By BCM Investment Team

The National Bureau of Economic Research’s decision to set the COVID recession at two months was surprising since more than a year and a half later, “normalization” is ongoing. And although longer-dated inflation expectations have been moderating (accepting the “transient” theme), 7 million Americans are still out of work despite many industries—particularly the service and manufacturing industries—continue to report hiring struggles. Looking to emerging markets, inflation rates in EM Asia appear subdued—well below their target midpoint—and are expected to recede further. Meanwhile, investors seek downside protection as the Skew index continues to climb and market leadership between growth and value continues to toggle. Bond yields around the globe have been moving lower but this could just be the seasonal effect we see every year as the 10-year Treasury yield has historically declined during the summer months. Will we see it rise within the next 6-months, following a 20% drop, or will the Covid factor force different results?

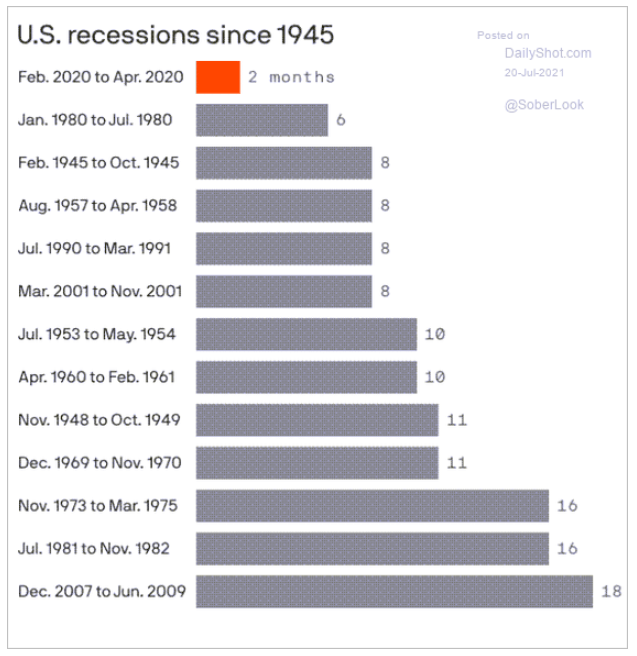

1. As a whole, it was determined the recession lasted only two months, the shortest in history. I suppose it depends who you ask…

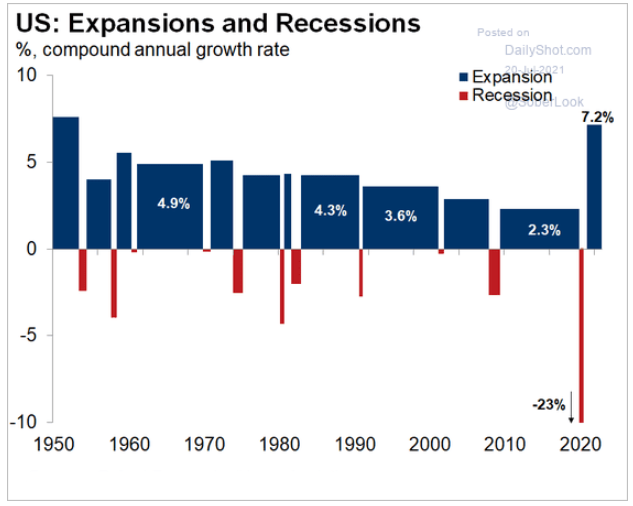

2. Normalization is still ongoing, yet so far the recovery is on par with post WWII:

3. US CPI does not always capture “true” inflation. The largest component, housing, is determined by “equivalent rents” which is based on a survey asking homeowners how much they think they could rent their house for. This is the best we can do?

