By Jonathan Bernstein, Stringer Asset Management

Change the Channel – Set the Tone!

Behavioral finance helps us to understand how human emotions can derail the rational investment decisions needed to achieve longer term goals. The financial markets and information related to financial markets, politics, and the economy is chaotic, confusing and difficult for Individuals, families and even institutions to navigate. Utilizing a Financial Advisor may help if that advisor represents steady hand and voice of reason. An Advisor can be the bridge that spans the gap between where an investor is and where they want to go.

Loss Aversion

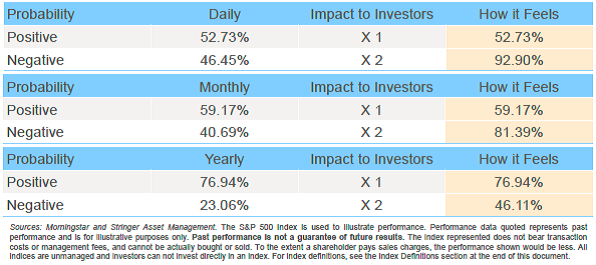

Viewing individual investors from a behavioral perspective it’s crucial to consider prospect theory or more specifically loss aversion. The theory states that investors feel pain of loss twice as much as euphoria of gain. That emotional responses can lead to emotional errors for investors that focus on shorter time frames. Summarizing the chart below, over longer time periods the upward bias to the financial markets provide a higher probability of a positive return (yearly) while shorter time frames those probabilities of gain or loss are almost equal. Additionally, the “how it feels” column measures the impact that might have on investors as they consider returns on a short term versus a longer-term basis. In this chart there is a similar probability, between a gain or loss on a given day and that impact on the individual investor is significant.

The Waiting Experience

I recently walked into a Financial Advisor’s waiting room on a particularly volatile market day and sat with a couple who were waiting for their Advisor. There was a TV in the waiting room tuned into some business news channel. Considering that there is a roughly equal chance that the business news and markets will be showing positive results on that day versus negative, a given client may feel good or bad about it and should that be a negative day feel the negative market nearly twice as much. On this particular day, they were showing a chaotic live feed from the floor of the exchange. The chyron read something like, “Trade Tensions Crater Markets.” while the ticker at the bottom of the screen rolled by just fast enough to see that everything was red but without context. The clients sat quietly and watched and the longer they waited the more agitated they became. Before they went into their meeting, the wife turned to her husband and said, “This is bad, just tell him we want to just go to cash.” What a way to start a meeting! And I’ll bet the advisor had no idea why. They were led through the door to their Advisor’s office and as soon as they left, I turned to the receptionist and suggested that perhaps the home improvement or the travel channel would be a better choice while people wait. She responded, “No, clients seem to like to watch this channel and so do the advisors.”

Define the Experience

There is not a single Financial Advisor I know who doesn’t talk about the challenge of keeping their clients on plan and away from short term negative financial news that in most cases has nothing to do with their long-term financial plan or investments. In speaking to the advisor after the meeting he confirmed that his meeting started off uncharacteristically poorly and he had no idea why. Could that have been a day where the market was rallying, news was positive, and the clients walked in feeling better? Perhaps, but it’s practically a coin flip. Focus your messaging on the end goal. Obstetricians typically have pictures of beautiful healthy babies. Travel agencies have pictures of remote vacation destinations. Dental offices do NOT live stream the root canal channel. Setting the tone starts in the reception area. Be creative; define the experience; Keep your clients on point with their goals and objectives.

This article was written by Jonathan Bernstein, director of sales and marketing at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Index Definitions:

S&P 500 Index – This Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.