By Kimberly Woody, Senior Portfolio Manager – GLOBALT Investments

Never bet on the end of the world because it only happens once. – Art Cashin

OUTLOOK

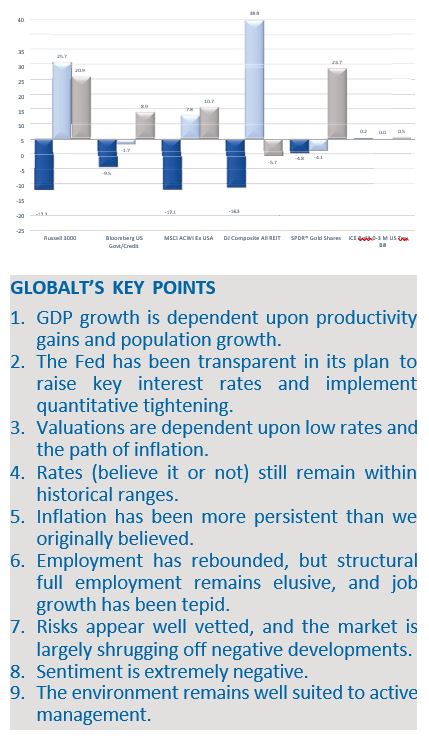

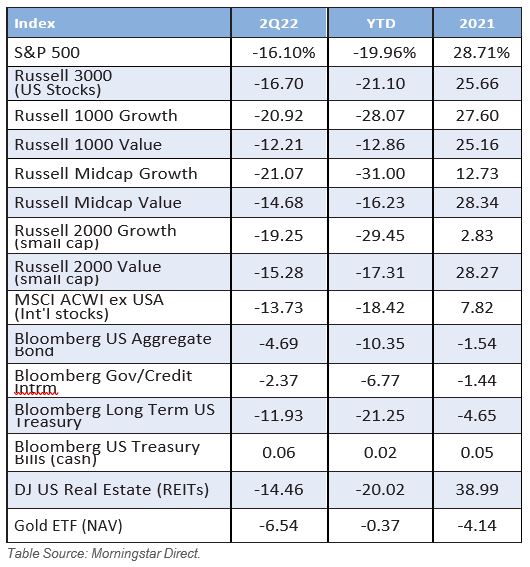

Markets have digested a great deal of bad news thus far in 2022. The performance of the corresponding indexes reflects quite a bit of pessimism (see year to date returns through July 20th for some of the major asset classes in the chart to the right). We know inflation has been less transitory than consensus expected. The dollar has been strong, applying pressure to a world awash in dollar-denominated debt. Ten- year yields have gone from near zero in 2020 to levels not seen since 2018, pressuring equities and growth stocks in particular. The impacts of COVID are still disrupting supply chains and the employment environment worldwide. The war in Ukraine has sent prices for crude and natural gas soaring. Finally, oil spikes, inverted yield curves and Fed tightening have all preceded recessions, and in 2022, we have all three simultaneously. Sentiment reflects the impact of an ostensibly dire environment, but we continue to advocate looking beyond the imminent realities of the current setting to what may lie ahead.

Markets have digested a great deal of bad news thus far in 2022. The performance of the corresponding indexes reflects quite a bit of pessimism (see year to date returns through July 20th for some of the major asset classes in the chart to the right). We know inflation has been less transitory than consensus expected. The dollar has been strong, applying pressure to a world awash in dollar-denominated debt. Ten- year yields have gone from near zero in 2020 to levels not seen since 2018, pressuring equities and growth stocks in particular. The impacts of COVID are still disrupting supply chains and the employment environment worldwide. The war in Ukraine has sent prices for crude and natural gas soaring. Finally, oil spikes, inverted yield curves and Fed tightening have all preceded recessions, and in 2022, we have all three simultaneously. Sentiment reflects the impact of an ostensibly dire environment, but we continue to advocate looking beyond the imminent realities of the current setting to what may lie ahead.

In our estimation, inflation is still transitory but clearly this depends on your time frame. The Fed has been trying since 2009 to get GDP growing meaningfully and inflation to ≈2% but it was achieved instead by unprecedented stimulus and a global pandemic. Unfortunately, this drove excess spending into a supply constrained environment. The global tightening (rising long and short rates and higher oil prices) that has been going on for the last couple of years is starting to take a bite out of the economy at the same time the Fed is aggressively defending against inflation. It’s a not-so-delicate waltz between stoking economic growth and keeping inflation at bay which has become increasingly frenetic.