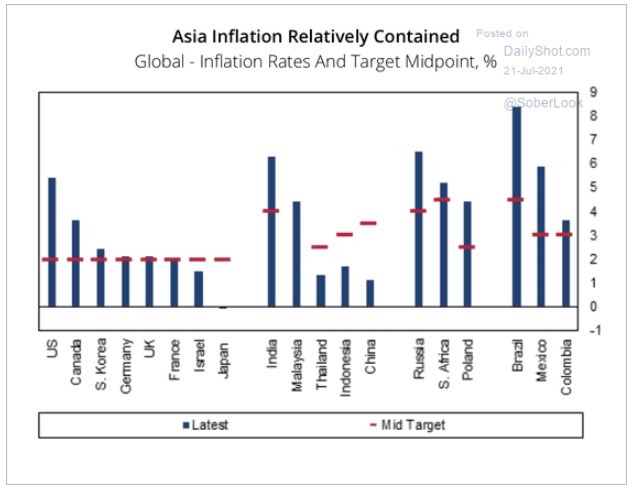

4. Inflation rates around the globe:

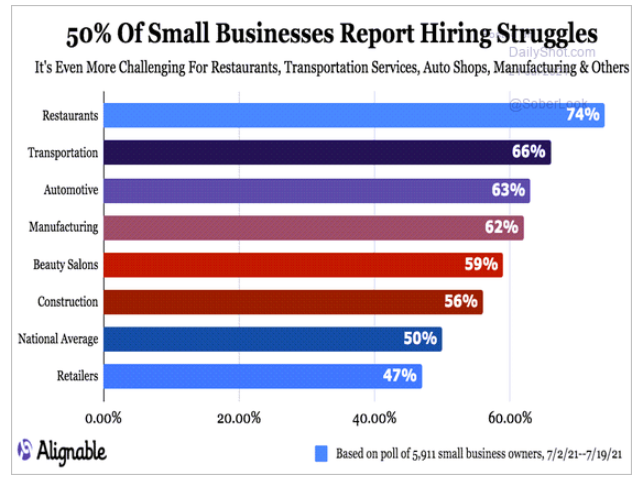

5. ~7 million Americans are still unemployed from the Covid recession, yet:

