By Chris Konstantinos, CFA, Director of Investments, Chief Investment Strategist

SUMMARY

- Policymakers’ swift action should stem contagion risk from reaching large US banks, in our view.

- We believe implications include a less hawkish Fed, lower bank earnings, more regulation, and potentially lower economic growth.

- The stock market is likely to remain range bound in the near-term, but has not yet violated key areas of support, in our opinion.

Quick Action Stems Contagion Risk; Less Hawkish Fed, Lower Bank Earnings, More Regulation Likely, In Our View.

Every Federal Reserve interest rate hiking cycle unearths companies or industries who have not adequately anticipated and prepared for the magnitude of the rate hikes. In 2008 this manifested itself in a huge decline in the values of real estate and the large financial institutions that were too exposed to it. This time it has come home to roost in smaller banks operating in niche segments like crypto and venture capital. While the ripple effects of this will be felt for some time, we have reassessed our view of banks, and do not see the magnitude of this banking crisis or its economic impact as comparable to 2008…below we explain why.

In our view, the ‘Great Financial Crisis’ (GFC) of 2008 was, at its core, a credit quality issue, with ill-advised real estate loans parceled out to non-transparent parts of the financial world, only to fail spectacularly. Thus far, we believe, the ‘Bank Panic of ’23’ is not a credit issue -asset quality is strong and credit stress remains relatively low across most of the banking industry -but rather one of an interest rate sensitivity. Banks holding lots of otherwise high-quality US government-backed bonds experienced acute solvency risk when they failed to account for the rapidity of deposit outflows and short-term fluctuations in these bond prices in a hiking cycle…a timing issue, not a credit issue. This is an ‘easier’ problem for the government policymakers to solve than a credit crisis in our view, albeit with lots of short-term uncertainty.

Tightening Cycle and Poor Risk Control Causes of Bank Failures

A shockwave pulsed through financial markets on Friday, March 9 when California banking regulators announced they were shuttering Silicon Valley Bank (SVB) and transferring deposits to the Federal Deposit Insurance Corporation (FDIC) for receivership. Adding to the malaise was the failure of cryptocurrency lender Silvergate Capital (SI) and the failure of a third bank, also with crypto ties- Signature Bank (SBNY)– over the weekend. SVB represented the first FDIC-insured bank to fail in 2023, and the largest bank failure since 2008 (see chart next page, courtesy of FDIC). Contagion risk spread across the pond to Europe in the following week when shares of beleaguered Swiss firm, Credit Suisse, tanked after a prominent shareholder said they would not consider investing more into the company. Capping a wild week was Thursday’s announcement that some of the biggest banks on Wall Street, led by JPMorgan Chase & Co. CEO Jamie Dimon, pledged $30 billion of cash for another troubled lender, First Republic…which failed to stem a collapse in that bank’s equity value.

The catalyst for this crisis was the historic levels of interest rate volatility caused by the Fed. But the blame for this calamity, we believe, rests solely with these banks, which did a poor job of what banks are supposed to be adept at– understanding and preparing for asset/liability mismatches and interest rate risks. We believe that the swift action taken by the Fed will limit further contagion risk from here and will keep more conservatively managed banks solvent.

Source: Federal Deposit Insurance Corporation (FDIC). Data as of March 12, 2023. Chart shown for illustrative purposes.

Swift Fed Action Limits Contagion Risk, in Our View

The Federal Reserve stepped in swiftly over the subsequent weekend with two important announcements. First was that the Fed would move to ‘backstop’ all depositors – including uninsured ones- in SVB and SBNY, making sure that anyone who had money with the bank would be made whole. Importantly, the Fed insured that depositors had access to their money on Monday, March 13, to limit disruption. By bypassing the $250,000 FDIC insurance limit in the case of SVB, the Fed is setting a precedent and implicitly raising an ‘unlimited’ backstop for depositors in failing banks. These actions should provide crucial confidence in the financial system.

It is worth noting that losses incurred by the FDIC will be absorbed by a special assessment on banks as part of their participation in the FDIC insurance, in the effort to prevent taxpayers from shouldering the bill for this ‘bailout.’