Measures of inflation, especially the hottest contributors to the Consumer Price Index (CPI), are lagging measurements. Just as we “felt” inflation before it actually showed up in inflation data, we seem to be feeling an easing in certain costs. Of late several retailers have reported excess inventory and have had to unload goods at lower prices. We know home sales in general (varies by region) are reporting slower single family starts and mortgage applications. Prices at the pump have moderated some and commodities are well off their highs from six months ago. Consumers have been trading to more private label products, meat consumption is weaker, and gas consumption is seasonally at its lowest in a decade. Finally, we’ve seen a spike in revolving credit suggesting consumers may be short on their budgets. This must be considered in light of the proliferation of pay-as-you-go plans from the likes of Klarna and Affirm. This “debt” doesn’t show up as a debit on the consumer’s balance sheet and is only sometimes reported to the credit agencies in the event of delinquency. AT&T recently reported increased delinquencies from consumers in what is arguably their least inelastic fungible expense. Wage inflation is a pressure point in the inflationary landscape, and we welcome any hint that the labor pool could be expanding. Simply put, more Americans reentering the workforce should alleviate wage pressures in a positive way. On the more negative side, however, we have seen increasing announcements of removal of job openings, hiring freezes and layoffs.

What was most perplexing about the consumer is how they managed to transition from receiving direct government stimulus to receiving nothing at all with seemingly little change in behavior. What we discovered is that many had amassed considerable cash savings which seems to have allowed them to remain out of the available workforce longer than anticipated. As a result, unemployment remains quite low, wage pressure persists, and supply chains remain disjointed. However, lately we have seen an uptick in several measures that may indicate the environment may be changing. Jobless claims have been rising steadily since April. In fact, since 1980, jobless claims have never increased as much as they have over the most recent four-month period without the US economy being already in recession or entering one soon thereafter. Markit US flash manufacturing PMI was down 0.4 points to 52.3, the lowest print in two years. Output fell below 50 for first time since June ’20, with rate of cost inflation at its softest level since Apr ‘21, and selling price increases were the slowest since Feb ‘21. Flash Services PMI dropped below the all-important 50 level to 47.5, the lowest reading since May ‘20. Employment still rose, though at its slowest pace in five months. While nothing is easily confirmed by a sampling of economic series, recently reported data seems to be furthering both peak-inflation and peak-Fed narratives.

There is an old saying we believe rings true more often than not: “The bond market tells the truth and equity markets lie.” This has more to do with the bond market being more forward looking while equities often reflect current realities. The bond market appears to be reiterating these “peak” narratives. Measures of the spread between real yields and the yields on treasuries of similar tenor imply investors believe inflation on a five year or longer horizon is relatively benign and in line with the Feds goals at ≈2%. An inverted yield curve signals the Fed will at least have to take its foot off the brakes in order to avoid hiking the economy into recession.

We posit that the Fed does not influence the path of rates but actually follows it. The Fed has achieved much of the desired tightening just by speaking of it. The Fed may find itself in a position to pause at some point this year. As soon as investors start to think the Fed may be less aggressive, rates are likely to ease and relieve downside pressure somewhat. An aggressive rate trajectory in a weakening economy can be very damaging to almost everything. If they begin to ease tightening expectations alongside inflation that is higher but tolerable and short lived (6-8 months), they may achieve the “soft landing” we all dream of.

The bad news appears to be well understood. Last week both the CPI and PPI reports shocked investors expecting, at a minimum, a pause in inflation’s advance. The equity market as measured by the S&P 500 reacted negatively initially but recovered and surpassed beginning levels within a week. Measurements of sentiment are on balance very bearish. In speaking with clients and witnessing their behavior first-hand, we find most investors are jittery at best. Even professional money managers are rattled. The BofA chart depicts the Bank of America Global Fund Manager Survey which included 259 participants with $722 billion under management in the week through July 15. They highlighted their biggest concerns as (in the following order) high inflation, followed by a global recession, hawkish central banks, and systemic credit events. At least according to these measures, sentiment has never been this bad.