6. Is another blow to crypto on the way?

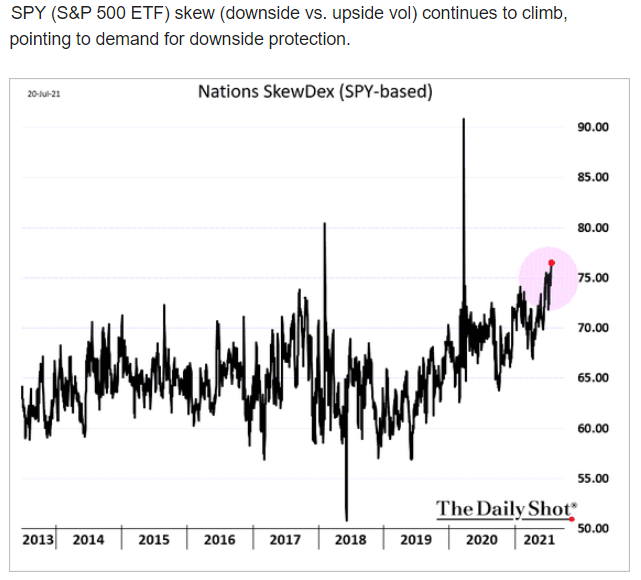

7. Most investors look for downside protection after it is too late (see spikes). We offer more permanent alternatives:

8. Market leadership has been on a rollercoaster this year. This chart shows a value ETF/a growth ETF:

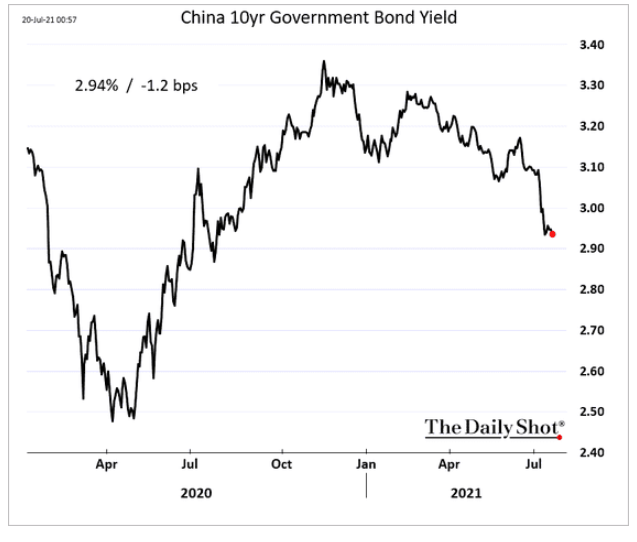

9. Falling bond yields has generally been a global phenomenon. Are the bond markets telling us the growth will moderate sooner/more than expected?

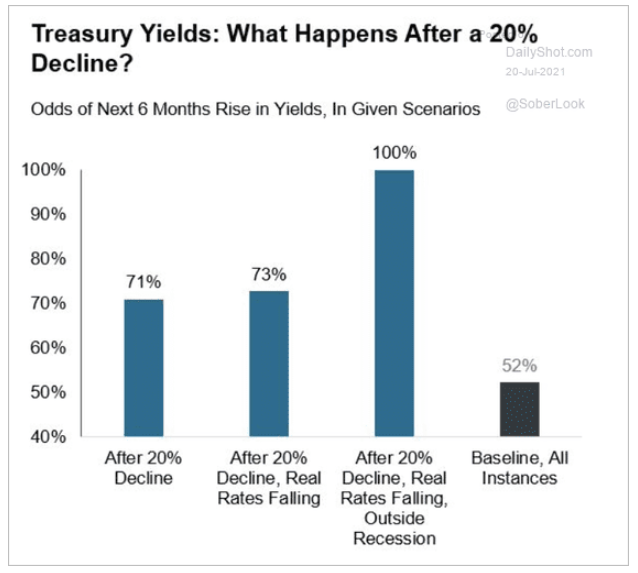

10. Interesting, but the yield drops appear to be more than seasonal, especially in the face of rising inflation concerns:

11. But Covid never happened before…

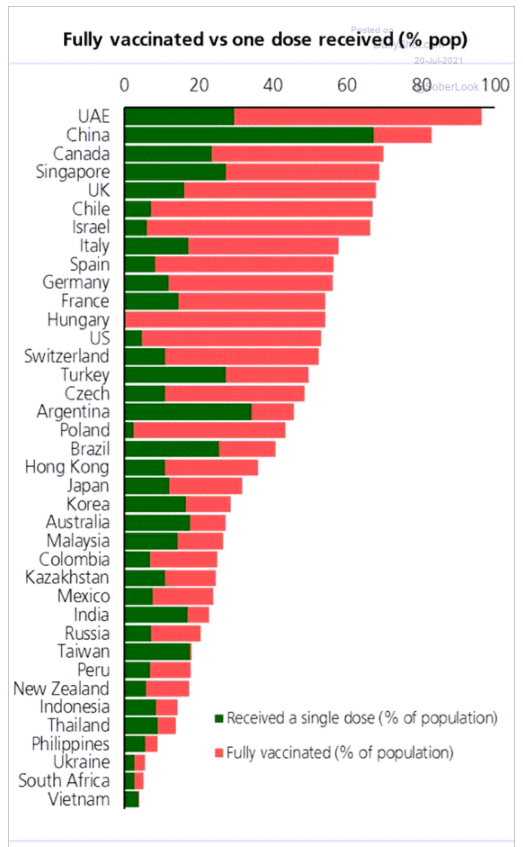

12. If herd immunity requires 70% or more (figures vary), then the planet is still woefully exposed to the delta variant:

This article was contributed by Beaumont Capital Management Investment Team, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.