By RiverFront Investment Management

WHY WE LIKE INVESTMENT GRADE CORPORATE BONDS

Since the volatility last December, there have been a growing number of experts warning about an imminent wave of downgrades for investment grade (IG) corporate bonds. Specifically, the negative commentary has focused on the BBB-rated sector, which is just one level above “junk” status. Many of these commentators have claimed the collapse has already started, citing the recent struggles of blue chips like General Electric (GE) and Ford (F), to name a few. It is not completely off base to raise some warning flags about leverage. Since the financial crisis, the proportion of bonds rated BBB have steadily increased, such that almost half of the corporate bonds in the Bloomberg Barclays Aggregate Index carry this rating. Furthermore, 2018 was the worst year for corporate bond returns in about 10 years, which has helped reinforce this cautious narrative.

We believe there are several reasons to overlook the bearish forecasts regarding IG corporate bonds. Specifically, we are comfortable holding them in our portfolios because:

- History suggests limited downside

- IG corporate bonds can offer protection due to their interest rate sensitivity

- IG companies have multiple options for de-leveraging, if needed

- IG credit spreads are not indicating imminent downgrades or defaults

We discuss these points in more detail below:

HISTORY SUGGESTS LIMITED DOWNSIDE: To understand the potential magnitude of the risk in IG corporate bonds, we can look back to the Great Recession, which was largely a credit-induced crisis. Although the downturn in 2008 was one of the worst recessions in US history, it’s interesting to note that IG corporate bonds were down less than -5% in 2008, as measured by the Bloomberg Barclays US Corporate Index. Furthermore, after the modest negative return in 2008, IG corporate bonds rallied more than 18% in 2009 to recoup their losses.

In comparison, IG corporate bonds were down -2.5% in 2018, which made it the worst year since the last recession, but still bested global equities by roughly 6 percentage points. In fact, the last time IG corporate bonds had two consecutive years of decline occurred in 1979 and 1980, when they returned -2.1% and -0.3% respectively. Despite the negative press, you probably haven’t heard that IG corporate bonds are up over 6% in 2019. That equates to one of the best starts to a year for investment-grade credit since 2009.

INTEREST RATE PROTECTION: Although IGs are riskier than government guaranteed bonds, they have historically been a much safer investment than equities during a recession. If a wave of downgrades were to occur, we believe that downward pressures would also be reflected in equity prices, since equity holders have a lower priority in the capital hierarchy. In that scenario, there would likely be a flight to quality and interest rates would fall as investors seek the safety of bonds over equities. IG corporate bonds with fixed coupon payments would benefit from lower interest rates, which would limit the extent of their losses.

DE-LEVERAGING OPTIONS: As we’ve seen with other BBB-rated companies this year, there are multiple ways to reduce leverage. Although not popular with equity investors, one of the easiest ways for management teams to improve their balance sheet would be to reduce their stock’s dividend or stop paying it all together. This is complicated considering the signaling effect of a dividend cut, but it’s a move that is typically welcomed by bondholders.

Companies can also divest certain segments of their business that are no longer strategic to their core value proposition. For example, GE divested a portion of their healthcare business earlier this year and used the proceeds to pay down debt and improve their balance sheet, which was viewed favorably by bondholders. Similarly, plans for capital expenditures can be reduced in the event a company is concerned about being downgraded to “junk” status.

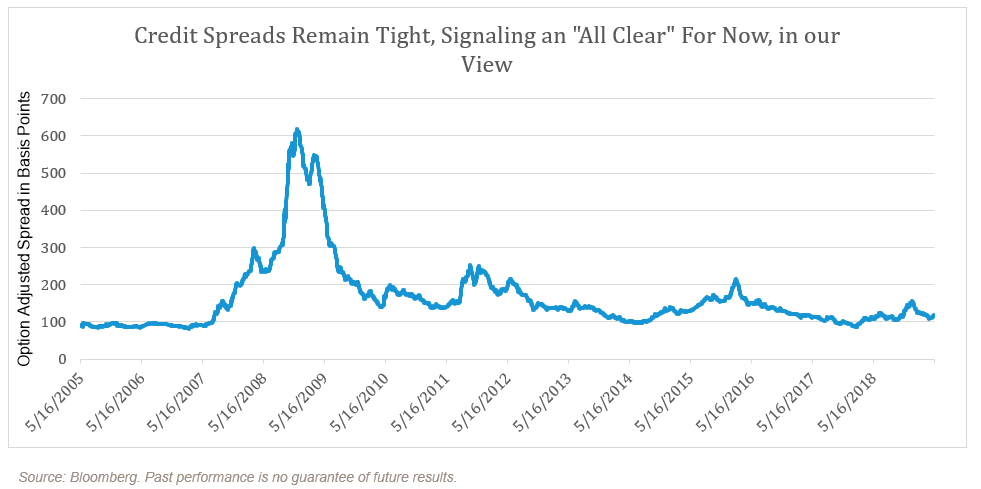

CREDIT SPREADS NOT WIDENING: Although some critics claim that IG corporate bonds are vulnerable, the market is sending a very different message. Credit spreads, which measure the additional premium investors demand for default risk, continue to grind lower and are now at +118, which is below their historical average. As interest rates and credit spreads remain subdued, most IG companies can refinance their debt at attractive levels, keeping interest expenses low.

Therefore, despite the alarms about an increase in total debt outstanding, low rates and credit spreads have made the cost to service the debt much lower. We believe this will continue to support credit markets and minimize the risk of defaults.

Lastly, if a wave of downgrades from BBB to BB were to occur, it doesn’t necessarily imply a wave of defaults. In a study by S&P Global, the historical default rate for BB-rated bonds is less than 1% going back to 1981. Therefore, although IG companies might face higher capital costs if downgraded to “junk” status, it does not suggest an immediate uptick in bankruptcies and defaults.

CONCLUSION: Despite the concerns surrounding IG corporate credit, we feel there are reasons to keep an allocation to the asset class. Even with the recent decline in interest rates, IG corporate bonds are still yielding around 3.5%, which is more than current inflation (2%) and more than the yields offered by comparable Treasury bonds. We believe that income wins over time and that the additional coupon payments help offset the increased volatility of corporate bonds relative to US Treasuries and cash. Specifically, as reflected in our portfolios, we continue to prefer shorter maturity (1-5 year) IG corporate bonds for investors looking to generate income.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared with composite benchmarks for each portfolio, as opposed to compared with the portfolios’ composite benchmarks.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

An investment grade is a rating that indicates that a municipal or corporate bond has a relatively low risk of default. Bond rating firms, such as Standard & Poor’s and Moody’s, use different designations consisting of upper- and lower-case letters ‘A’ and ‘B’ to identify a bond’s credit quality rating. ‘AAA’ and ‘AA’ (high credit quality) and ‘A’ and ‘BBB’ (medium credit quality) are considered investment grade. Credit ratings for bonds below these designations (‘BB’, ‘B’, ‘CCC’, etc.) are considered low credit quality, and are commonly referred to as “junk bonds.” The bottom tier of investment grade credit ratings includes BBB+, BBB, and BBB-. These companies are considered “speculative grade” and are vulnerable to changing economic conditions and could face big challenges if economic conditions decline. When rated, however, these companies have demonstrated both the capacity and capability to meet their debt payment obligations.

Index Definitions: (you cannot invest directly in an index)

Bloomberg Barclays US Aggregate Bond Index measures the performance of the US investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States – including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

The Bloomberg Barclays US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Individual securities mentioned in this piece are not intended as recommendations. As of the date of this publication, RiverFront has discretion over credit positions in F and GE in client portfolios

A basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 853615.