By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

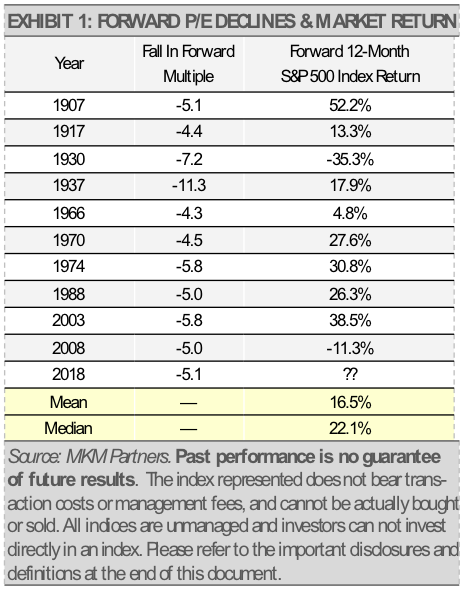

Overall, our base-case scenario is constructive and built on solid U.S. economic fundamentals that are now combined with compelling equity valuations resulting from the recent market declines. The forward price-to-earnings (P/E) ratio of the S&P 500 Index fell 5.1 between December 2017 and 2018. History suggests that when the price to expected 12-month earnings for the S&P 500 Index has fallen by a similar degree as it did during 2018, the returns over the next 12-month can be significant (exhibit 1).

However, we recognize that there are significant risks to the global economy and the markets. We estimate that about half of the recent equity market declines were associated with what we view as non-fundamental risks to the U.S. economy, such as trade wars and other geopolitical threats. Furthermore, we expect global economic growth to slow, which should result in slower corporate revenue and earnings growth.

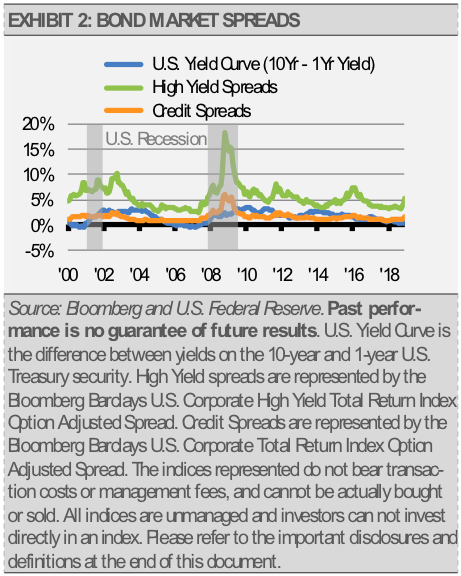

We continue to think that the primary risk to the U.S. economy and the continuation of the current business cycle is U.S. Federal Reserve (Fed) policy. Given the flattening yield curve, slowing money growth, declining market-based inflation expectations, such as TIPS spreads, and the slowing pace of economic growth, we think that the Fed should stop raising interest rates and declare victory (exhibit 2).

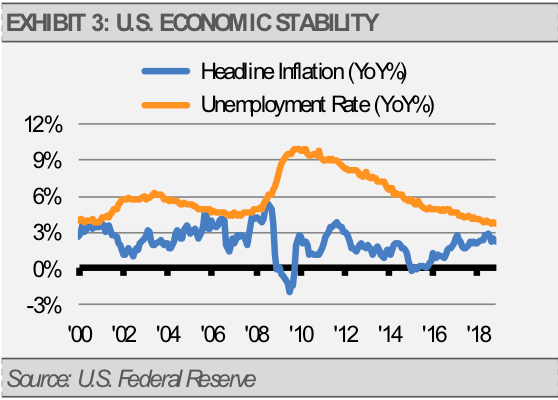

Since the recovery from the global financial crisis began, we think the Fed has done a good job with actual monetary policy, but not with their communication. Our economy is experiencing low unemployment and low inflation at the same time that the it continues to grow. That is a great outcome and much of the credit should go to the Fed (exhibit 3).

All things being equal, if the Fed were to make an announcement that they were done for now, we believe that this business cycle would continue, corporate revenues and earnings would grow, and stock prices would move higher.

Conversely, if the Fed were to continue to raise short-term interest rates, we would respond quickly by paring back on equities while increasing our allocations to high-quality bonds and cash.

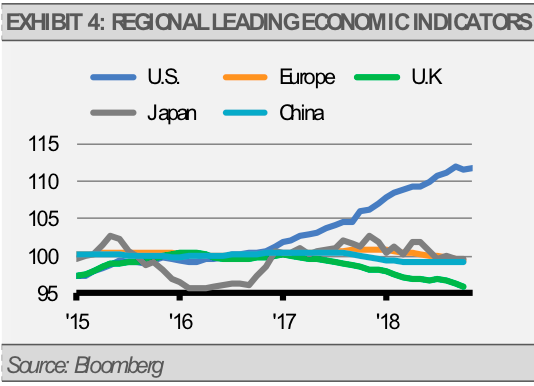

Unless the global economy picks up pace, driving long-term interest rates higher, we think the Fed should stop their rate hikes. Long-term interest rates are driven by global economic factors because the market for U.S. Treasury bonds is a global market. Central banks, large corporations, and other institutional investors dominate the U.S. Treasury market. We think that the Fed should be concerned with economic developments in Europe, Japan, and other major economies. Global leading economic indicators suggest that the U.S. is on solid footing, but the rest of the world looks relatively sluggish overall (exhibit 4).

INVESTMENT IMPLICATIONS

In 2019, we think that it will be critical for investors to be ready for a binary set of potential outcomes. It will likely be important to continue putting risk first while also being ready to act tactically to potentially benefit from an equity market recovery. Equally crucial, we think that investors should be ready to take defensive tactical positions in the new year, along with the willingness and ability to raise cash up to 50% of a portfolio, as can be done via our Cash Indicator methodology.