The labor market is setting new—and concerning—records in the U.S. as Covid restrictions ease, life gets a little more normal, and “return-to-office” efforts begin in earnest; job openings have hit their highest level on record, layoffs hit a record low, and workers are quitting at a record pace. Prices are also climbing, spurred at least partially by the need to accommodate higher wages, though the pandemic-induced rent crash may prevent the climb from fully reflecting in CPI… for as long as it lasts. The equity markets meanwhile are revisiting a pattern from the ’90s and value stocks have continued their outperformance. And it’s been a busy week for Bitcoin after tumbling on the back of the Colonial Pipeline random seizure and then being adopted as legal tender for the first time in a landmark move by the El Salvadorian government—does such a mixed bag of headlines mean more yet volatility could be in store?

1. The unusual continues as job openings hit a record high. Businesses want to hire, but the low end of the pay spectrum is still competing with the pandemic-based unemployment benefits.

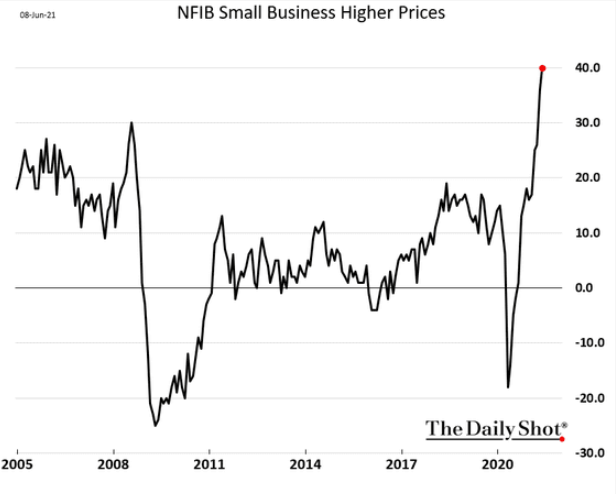

2. After over a decade with limited ability to pass on price increases, businesses now can and are passing on higher prices:

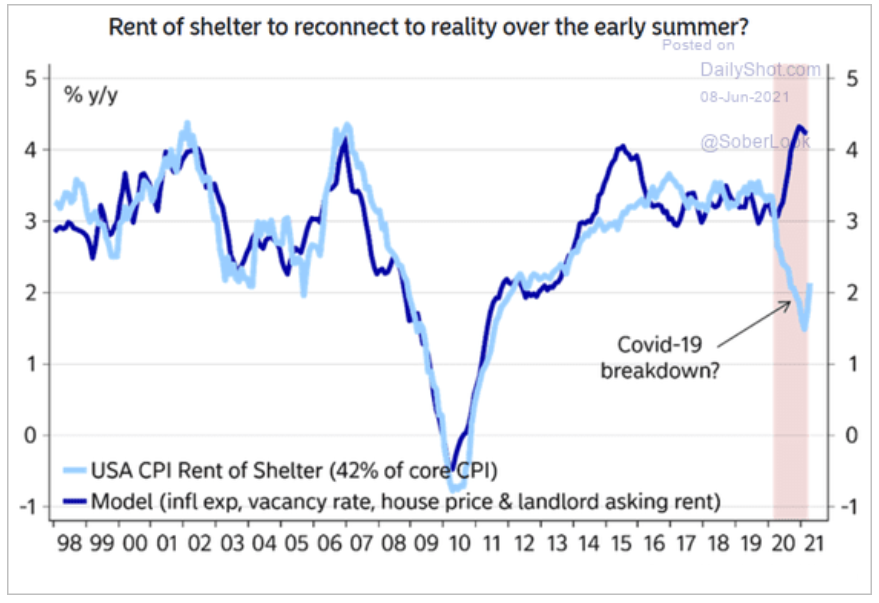

3. Many have argued that CPI has been understated during the pandemic. 42% of the CPI is the housing component, and while “equivalent rents” have plummeted, buying a house has become much more expensive:

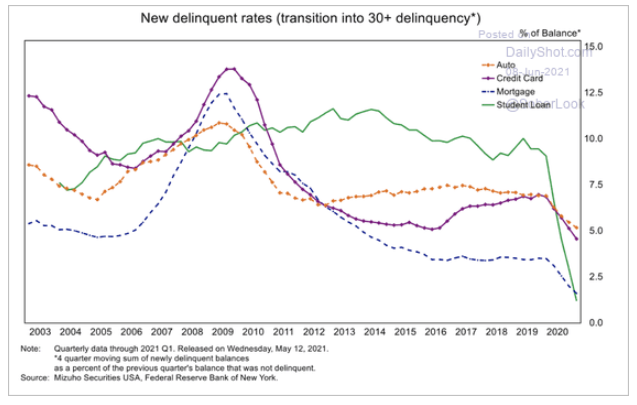

4. The U.S. consumer, on average, is in great shape. How much of this is due to government moratoriums on payments and defaults?