Second, on Sunday March 12th, the Fed, the FDIC and Treasury – in a flashback to 2008’s GFC –- put into place an emergency lending facility called the ‘Bank Term Funding Program’ (BTFP) to help protect any US bank deemed vulnerable to short-term deposit losses. The Fed will offer loans of up to one year in length to banks, at reasonable pricing. This allows banks to pledge high quality assets such as Treasuries, agency debt, mortgage-backed securities and other bonds as collateral. The collateral is to be valued at par, instead of the ‘fire sale’ pricing that assets would be subjected to if they were forced to ‘mark to market.’ This essentially prevents another bank from being forced to sell off government bonds in a fire-sale to meet depositor requests like SVB and SBNY did. The Treasury made available up to $25B as a backstop for this program.

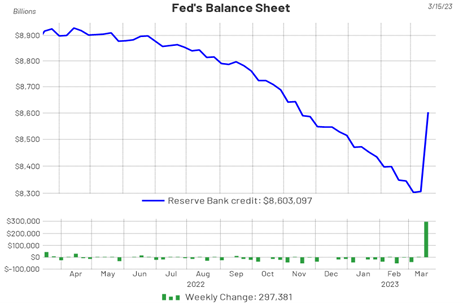

Source: Refinitiv Datastream, RiverFront. Data as of March 15, 2023. Chart left, shown for illustrative purposes.

The combination of the creation of the BTFP and a massive increase in banks accessing the Fed’s emergency borrowing program has caused the Fed’s balance sheet to balloon back to last November’s levels (see chart, left). This spike demonstrates how seriously the Fed and the nation’s banks are taking this recent confidence crisis, and how transferring interest rate sensitive loans from banks to the US government’s ‘safer pair of hands’ can help stem solvency risk.

We Believe Investors Should Not Extrapolate Issues at Less-Regulated Lenders to Larger, Well-Capitalized Banks

The Fed action was crucial, in our opinion, but is not the only reason that we maintain confidence that these issues for risky lenders should not spill over to liquidity crises for much larger, better-capitalized US financial institutions.

- Failed Banks Were Not Closely Regulated: As smaller banks with less than $250B in assets, SVB and SBNY were not subject to the same regulatory oversight as larger US banks and were exempt from having to include ‘unrealized’ (mark-to-market) gains or losses in their capital adequacy ratios. Unlike larger, more traditional banks, SVB had an extraordinarily high portion of its assets in its investment portfolio, including government bonds that dropped quickly in value as the Fed hiked rates. In addition, SVB appears not to have been hedging this significant interest rate exposure in their asset portfolio, which is unusual for a bank and an example of extraordinarily poor risk controls, in our view.

- All the Failed Banks Were Involved in Particularly Volatile Non-Traditional End-Markets: SVB’s ‘bread and butter’ was lending primarily to risky, highly uncertain clients, such as technology start-ups and venture capital firms. SBNY and SI both had significant deposit exposure to cryptocurrency. Signature had a significant amount of crypto-related deposits, a highly volatile segment that has seen huge price downturns over the past year.

- Costs of Funding Deposits are Higher at Smaller Institutions: Large US banks are not as sensitive to deposit funding costs as smaller community, regional and specialty lenders, due to their much deeper deposit bases and their lower ‘deposit betas’ – the sensitivity of deposit costs to fed funds interest rate raises.

In contrast, larger US Banks (>$250B in assets) are highly regulated and much more transparent than smaller lenders. After post-financial crisis regulation, large, ‘global systemically important’ banks (GSIB) are well-capitalized, in our view. If anything, we expect the largest and strongest banks to be a net beneficiary of deposit flows migrating from smaller, riskier banks. To this end, Bloomberg reported last week that JP Morgan, Bank of America, Citigroup and Wells Fargo are all seeing higher-than-normal deposit increases since SVB’s collapse. We would also note that, despite the company-specific issues at Credit Suisse – which have plagued the company long before last week – we think European banks are in at least as good, if not better shape than US ones. Their conservatism has been shaped by a decade of rolling Euro financial crises and thus regulations are arguably more comprehensive than the US. Also, the European banking system is less dependent on smaller lenders and tends to have a deposit base that is less dependent on commercial loans than US banks.