Much like the overly bullish environment in which we ended 2021, we feel things are so extreme that the risks are potentially to the upside. With sentiment so negative, it would take little in the way of “less bad” news to provide some life to severely damaged markets. The sell-off has been broad in terms of asset class, sector, and industry with scant opportunity to hide. We sense that investors are wracked with fear. We are entering a seasonally sanguine period, inflation and rates may be peaking, the Fed may have achieved enough tightening to at least pause, valuations have compressed meaningfully, especially given the durability of corporate earnings, and we have yet to see the kind of blow off top or capitulation normally associated with the end to bull markets. All of this is to say, the setup through the end of this year could trigger a broad-based rally in meaningfully depressed asset classes – which is just about everything.

Our outlook continues to be dominated by our weight of the evidence approach utilizing fundamental, technical, and quantitative disciplines. The key elements of this process are driven broadly by expectations for inflation, interest rates and currency. We develop a narrative for how things may play out but wait for the pieces to fall in to place before acting. We believe timing is important. We have been relatively inactive because markets, rates, and commodities seems directionless despite elevated volatility. We require confirmation before commitment. Sometimes the hardest thing to do is to remain patient.

SECOND QUARTER 2022 REVIEW

The United States equity market, as broadly measured by the Russell 3000 Index, declined -16.70% in the second quarter of the year. No sector posted positive returns over the quarter. Rising oil and food prices forced consumers to make difficult decisions, moving away from elective items to leading household goods. This is evident in the dispersion between best and worst performing sectors, Consumer Staples down only (-4.04%) and Consumer Discretionary down (-25.51%) over the period, as measured by the S&P Select Services Index family. At the beginning of the year, Russia/Ukraine tensions sent oil prices skyrocketing leading to overbought conditions. In recent weeks we’ve seen a pullback in commodity prices resulting in a decline in the energy sector, the second top-performer over the quarter (-5.26%). Negative economic surprises continued to weigh on the market over the quarter and investors appeared to brace themselves for impending recession, rotating towards more defensive sectors and away from growth themes with Health Care and Utilities down only (-5.91%) and (-5.09%) respectively and Communication Services and Technology down (-20.88%) and (-19.67%) respectively. As mentioned previously, the remaining sectors also posted negative returns over the period, Real Estate (-14.72%), Industrials (-14.78%), Materials (-15.90%) and Financials (-17.50%). Growth was the clear loser across all market caps, as it continued to underperform its value counterparts as measured by the Russell indices. The greatest dispersion between style class was seen in Large Cap, where Russell 1000 Growth declined -20.92% and Russell 1000 Value was down -12.21%. With that said, Russell Large Cap Value was the best performer of the quarter, followed by Russell Mid Cap Value (-14.68%), Russell 2000 Value (-15.28%), and Russell 2000 Growth (-19.25%). Russell Mid Cap Growth led to the downside, declining (-21.07%) over the quarter. International markets outperformed in Q2, with the MSCI All Country World Index ex USA down (-13.73%) compared to the S&P 500 which was down (-16.10%).

The United States equity market, as broadly measured by the Russell 3000 Index, declined -16.70% in the second quarter of the year. No sector posted positive returns over the quarter. Rising oil and food prices forced consumers to make difficult decisions, moving away from elective items to leading household goods. This is evident in the dispersion between best and worst performing sectors, Consumer Staples down only (-4.04%) and Consumer Discretionary down (-25.51%) over the period, as measured by the S&P Select Services Index family. At the beginning of the year, Russia/Ukraine tensions sent oil prices skyrocketing leading to overbought conditions. In recent weeks we’ve seen a pullback in commodity prices resulting in a decline in the energy sector, the second top-performer over the quarter (-5.26%). Negative economic surprises continued to weigh on the market over the quarter and investors appeared to brace themselves for impending recession, rotating towards more defensive sectors and away from growth themes with Health Care and Utilities down only (-5.91%) and (-5.09%) respectively and Communication Services and Technology down (-20.88%) and (-19.67%) respectively. As mentioned previously, the remaining sectors also posted negative returns over the period, Real Estate (-14.72%), Industrials (-14.78%), Materials (-15.90%) and Financials (-17.50%). Growth was the clear loser across all market caps, as it continued to underperform its value counterparts as measured by the Russell indices. The greatest dispersion between style class was seen in Large Cap, where Russell 1000 Growth declined -20.92% and Russell 1000 Value was down -12.21%. With that said, Russell Large Cap Value was the best performer of the quarter, followed by Russell Mid Cap Value (-14.68%), Russell 2000 Value (-15.28%), and Russell 2000 Growth (-19.25%). Russell Mid Cap Growth led to the downside, declining (-21.07%) over the quarter. International markets outperformed in Q2, with the MSCI All Country World Index ex USA down (-13.73%) compared to the S&P 500 which was down (-16.10%).

