![]()

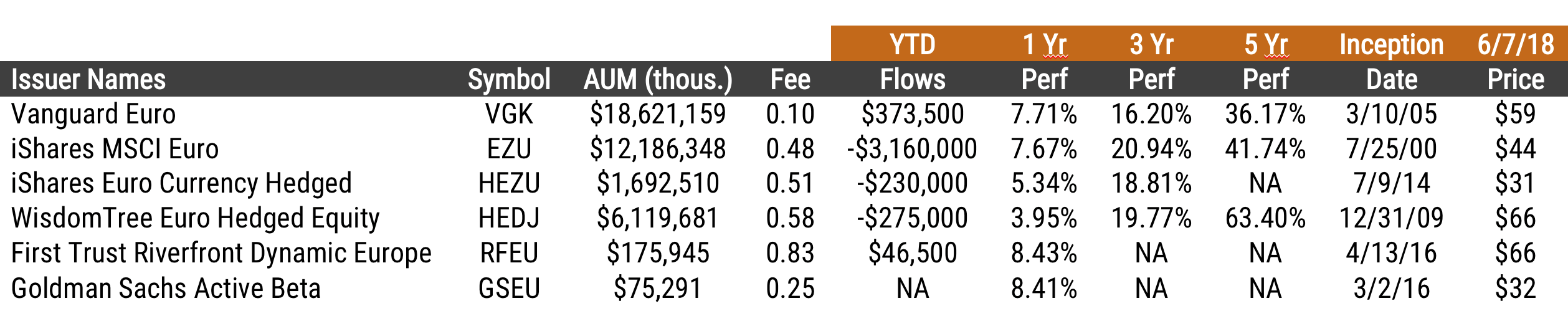

We understand that U.S. investors tend to allocate according to a neutral currency stance, but we live in a “Buy, Sell or Hold” world, and by opting out of a currency call we would argue an investor is in fact making a traditional market call on the currency. Put simply – Blackrock’s decision to wrap EZU in HEZU, which includes the hedge, has led to about a 200 basis point difference in returns over these past 3 years.

Flows are arguably a telling sign, but without knowing who the buyers and sellers are, it can also be misleading. Nevertheless, ETFs do serve as a short term tactical sentiment indicator which for now looks to be net negative of about $3.24 billion in the month of May. This brings us to the question again– how does an investor manage the risk that Europe is a value trap? Answer: Benchmark your choice against the largest and lowest cost ETF available, the Vanguard Europe ETF (VGK), and take the challenge of trying to add alpha through security selection. Look beyond the 10 Bps of savings. Of course, history may not repeat itself and past performance is not indicative of future performance, but where does it read that future innovation or tactical decision making around these new volatile markets won’t necessarily outperform a product that was created in 2005. Ever buy a computer that is 13 years old?

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.