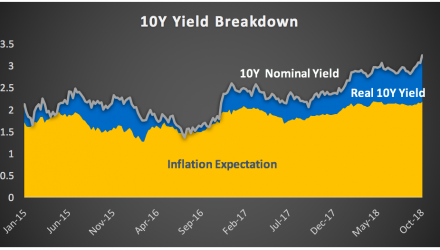

6. The recent increase in bond yields was led by an increase in real interest rates, which is representative of expectation of future Fed policy, rather than a rise in inflation expectations. For a sustained rise in yields, inflation expectations need to move higher.

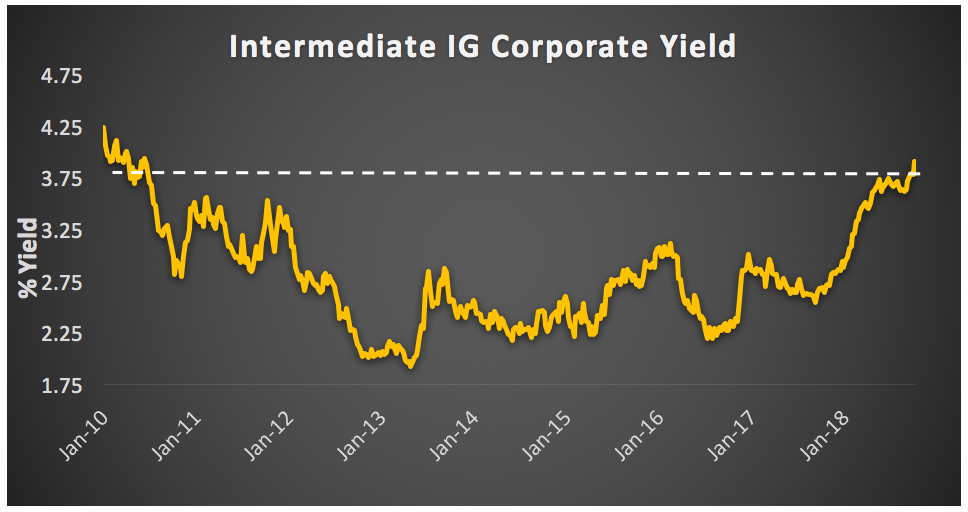

7. Corporate bonds yields are the most attractive they’ve been since 2009, especially among shorter maturities.

8. Despite macro headwinds, we expect strong fundamentals to support equities in Q4. Earnings remain a tailwind, aided by U.S. GDP growth expectations above 4% and added stimulus in China.

9. Strong growth and earnings trends, and trade concerns have contributed to U.S. outperformance. U.S. valuations have risen in tandem, making the risk/reward for international diversification more attractive.

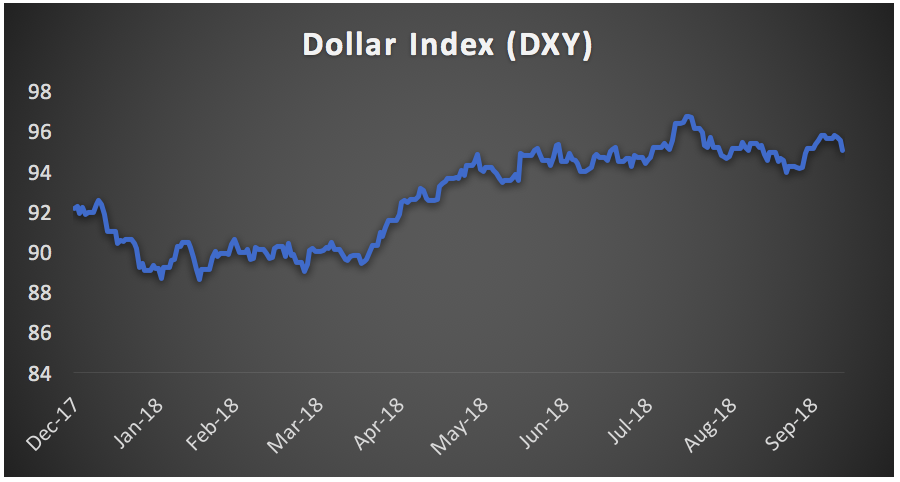

10. Emerging market equities in particular have repriced for the worst-case trade and contagion scenarios. We see macro headwinds started to ease with a more stable U.S. dollar, Fed hikes well-priced in, and the base case for trade still reasonable and offset by China’s increased stimulus.

10. Emerging market equities in particular have repriced for the worst-case trade and contagion scenarios. We see macro headwinds started to ease with a more stable U.S. dollar, Fed hikes well-priced in, and the base case for trade still reasonable and offset by China’s increased stimulus.

This article was written by the team at Sage Advisory, a participant in the ETF Strategist Channel.