By Grant Engelbart, CLS Investments

The explosive growth within the ETF market has been spurred by the numerous benefits ETFs offer over traditional mutual funds. One oft-forgotten improvement is the ability to trade option contracts. Options can be used to generate income, manage risk, speculate, and even help navigate tax issues. Given the benefits of the ETF structure and added flexibility, it may be surprising to learn that options on ETFs have been stagnant for years by a variety of measures.

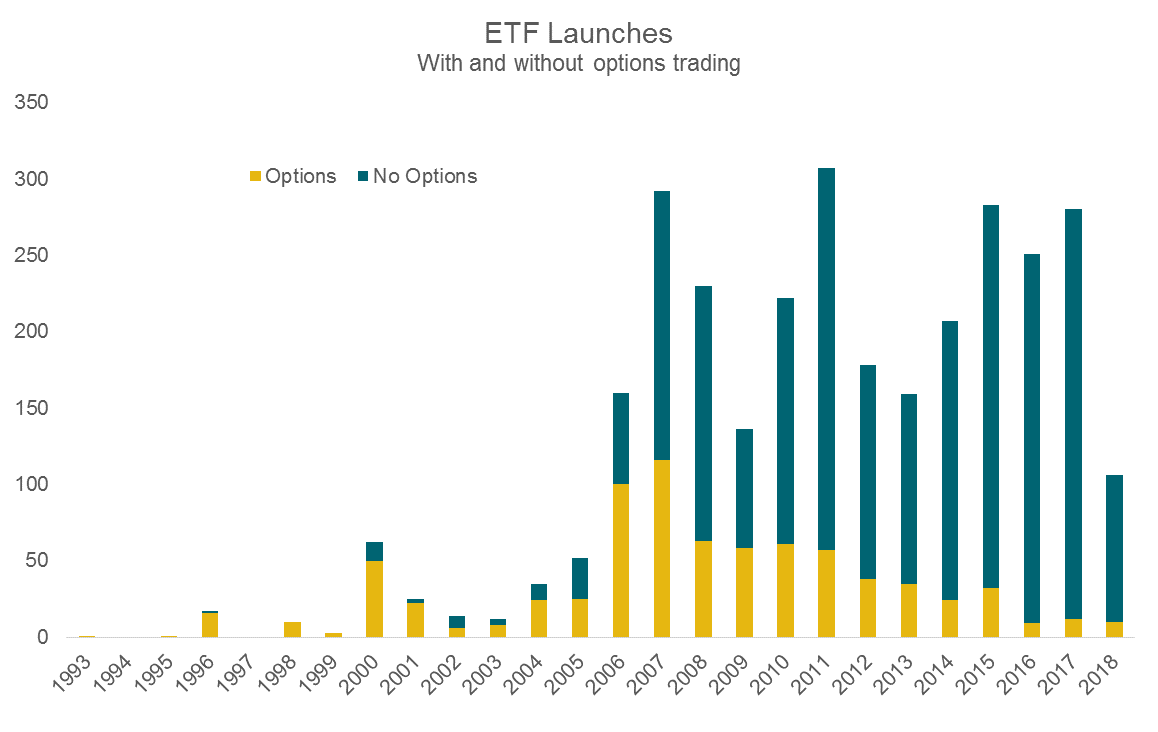

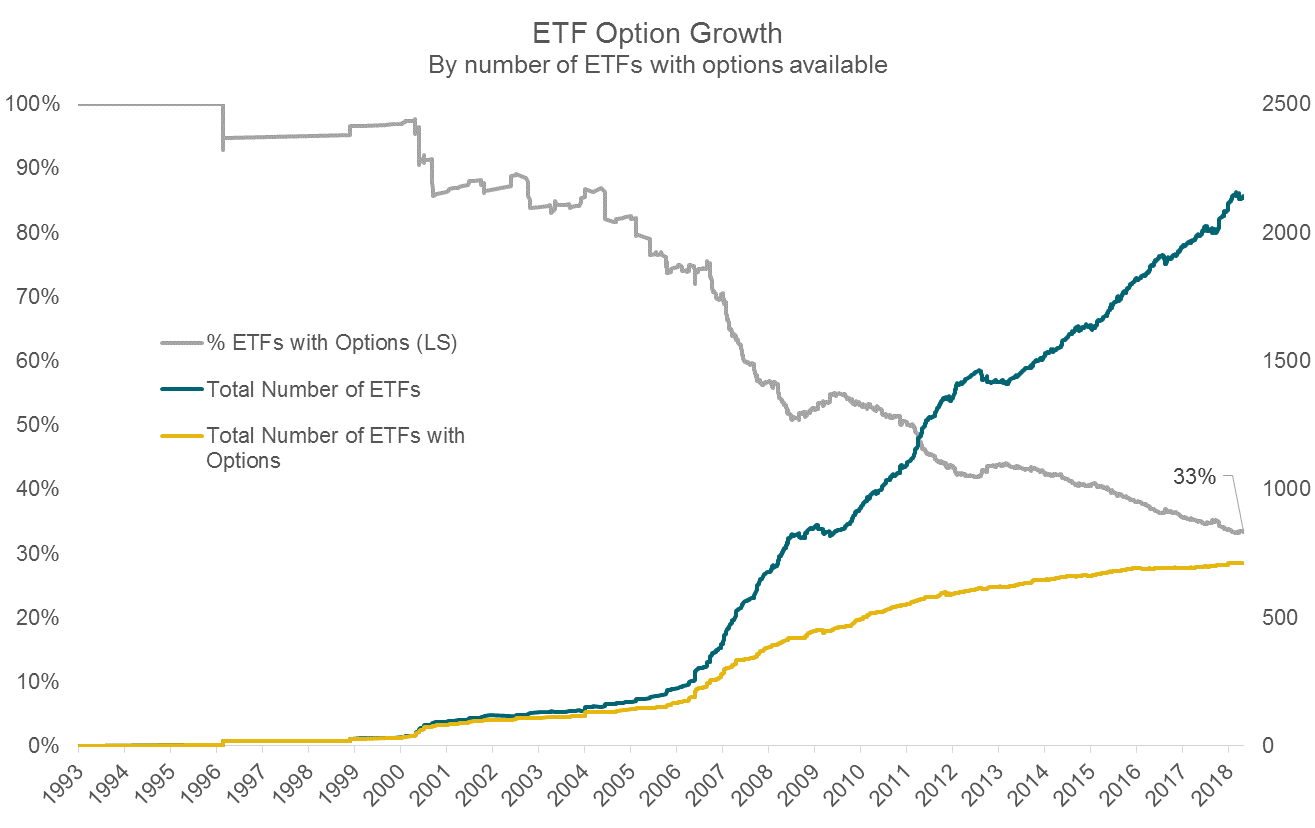

In the early days of ETFs, many funds arguably were — and still are — trading vehicles. As a result, options were commonly listed on these early ETFs, and their option markets became quite robust. In fact, of the first 100 ETFs launched, at least 87 had listed options. This trend continued for a number of years, and by late 2006 nearly three-quarters of all ETFs launched had options available.

![]()

Sources: Morningstar, Bloomberg, CLS Investments

However, the trend would soon change. In and around the financial crisis of 2008–2009, ETF growth began to accelerate rapidly, and the number of products with listed options began to drop. From 2007 to 2009, the number of ETFs doubled, yet only half of the available ETFs had options. This number continued to fall as ETF growth surged higher, and today only a little more than 30% of all ETFs have options available. (Amazingly, due to the top-heavy nature of current ETF assets, 90% of all ETFs have options available on an asset-weighted basis.)

![]()

Sources: Morningstar, Bloomberg, CLS Investments