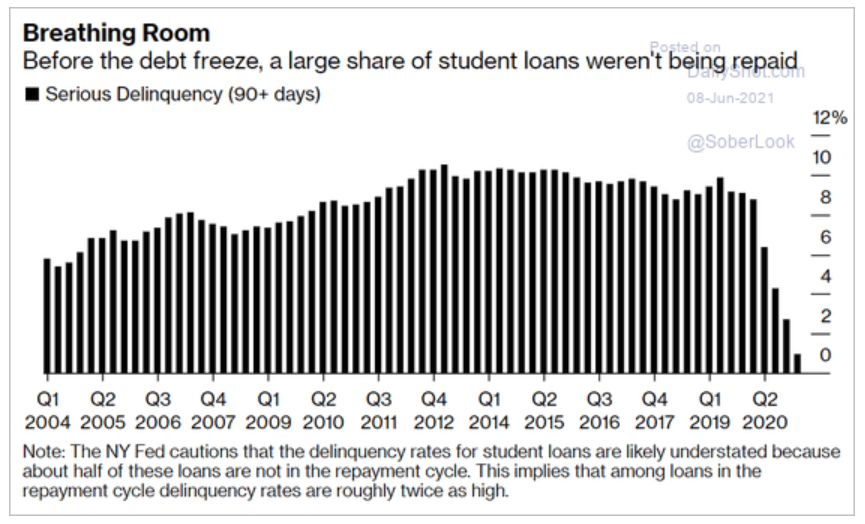

5. Student loan debt is once again a looming macro issue. The moratorium on payments ends in October and many have simply stopped paying. The default rate is higher than junk bonds!

There is an alternative: Cut the interest rate to 1% above the 10-year Treasury yield (for servicing costs). This way, repayment is much more affordable for all who have loans but is also fair to those who have already paid off their loans.

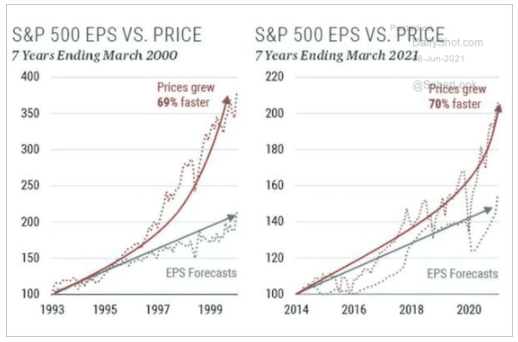

6. “History does not repeat but it often rhymes.” While the author is under debate, this remarkable comparison to the late 1990s is not:

