By RiverFront Investment Management

Season Strength Argument: Interesting But Not Always Predictive

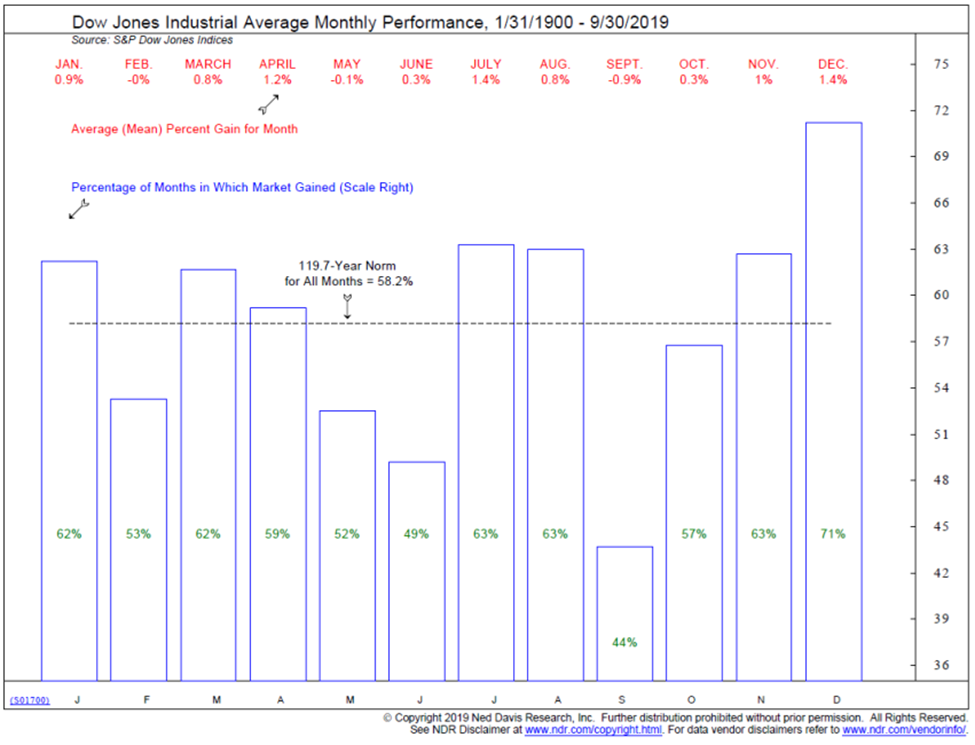

Most investors have likely heard the term, “Sell in May and Go Away.” While familiar with the phrase, I only recently learned that it originates from an investment theory known as the Halloween Indicator. The theory suggests that the period from November to April generally produced stronger stock market gains, on average, than other months of the year. The chart below, which illustrates performance of the Dow Jones Industrial Average, highlights the many times since 1900 that the Halloween Indicator theory has proven correct. 2019 has bucked the historical trend, as most equity markets have continued an upward trajectory, albeit begrudgingly, throughout the summer and early fall. The S&P 500 Index remains within 2% of the all-time high,under the ‘spell of hope’ that geopolitical issues will be resolved, and the US economy will avoid a recession.

Disclosures: Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Will the Halloween Indicator be Correct This Year?

It is hard to envision the market can move meaningfully higher, without a positive catalyst in the form of a definitive trade deal, a positive outcome on Brexit, or a turnaround in global growth, for example. Therefore, we believe the S&P 500 will remain range-bound in the near-term, roughly between 2,850 and 3,050, until these issues are solved. It is our belief that these issues will be eventually resolve to the upside, which is why we remain fully invested across our portfolios. Our tactical indicators remain positively biased favoring stocks over bonds and US equities over developed international at this time.

As we have just navigated the first week of third quarter earnings reports, analysts have been encouraged by the fact that most companies reporting have met or exceeded expectations. This fact is less surprising given that analysts had recently slashed their forecasts for estimated earnings to decline by as much as 4% year over year (Source: FactSet). In fact the pattern is similar to both the first and second quarters of this year where forecasts at the beginning of earnings reporting season proved to be more bearish than the actual results. This leaves many asking if the positive outcomes from this past week will follow a similar path and earnings will continue to surpise to the upside.

In addition to the actual data that is being reported, analysts are focused on what company executives are saying about the state of the current business environment as well as their future expectations. Investors are also looking at reported earnings to quell or stoke the concern surrounding the impact of slower growth as seen in September’s US Retail Sales report and the US Industrial Production report. In our view, we are not alarmed by the one month miss for retail sales given the continued high levels of consumer confidence. Further, we believe that the recent auto workers strike contributed to the worse-than-expected Industrial Production report, which remains relatively close to last December’s high. Additionally, we are monitoring the impact of the Conference Board’s CEO Confidence Measure, which came in at the lowest level in a decade when it was reported earlier this month. This could translate into cautious guidance for sales expectations and corporate investment as we look ahead to 2020 when current expectations are for a resumption in corporate growth. We believe this expectation for a resumption of higher corporate earnings growth is critical in order to maintain and/or expand the forward market multiple from the current level of 17x-18x on the S&P 500.

‘Past performance is no guarantee of future results’

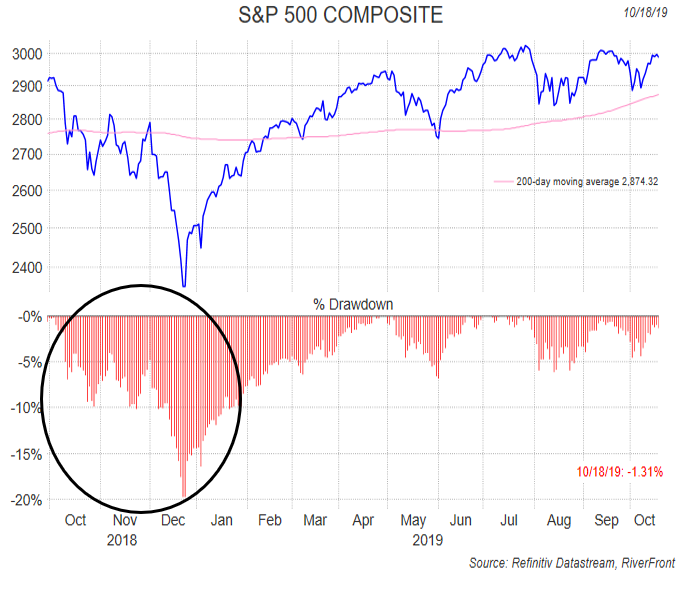

This oft required disclaimer makes an important point. Last year’s fourth quarter was considered history-making, as the sharp downward spiral experienced in the equity markets caused the S&P 500 Index to end 2018 with a loss, despite having been positive for the first three quarters of the year. The chart below serves as a reminder that the last few months of the year are not always positive for markets.

Conclusion

The Halloween Indicator does not always work. Headlines caused the selloff last year and those same headlines seem to be driving day to day market movements in 2019, in our opinion. The idea of the Halloween Indicator is interesting, but not always predictive.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities mar

CEO Confidence Survey is conducted, analyzed and reported by the Conference Board, and it seeks to gauge the economic outlook of CEOs, determining their concerns for their businesses, and their view on where the economy is headed.

Dow Jones Industrial Average Index — measures the stock performance of thirty leading blue-chip U.S. companies.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 988366