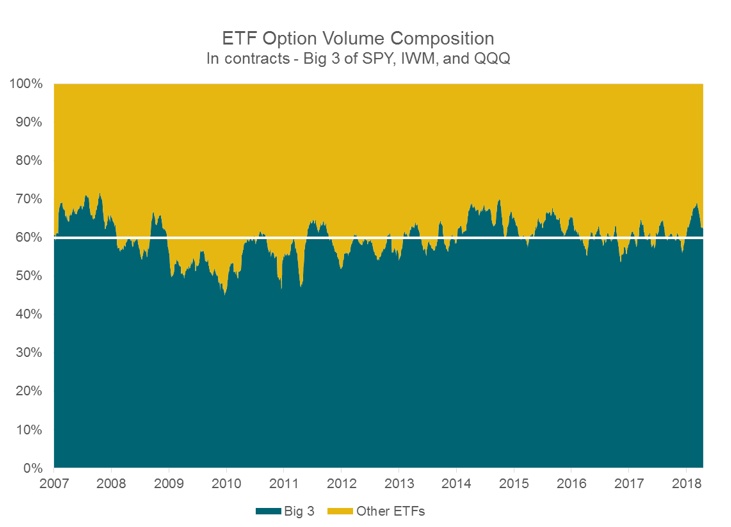

Option trading volume has also stagnated in recent years, failing to expand beyond many of the original issues. In fact, 60% of all ETF option trading volume (measured in contracts) is occurring within three ETFs: SPDR S&P 500 (SPY), iShares Russell 2000 (IWM), and PowerShares QQQ (QQQ). All were launched before 2001! Much of the remaining volume is taking place within equally established ETFs, such as GLD, EEM, volatility-based ETFs, and the Select Sector SPDR series of sector ETFs. Amazingly, 95% of historical trading volume over the past 10 years has occurred within just 35 ETFs.

![]()

Sources: Bloomberg, CLS Investments

There are a few possible reasons for the stagnation in growth.

Other Options

In 2006, the Chicago Board Options Exchange launched options on its Volatility Index (VIX), and it didn’t take long for these to explode in popularity as tools to hedge portfolio risk. Index options and futures volumes have also increased. These other tools for investors may have led to lower adoption of ETF options.

Barriers to Entry

There have been a number of examples of newer ETFs taking assets and trading volumes from the established, original products, but this hasn’t happened in the related option markets. It’s seemingly very difficult to convince investors that a newer, cheaper ETF makes for a better option experience. Also, many of the major asset classes have a well-established, extremely liquid ETF already covering it. This ETF or ETF’s option market can be used by traders to hedge similar exposures, such as using the option market on SPY to hedge a large-cap, U.S.-based ETF.

Change in the ETF Landscape

The plain vanilla index space in ETFs has been well established. Many new launches are focused on smart beta, thematic, and actively managed products. Typically, these are used by long-term investors who aren’t looking at the ETF as a trading vehicle but more so as a way to gain exposure to the asset class of their choice. Speculation, therefore (amongst other uses of options), becomes much less of a need. About a quarter of all smart beta ETFs have options available, and less than 10% of active ETFs have listed options.

It is difficult at this point to see the option market returning in full force across the ETF space, which is unfortunate. When used properly, options offer investors of all shapes and sizes many potential benefits. However, the continued innovation across ETFs will lead to better outcomes and tools for investors and traders alike.

Grant Engelbart, CFA, CAIA, is a Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing.

1578-CLS-6/6/2018