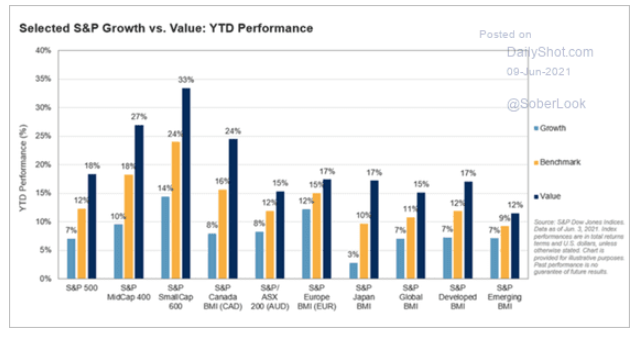

7. The shift from growth to value has been a global phenomenon…

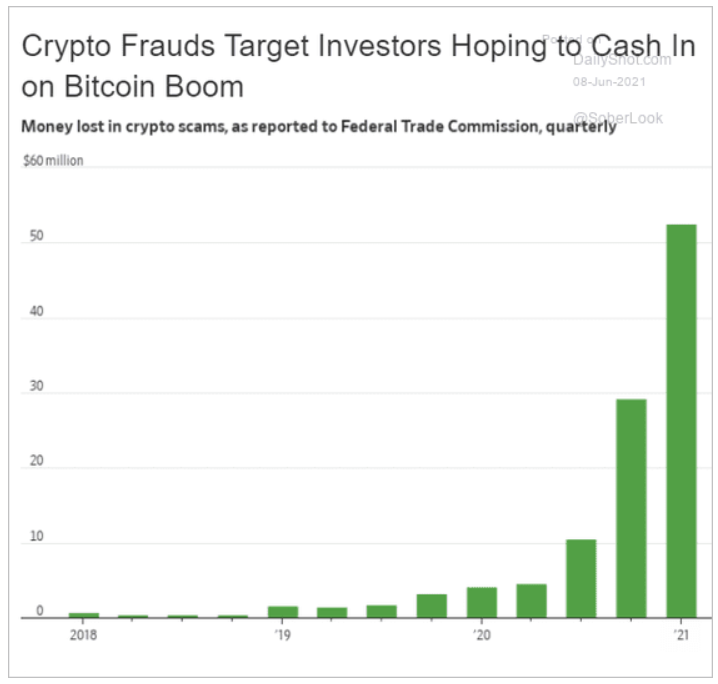

8. Wait, so a supposed currency, designed in large part for criminal enterprise, is open to fraud? Are cryptos under pressure because the U.S. government was able to recover much of the Colonial Pipeline’s ransom?

9. As we mentioned Monday, when the Fed stops buying new bonds, who will buy them, and at what price/yield?

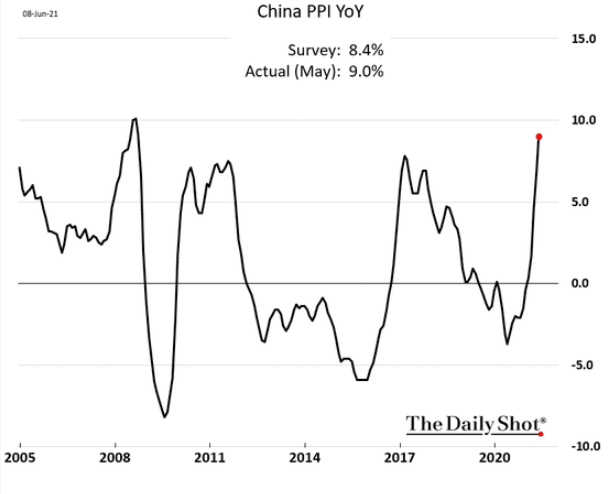

10. China, similar to the U.S. and Europe, is seeing benign CPI but rising PPI. Something will have to give soon…

11. After a parabolic rise, many commodities are returning to earth. Here is lumber:

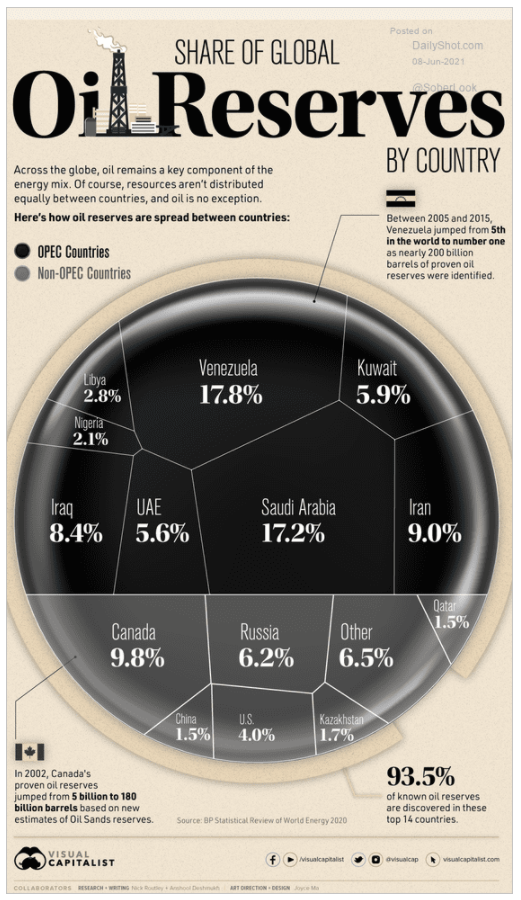

12. Can you name the three countries with the most oil reserves?

This article was contributed by the Beaumont Capital Management (BCM) Investment Team, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.