We do think this episode points to the increasingly difficult backdrop faced by poorly capitalized, early-stage businesses, given the current macroeconomic backdrop of high inflation, volatile interest rates and lending backdrop and uncertain Federal Reserve policy going forward. With quantitative tightening (QT) reducing available deposits coming from the government, this may have broader negative implications for smaller regional banks with riskier loan books as well.

Broad Implications: A Less Hawkish Fed, Lower Bank Earnings, and More Regulation

Taken in aggregate, we believe the Fed’s swift actions will meaningfully lower the risks of further ‘runs on the bank’ in other small US financial institutions and will help stabilize financial markets. These actions also buy regional bank management teams some time to consider whether or not to seek shelter within the Fed program. We believe this will be a difficult choice as it will likely come with ‘strings attached’ in the form of reduced profitability and future regulation, as the large banks dealt with after the GFC. Other broad implications, in our view, include:

- Banking Sector Earnings May Experience Headwinds from Rate Volatility. Up until now, RiverFront had been relatively constructive on the US and European large-cap banking sector recently, in part because our belief in rising interest rates translating to higher bank earnings. In our opinion, the recent risky bank failures increase the likelihood of a Fed pivot or pause, as we noted above. This would put further downward pressure on bank earnings due to lower interest rates. Due to the recent events, we no longer prefer US banks and we are waiting for a positive catalyst in the form of a more normalized yield curve.

The ongoing US yield curve inversion potentially signals rates coming down in the future; an inversion would likely put downward pressure on bank net interest margins, and thus earnings. If depositors begin searching for higher returns, net interest margins could be squeezed as banks have to pay higher rates to maintain deposits.

- Regulation Coming Again for Small Banks. Regional banks are likely to end up in the regulatory penalty box due to this crisis, with more transparency demanded. To this point, Bloomberg reported last week that the Fed is reviewing sterner capital and liquidity requirements and measures to strengthen annual stress tests, with the potential plans to see firms with $100-250B in assets face harsher rules. This is likely to be a boon for big, more transparent banks, as they are likely to gain deposits over this. We believe investors should be selective and we favor investing in large banks over smaller ones.

- Possible Slowing Interest Rate Hikes from the Fed…But Not as Far as Some Expect. The Fed may progress more slowly with interest rate hikes, now that there is concrete evidence that their aggressive pace of interest rate hikes has ‘broken’ something in the real economy. To this end, fed funds futures rate expectations for the end of ‘23 have dropped meaningfully in the last 3 days (as of March 17th); now less than 1% probability being priced in of rates ending the year above 5% fed funds rate. We believe that this will slow Fed rate hikes, culminating with ‘only’ a 25 basis point (0.25%) hike at the next Fed meeting on Mach 22, 2023.

However, inflation is still likely the Fed’s overarching concern here– we are not convinced that the effect of this mini-banking crisis will have any longer-term negative impact on core inflation, and thus we still think the Fed has to be ‘on the case.’ With the backstop in place, the Fed has further loosened financial conditions by effectively re-engaging quantitative easing (QE) by bailing out depositors, thus making the job of fighting inflation more difficult.

We think the Fed will likely raise the fed funds target range to 4.75 – 5.00% at its next meeting as core inflation remains elevated at 5.5% for February. While regional bank failures will slow the pace of Fed hikes, we do not agree with the market that the Fed will begin cutting rates after two more 25 basis point hikes. We still believe that the Fed will err on the side of fighting inflation, as the BTFP will provide stability to the banking system.

- Less Credit Available May Constrain Economic Growth: One clear impact from this event is smaller banks tightening lending standards and potentially curtailing access to capital and driving down aggregate investment spending. This may have a slightly negative aggregate impact on the US economy, though as we mention above, we also believe it may at the margin cause the Fed to hike less. For context, the US Economics team at Goldman Sachs states that US banks with less than $250bn in assets account for roughly 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending in the US economy. They cited this reason for decreasing their forecast for US GDP in 2023 by 0.3%.

