By Lawrence Whistler, CFA, Nottingham Advisors

As we enter the last quarter of this decade, and look ahead to 2020, we can’t help but marvel at the remarkable bull run in the equity market. Ascending from the depths of the great 2008-09 bust, the S&P 500 index has risen 335%. Toss in dividends and the return amounts to an astounding 441%! This translates to a 17.3% annual return over this period. Amazing.

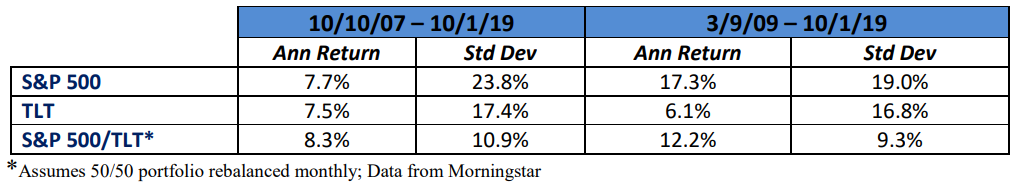

Now, as with all things – especially investing – some perspective is in order. These phenomenal returns all stem from the absolute bottom of the market crash. If we go back to the pre-recession high in October 2007, investors will find a markedly different (but still decent) annual return of 7.7%. This includes an 88% rise in the price level of the S&P 500, along with an additional 55% added in via dividends.

Perhaps as interesting to us, longer dated US bonds nearly matched US equities over the 2007-19 period. Using TLT, the iShares 20+ Year Treasury Bond ETF, as a proxy, US Treasury bonds returned 7.5% annually over the ’07-19 period, nearly matching the performance of the S&P 500 – with 26% less risk!

If nothing else, this highlights the value of Treasury bonds during a market correction. If we look at TLT from the market bottom in 2009, it returned a still respectable 6.25% annually, versus the S&P’s 17.3%.

The point in highlighting these two time periods is to call to mind the value of a “hedge” in one’s portfolio. The S&P 500 fell by -56.7% from 10/10/07 to 3/9/09. TLT returned +25% during this period.Granted, on October 10th, 2007 the long US Treasury bond was yielding 4.87%, a veritable king’s ransom relative to today’s yield of 2.04%. This begs the question: with yields so low, can bonds still function as a meaningful hedge against equity drawdowns or is it cost prohibitive? We believe they can.

Third Quarter Recap

Equity returns were somewhat lackluster during Q3 with August’s sell-off marring decent months in July and September. Large-caps eked out a 1.7% return for the quarter while both mid- and small-caps declined slightly. At roughly 18x earnings, US equities continue to be optimistically priced, and a lot will rest on upcoming Q3 earnings reports. While growth expectations have been ratcheted down somewhat, we don’t expect the market will be too forgiving should companies miss lowered estimates.

The IPO frenzy and drama around WeWork dominated much of the quarter’s headlines. Former “unicorns” such as SmileDirectClub and Peloton came public in Q3, with disappointing outcomes.

SmileDirectClub came to market at $23 per share and is now, less than a month later, trading hands at $13. Ouch. And Peloton hasn’t fared much better. Having gone public on 9/25 at $29 per share, the maker of spinning bikes and other fitness equipment has seen its share price drop to $22. Lastly, perhaps the worst IPO of 2019 is the one that didn’t happen.

Valued at nearly $47 billion in January of this year, WeWork, the largest owner of office space in NYC, was forced to postpone its IPO after investors balked at the lofty valuation, indicating the company may only be worth $10-15 billion or so. In 2018, WeWork had $1.8 billion in revenues. It lost $1.9 billion! Since the failed IPO, WeWork founder and CEO Adam Neumann was forced to resign, their debt has been downgraded deep into junk territory, and their ability to survive a recession has been called into question. Gulp. Any interest in the “hot” IPO market? If so, check out Uber and Lyft. Awful.

International equity markets didn’t fare much better in Q3. The ongoing Brexit saga, an economic slowdown in Germany and the ongoing trade war between China and the US has taken its toll on global growth prospects. The latest unrest in Hong Kong is only elevating the uncertainty around the direction of the world economy. Although most foreign markets are up measurably YTD, the 4th quarter will likely present challenges to further gains absent some more clarity on the aforementioned issues.

All the uncertainty in Q3 did prove favorable to bonds as nearly every domestic sector sported positive returns. US corporate bonds were up over 3.0% for the quarter and have gained 13.2% thus far in 2019. As interest rates around the world plumb new depths thanks to expanded quantitative easing from the ECB and BoJ, foreign buying of US debt instruments has seemingly put a ceiling on yields here in the US. US interest rates remain near historically low levels and the Federal Reserve has pivoted from a tightening bias just a year ago to a more dovish stance. Having lowered the Fed funds rate 25 basis points in September, the FOMC is widely expected to cut another 25 bps before year-end.

The Road Ahead

As markets wobble here in the early stages of Q4, with economic data disappointing and impeachment rhetoric escalating, investors could be forgiven for feeling nervous. Part of the exercise at the beginning of this note is to highlight what diversification can do for one’s portfolio. The challenge with it is that it doesn’t work all the time (see International equity diversification for proof of that), but when you need it the most, it’s there. Unless one has a sufficiently long time horizon (10+ years), having some “dry powder” so to speak, is rarely a bad idea. In today’s market, one isn’t rewarded much for prudence; but that’s not to say it isn’t a good thing.