Analysts and companies have become more pessimistic in their earnings outlooks and revisions, consequently earnings estimates are lower today than at the beginning of the quarter. Additionally, 102 companies in S&P 500 have issued EPS guidance. Of these companies, 71 have issued negative EPS guidance – the highest number since Q4 2019. The second quarter earnings growth rate for the S&P 500 is estimated to be 4.3%. If this is the actual growth rate, it would mark the lowest earnings growth rate since Q4 2020. However, as companies are more likely to report positive surprises, the actual earnings growth rate has exceeded the estimated earnings growth rate in 39 of the past 40 quarters for the S&P 500. Thus far, 21% of S&P 500 companies have reported earnings for the second quarter. Of these companies, 68% have beat on EPS and 26% have reported actual EPS below mean estimate. Out of the companies to report so far, labor cost and shortages have been cited as major headwinds affecting earnings and revenues for Q2 and future quarters. We look to company commentary for insight into the impact of ongoing fundamental concerns.

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. GLOBALT provides professional money management to both institutional and individual investors through Equity, Fixed Income, and ETF Asset Allocation strategies. Registration of an Investment Adviser does not imply any certain level of skill or training.

Valuations in this report are based on information provided by third party sources. Although the data gathered from third-party sources is believed to be reliable, GLOBALT Investments has not audited or verified the accuracy or completeness of the information. GLOBALT is not responsible for any damages or losses arising from any use of third- party data. Any security, allocation, or weightings described herein are subject to change without notice and no assurances are made that they will remain in a strategy or portfolio at the time you receive this information. Illustrative strategies or portfolios shown may not be representative of strategies or portfolios of existing clients. Performance numbers shown are subject to change without notice. If there are any questions regarding this report, please contact your Advisor or GLOBALT for assistance.

The performance data presented represents past performance, which do not guarantee future performance and future performance may result in a loss. No current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended/offered by the Adviser or GLOBALT) or product referenced will be profitable or equal to past performance levels. The investment return and principal value of an investment will fluctuate, thus when sold or redeemed, may be worth more or less than the original cost. There are risks, including possible loss of principal, associated with investing in securities, including but not limited to erratic or volatile market conditions, financial and debt market risk, geopolitical risk, management risk, liquidity, non-diversification risk, credit and counterparty risk. Diversification and/or strategic asset allocation do not guarantee a profit nor protect against a loss in declining markets. Investors should carefully consider investment objectives, risks, charges and expenses. Clients are advised that their statements and individual trade confirmations, not this report, are the official records of their accounts and transactions. This and other important information are contained in GLOBALT’s Form ADV Part 2 and Part 3, which is provided by your Advisor and should be read carefully prior to investing. Report calculations and figures should not be relied upon for tax purposes. The information herein is not a substitute for professional tax advice. You should consult your tax advisor for specific questions regarding your own tax situation.

Indexes are unmanaged and it is not possible to invest directly in an index. Index returns shown do not represent the results of actual trading of investor assets. Index returns do not reflect payments of any sales charges, fees, or expenses that an investor would pay or incur to purchase or own the securities that indices represent. The imposition of such fees, charges or expenses would cause actual and back-tested performance to be lower than the performance shown for that index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. There is no assurance such investment products will accurately track index performance or provide positive investment returns.

GLOBALT claims compliance with the Global Investment Performance Standards (GIPS®).

GLOBALT has prepared this material for informational purposes only. It should not be construed as investment advice, a recommendation or solicitation to purchase and / or sell any security.

Content may not be reproduced, distributed, or transmitted in whole or in part, by any means without written permission from GLOBALT. To receive permission or obtain a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 200, Atlanta GA 30339. You can obtain additional information about GLOBALT Investments and its Advisors by accessing IAPD (Investment Adviser Public Disclosure).

NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY