups.

- A history of rewarding shareholders with growing dividends.

The table below highlights a few of our current preferences in US equities.

Source: RiverFront. Opinions are as of date shown above and subject to change. Not intended as investment recommendations.

RISK MANAGEMENT: HEIGHTENED UNCERTAINTIES DEMAND RISK MANAGEMENT PLANS

RiverFront’s Risk Management is designed to keep emotions out of the investment decision making process. The risk management process is layered and focused on identifying the risks associated with individual positions as well as broader portfolio risks such as: asset class, country, and sector exposures. Its four key tenets are:

- Independence of risk team

- Identify and quantify risk

- Set boundaries and monitor

- Authority to take action

Geo-political risks are currently high and many of these risks have binary outcomes… ‘good’ or ‘bad’… and it is critical to plan for either result. We have described our approach to this environment as: ‘stay at the party but drink water.’ ‘Staying at the party’ is all about participating in the upside from a ‘good’ outcome by maintaining exposure to global stock markets. ‘Drinking water,’ on the other hand, is remaining sober to the risks. With our portfolios positioned in-line with long-term equity/bond targets, we have the flexibility to quickly adjust our portfolio mix and have plans in place to do so.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-income-producing asset and is highly speculative. Therefore, commodities should not represent a significant portion of an individual’s portfolio.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

You cannot invest directly in an index

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 995399