Astoria’s key message now is this: long duration assets are experiencing a recession while there is a bull market for inflation-sensitive assets. It is our opinion that in the current environment, it would be wise to be globally diversified, own multiple factors, and utilize alternatives. It is important to hedge your inflation risk; CPI is not returning to its former trend-line anytime in the foreseeable future. Regarding the Fed, Astoria thinks there is a high probability that we have seen peak Fed hawkishness and bearish sentiment.

In previous recessions, the average pullback from SPY is 27%. Thus far, SPY has fallen 20%. Historically, there has been a favorable risk-reward for buying stocks during a recession. Stocks are on sale; create a shopping list.

What are we telling clients?

- Remain calm. Panic has likely reached its peak; this often coincides with market bottoms.

- A globally diversified portfolio utilizing alternatives is experiencing much less of a drawdown that SPY or QQQ.

- If you are worried about your portfolio, then you have too much risk.

- It is not too late to purchase inflation hedges and alternatives.

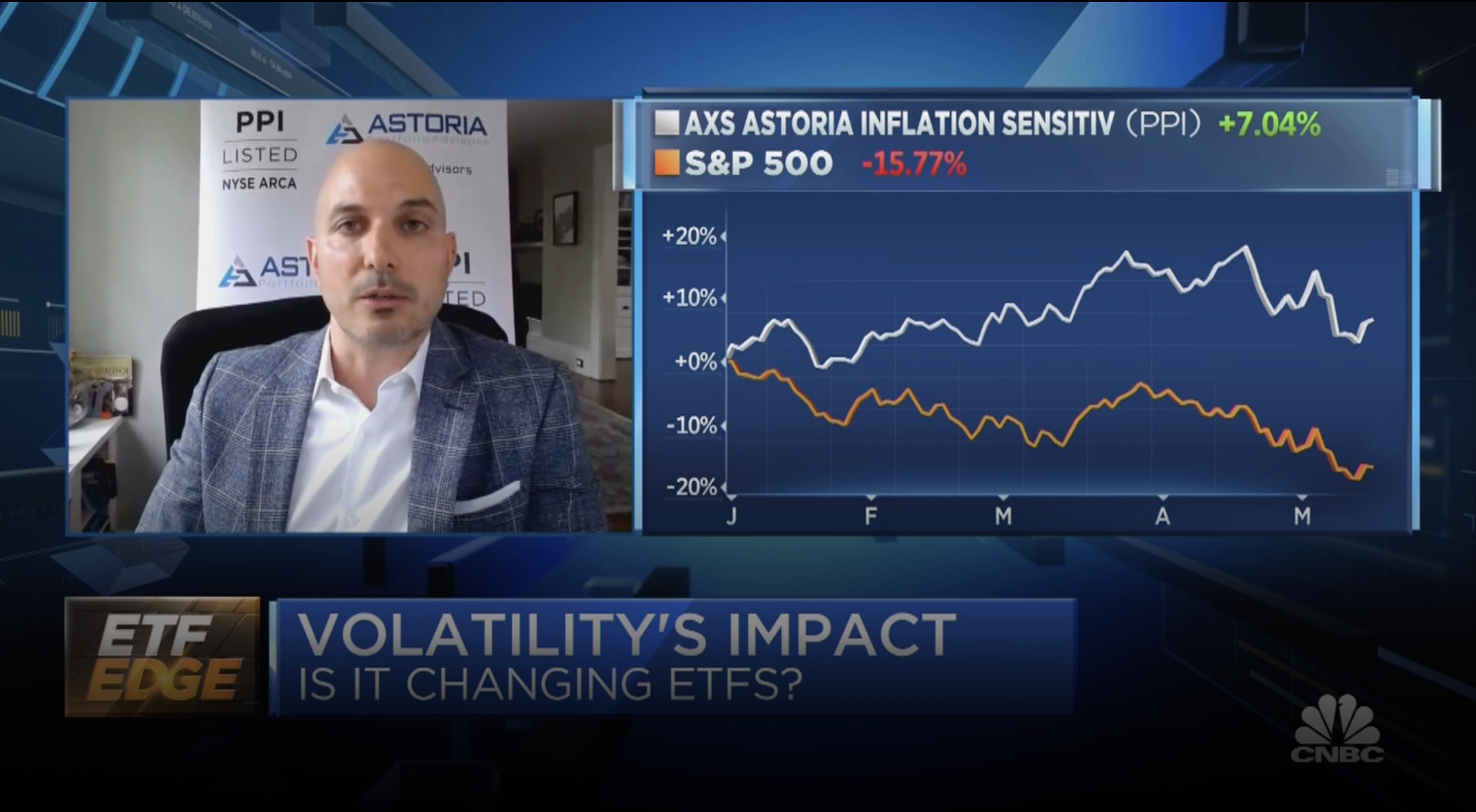

- Always keep alternatives in your portfolio. BTAL and PPI are up 15% and 7%, respectively, YTD while SPY and QQQ are down 15% and 25% YTD, respectively.

- To keep up with inflation levels, it is beneficial to own energy stocks, commodities, and commodity equities; SPY is currently not keeping up with inflation, in 2022.

Astoria does not expect a 2002/2008/2020 market reaction

- Corporate and household balance sheets are strong.

- The US consumer and economy remain strong. There is still ample spending and travel occurring.

- The market can appropriately price inflation risk. We have observed periods of rampant inflation in the past (i.e., 1970s).

- The market reacted the way it did in 2002, 2008, and 2020 because of unique, first-of-their-kind risks to the market

- SPY has a PE ratio of 17. Its long-run average is 15. Can the multiple decline further? It is possible, but it is impossible to time valuations.

- It is probable that the Fed tones down its hawkishness after 1-2 more rate hikes, avoiding a recession.

Active ETFs

- Too much money has been invested into passive ETFs which distorted valuations.

- The current environment favors actively managed ETFs. We suggest tilting portfolios away from technology, growth, and nominal bonds, given how valuations are no longer viable.

- Active management during a recession makes sense. Active managers can help by tilting towards value with dividend-paying and cash flow-producing entities.

- The conversion of active mutual funds to ETFs could be the ETF story of the year.

- It is safe to expect the arrival of more outcome-oriented ETFs that deliver specific solutions i.e., JEPI which has an 8% yield. The market is already saturated with beta and thematic ETF products.

Astoria Portfolio Advisors Disclosure: As of the time of this publication, Astoria held positions in PPI, BTAL, SPY, and QQQ, on behalf of its clients. Past performance is not indicative of future performance. Any third-party websites provided on www.astoriaadvisors.com are strictly for informational purposes and for convenience. These third-party websites are publicly available and do not belong to Astoria Portfolio Advisors LLC. We do not administer the content or control it. We cannot be held liable for the accuracy, time-sensitive nature, or viability of any information shown on these sites. The material in these links is not intended to be relied upon as a forecast or investment advice by Astoria Portfolio Advisors LLC and does not constitute a recommendation, offer, or solicitation for any security or investment strategy. The appearance of such third-party material on our website does not imply our endorsement of the third-party website. We are not responsible for your use of the linked site or its content. Once you leave Astoria Portfolio Advisors LLC’s website, you will be subject to the terms of use and privacy policies of the third-party website. Refer here for more details.

Please note that Astoria Portfolio Advisors serves as a subadvisor to the AXS Astoria Inflation Sensitive ETF. Readers should consult their financial advisor to determine if PPI is a suitable investment for their portfolio. For more information on PPI, please click here.

Photo Source: CNBC