Both classic and modern literature have countless stories of seemingly outmatched opponents finding a way to persevere and even prevail, despite the odds. One of our favorite examples, especially since we are talking about municipal bonds, is Aesop’s Fable “The Tortoise and the Hare” in which the slow and steady Turtle unexpectedly wins a race against the seemingly unbeatable Hare. Despite both literary and real-life examples of these events occurring time and time again, social influences, behavioral factors, and cognitive distortions cause many investors to keep betting, or in this case, investing in the proverbial “Hare.” Although adjectives like steady, stodgy, and plain-vanilla do not elicit a rousing response, municipal bonds continue to provide investors with positive returns, low volatility, and steady tax-free income.

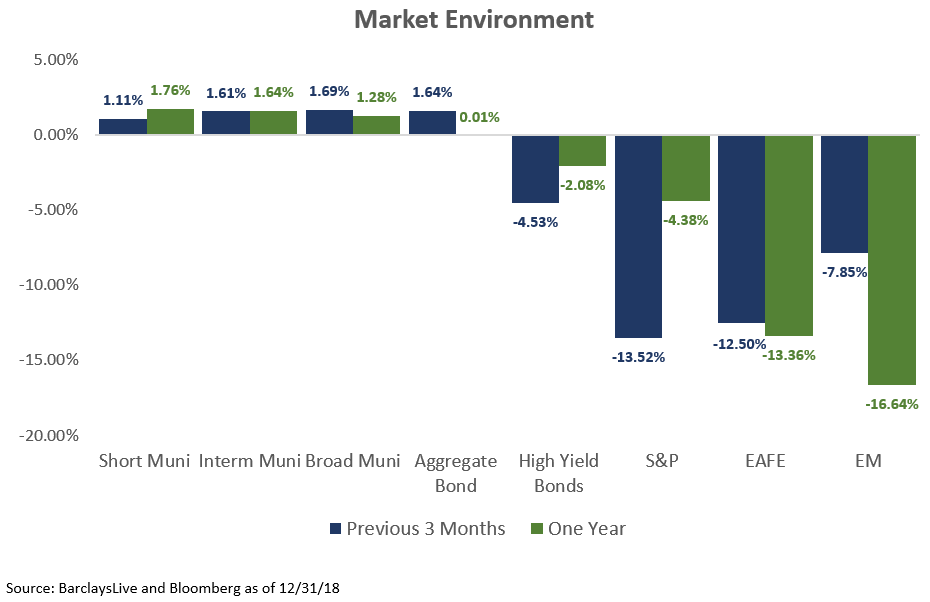

Once again in 2018, the municipal market showed its merit and provided investors with positive returns, low volatility, and ample liquidity during a time when it was needed most. Despite a quarter or two of low or negative returns earlier in the year, municipal bonds finished 2018 in positive territory as most other core asset classes experienced significant challenges, as shown below:

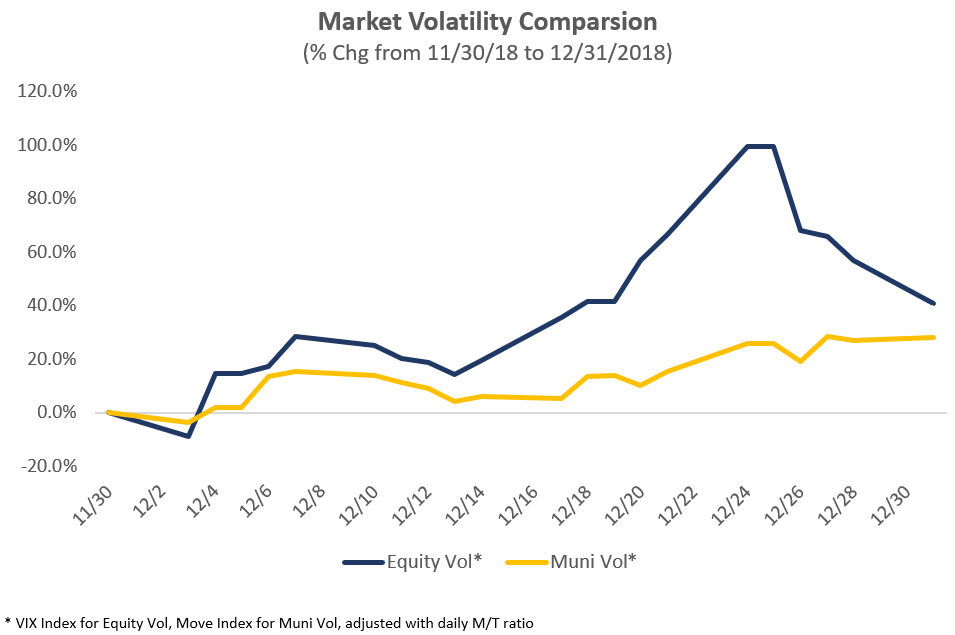

Despite the recent tumult of the global equity and corporate credit markets, municipal bond volatility was much more muted in comparison to the U.S. equity market, further validating municipal bonds’ role as a negatively correlated asset class that financial advisors and clients rely upon during times of market turmoil.