- Fed Learned its Lessons From 2008…They Will Remain Quick to Act. Their quick, decisive action here – in contrast to their slower reaction to backstop banks after Lehman Brothers failure in 2008 – suggests they’ll be quicker to react to possible financial contagion. This is a positive for risk assets, and one likely reason the US stock market is showing some resiliency above what we view as important technical support at 3800 this week. We are not ready to call the end of the recent rally that started last fall. However, our risk management disciplines are on ‘high alert’ as we continue to monitor market technical and internals very closely in light of this recent weakness (see technical section, below).

Technical Update: S&P 500 Under Pressure…But Holding Important Support Thus Far

Since our last Weekly View technical update on March 6, 2023 (Inflations Worries Resurface…but Stocks Show Resilience), the S&P 500 has been forced to endure a lot of bad news, including this unexpected banking crisis. Markets are down around 3% from that update, and the S&P 500 is now trading around its’ 200-day moving average. However, the market is still above what we view as important technical support at around 3,800, and the ‘Golden Cross’ condition we previously mentioned– where the 50-day moving average above the 200-day – is still in effect. Crowd sentiment has now moved back down to more pessimistic levels…this is usually viewed as a contrarian positive. However, we would’ve preferred that sentiment hadn’t fallen so far so quickly, as it calls into question the durability of the currently fragile recent uptrend.

Source: Refinitiv Datastream, RiverFront. Data as of March 20, 2023. Chart right shown for illustrative purposes.

We are not quite ready to say that the uptrend that started last fall is definitively over. However, we do expect the market to be range-bound for the time being, with a likely ‘decision box’ between 3800-4200. We believe it will be difficult for the S&P 500 to rally substantially higher from current levels with its third largest sector, financials, under pressure.

As for the US economy and corporate earnings, we have a similar sentiment to our market view, in that things are not quite ‘broken’ yet but are close to a critical juncture. GDPNow is currently predicting that growth for Q1 is 3.2%, which gives investors hope that recession will be avoided in the first half of the year. We continue to believe that the economy will not experience a recession until late 2023 into early 2024 because of the economy’s resilience. Additionally, analysts have stopped lowering operating earnings estimates for 2023, with estimates now sitting at $219.46 up .33 cents on the week.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Definitions:

The Federal Reserve System (FRS) is the central bank of the United States. Often simply called the Fed, it is arguably the most powerful financial institution in the world. It was founded to provide the country with a safe, flexible, and stable monetary and financial system. The Fed has a board that is comprised of seven members. There are also 12 Federal Reserve banks with their own presidents that represent a separate district.

The Federal Deposit Insurance Corp. (FDIC) is an independent federal agency insuring deposits in U.S. banks and thrifts in the event of bank failures. The FDIC was created in 1933 to maintain public confidence and encourage stability in the financial system through the promotion of sound banking practices.

Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them. Investors in mortgage-backed securities receive periodic payments similar to bond coupon payments.

Cryptocurrency is a digital or virtual currency secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

Fed funds futures are financial futures contracts based on the federal funds rate and traded on the Chicago Mercantile Exchange (CME) operated by CME Group Inc. (CME). The federal funds rate is the rate banks charge each other for overnight loans of reserves on deposit with the Federal Reserve.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

Quantitative tightening (QT) refers to monetary policies that contract, or reduce, the Federal Reserve System (Fed) balance sheet. This process is also known as balance sheet normalization.

Quantitative easing (QE) is a form of monetary policy in which a central bank, like the U.S. Federal Reserve, purchases securities from the open market to reduce interest rates and increase the money supply.

The 50-day simple moving average (SMA) is used by traders as an effective trend indicator. The 50-day moving average is the leading average of the three most commonly used averages. Because it’s shorter than the 100- and 200-day averages, it’s the first line of major moving average support in an uptrend and the first line of major moving average resistance in a downtrend.

The 200-day moving average is a popular technical indicator which investors use to analyze price trends. It is simply a security’s average closing price over the last 200 days.

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 2800144