Investors have become obsessed of late over this idea of an impending recession. So much so that we fear we may be talking ourselves into one! As soon as we alter our behavior, saving instead of spending, deferring that purchase until later, we’ve almost locked ourselves into to an economic slowdown. The US consumer is arguably the most powerful determinant of the fate of the world economy. Accounting for nearly 70% of our $21 trillion economy, consumption is the most critical factor in America’s long-term growth story. Fortunately, many of the factors driving consumption – employment, wage growth, household debt – are all favorable right now.

That’s not to say things won’t change and we’re beginning to see some indicators that global weakness is coming ashore to America. While the President’s trade war and the Democrat’s impeachment quest hog the headlines, below the surface we’re seeing some economic data (such as the recent ISM Manufacturing Survey, which at 47.8 was the lowest reading in 10 years) that is worrisome. So, how should investors react?

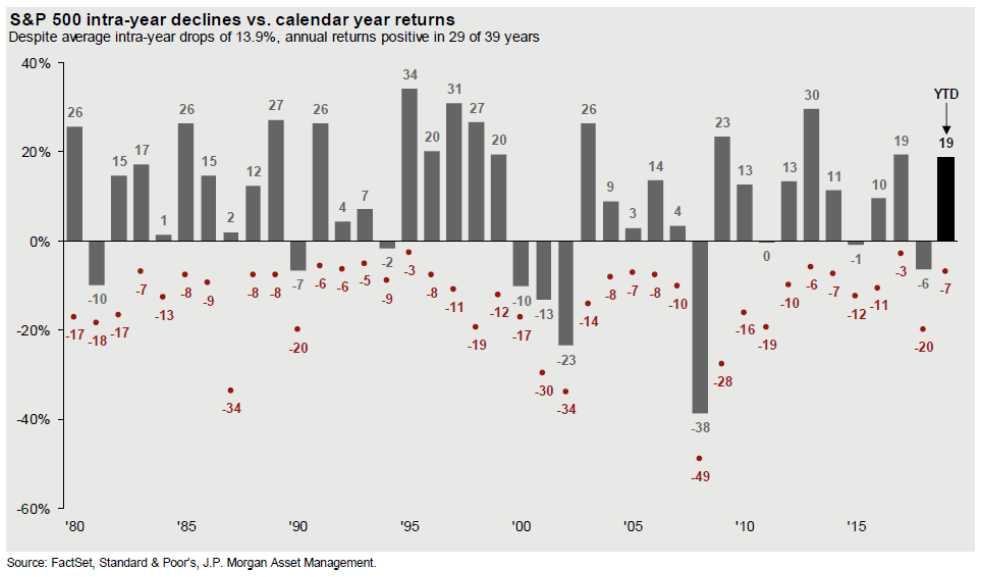

We’ve long preached on the folly of market timing. Aside from having to be right twice – when to get out and then when to get back in – the odds of perfectly timing an exit are minimal at best. Investors are better off ensuring their current asset allocation can survive a recession and portfolio drawdown, while bracing themselves for the inevitable shock of seeing their assets decline in value. Again referencing the table on page one, most investors would be pretty comfortable with any of the returns presented, not knowing they would have had to watch their portfolio value cut nearly in half at one during the time horizon.

Looking at the chart above, most years contain some significant drawdown. Steeling oneself for the inevitable sell-off, riding it out, and participating fully in the recovery is the key to long term investment success. Timing markets doesn’t work. Period. (And if you have done it successfully, you were LUCKY!) Now, let’s not confuse this with tactical or strategic allocation shifts. There may be times to be aggressive and times to be defensive. However, those times are often determined more by valuation analysis than by outside noise. The challenge with determining proper valuations today is the overt manipulation of interest rates by central banks. They have, for better or worse, messed around with the single most important factor used in determining value, the discount rate.

In suppressing interest rates by buying bonds, even negative-yielding ones, global central banks have rendered ineffective the mechanism that markets use to establish price. Supply of and demand for securities is what should establish price. When a large player like the European Central Bank increases demand, regardless of price, things go awry. This is happening the world over and we can only pray our Federal Reserve has the sense not to go down the path of negative interest rates. In our opinion, it is time for this grand monetary experiment known as “quantitative easing” to come to an end.

Summary

So, in summary, 2019 has been a strong year for most asset classes. Many investors have portfolios near all-time highs after this long bull market. If you think allocation adjustments should be made, let’s talk about it. A recession is inevitable, but perhaps not imminent. Be ready though, because equity markets will likely fall at some point, perhaps by a lot, perhaps by something less than “a lot” – I was never too good at forecasting. Don’t be surprised; be ready – mentally, as well as in your portfolio.

There will be a lot more noise over the months ahead with the presidential election a little more than a year away. The trade war, impeachment process, recession talk – a lot of the noise will be negative. While it’s important to always stay informed, it’s also important for investors to try and distinguish the signal from the noise. Fortune favors the bold, so the saying goes. It also favors the prudent. We’re not quite sure where interest rates will go in the short run; nor, for that matter, the level of equity prices. We do think, however, that low-cost, well diversified portfolios can withstand the test of time. Having made it through the Great Recession, we feel good about our chances during the next downturn. In the meantime, please don’t hesitate to reach out and let us know how we can be of help.

Larry Whistler, CFA

President/Chief Investment Officer

October 2019

This article was written by Lawrence Whistler, CFA, President/Chief Investment Officer of Nottingham Advisors, a participant in the ETF Strategist Channel.

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent,

direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed

to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some

portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in

your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.