By RiverFront Investment Management

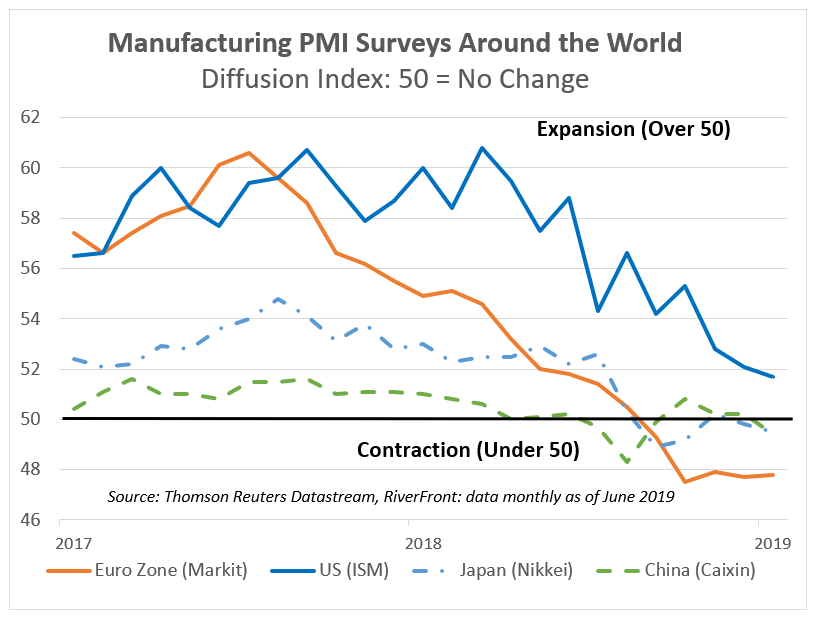

Forward-looking business sentiment indicators, such as the manufacturing Purchasing Managers’ Index (PMI) surveys, have deteriorated recently across the world (see chart). Unlike many prior periods of economic weakness where policymakers were willing to wait for confirmation before acting, they now appear poised to act preemptively. In our view, their rationales for a quick response are:

- the looming threat of tariffs

- a more populist political environment

- the fact that it is less costly to stoke a slowing economy than to reignite it

RATE POLICY NOW SUPPORTIVE OF STOCKS: THE FED IS OUR FRIEND

In the US, traders now assume a 100% probability of at least one 2019 rate cut. Thus, we believe the Fed is our friend again and that should be supportive for the secular bull market.

Outside the US, manufacturing is flirting with recession, but we think the cavalry is on the way. Some of the potential fixes proposed just in the last few weeks include cutting interest rates (Fed and ECB), weakening currencies to make exports more competitive (Trump Administration), and restarting or increasing quantitative easing/bond buying programs (ECB & BOJ). China has also been seeking to boost its economy through both monetary and fiscal policy throughout the year. Additionally, recent comments by ECB President Mario Draghi and the nomination of IMF Chairwoman Christine Lagarde as his potential successor lead us to believe that the EU understands that they need to ‘step up the pace’ of accommodation.

SAVERS OFTEN GET PUNISHED WHEN POLICYMAKERS STIMULATE

SAVERS OFTEN GET PUNISHED WHEN POLICYMAKERS STIMULATE

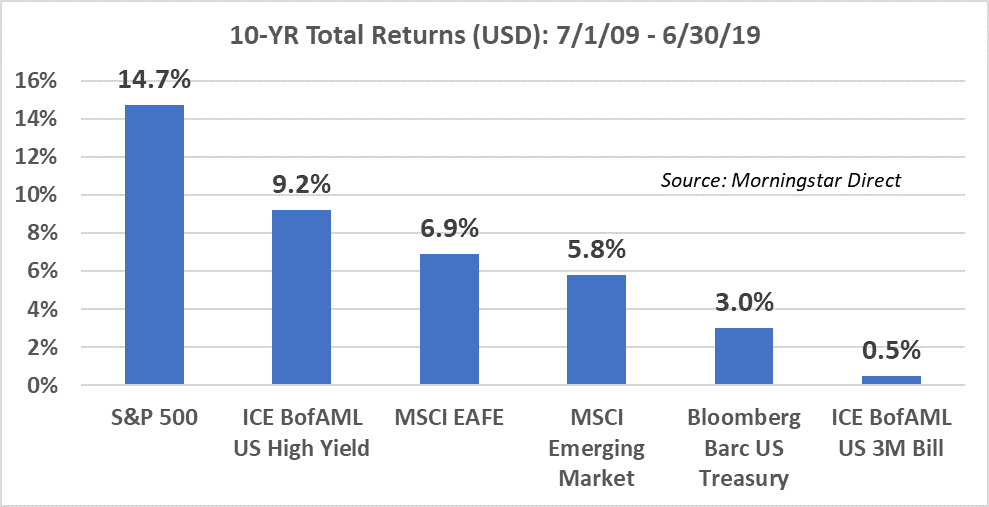

It has been difficult to be a ‘saver’ over the last 10 years. ‘Savers’ are those investors that are typically risk averse and tend to hold cash, CDs, and government bonds. Savers often get punished when policymakers stimulate because low interest rates negatively impact the returns on CDs and bonds. While quantitative easing and fiscal spending can weaken currencies and introduce inflation. For this reason, we adhere to the credo ‘Don’t Fight the Fed’; recognizing that central banks possess the necessary tools and wherewithal to change investor behaviors.

Savers have recently become very familiar with the implications of ‘Fighting the Fed’. In fact, the punishment to savers has been especially acute over the last 10 years in the aftermath of the 2008 Financial Crisis. During this time, policymakers stimulated the economy at an unprecedented pace, which significantly boosted the returns of ‘risky assets,’ like stocks and high yield bonds, while limiting the returns of ‘safe assets,’ like Treasury bonds and cash. The asset class return chart (above) highlights this point, where one can clearly see the outperformance of ‘risky’ assets relative to ‘safe’ assets over the past 10 years.

THE BEATINGS TO SAVERS WILL CONTINUE UNTIL ECONOMIC MORALE IMPROVES

The message from policymakers has been clear: they have no intention of sitting idle while their economies falter. Over the last week policymakers from the US and abroad have commented on the possible ‘fixes’ for slowing global economies including rate cuts, increases in fiscal spending, and additional quantitative easing. Essentially, the message to savers is that the beatings that result from economic policy ‘fixes’ will likely continue until the economic outlook improves. For this reason, we would caution investors to think twice before running to the traditional ‘hiding places’ that become popular during periods of angst. In our view, ‘hiding places’ like cash, CDs, and bonds have become increasingly vulnerable and may not provide the protection investors expect.

CONCLUSION: HOPEFUL, BUT NOT AGGRESSIVELY POSITIONED

Recognizing that risk takers tend to be rewarded when policy makers stimulate the economy, our portfolios are neutral to slightly overweight equities. However, we have been reluctant to increase our equity positions to a larger overweight because of the recent deterioration in two out of three of our economic guideposts, which we refer to as the ‘3 Rs’. The two that recently worsened were ‘Recession Risk’ and ‘Trade Resolution’, while the only one that strengthened was ‘Rates’. Ultimately, we would like to see one of the two remaining ‘Rs’ improve before increasing our overweight to equities.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

[Index Definitions]: You cannot invest directly in an index

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 899912