Our current stance:

The market dislikes confusion and we have a ton of it currently. Now is the time to own high quality, high pricing power, economic moats and in brands selling products and services that are in-demand and timely for the important demographics we track. The youth of America are devouring video games, energy drinks, experiential services and entertainment. Millennials are just beginning their family formation years and housing and home improvement is a direct beneficiary. Athleisure is at the center of American culture and it’s spreading across the globe. Technology is at the center of virtually every business and cap-ex is strong, particularly from cash-rich companies with superior products. We may have entered “peak social” which is why we sold Facebook in late December.

We prefer business enablers like Adobe and Microsoft, online retail, organic foods and cloud computing through Amazon. The only FAANG names we currently own are Apple and Amazon. We are quite comfortable with that at the current time. We still like Apple given its defensive characteristics with oodles of cash and a 92% retention rate for iphone buyers.

Alcoholic beverages are at the center of every demographic, particularly when people get their March statements and see the daily headlines. Constellation brands has been a favorite beer, wine & spirits brand for years and remains a top pick. We will continue to build on our “Asian consumer spending bucket” given “new China and Asia” is much better positioned than “old China/Asia”. China’s GDP is roughly 38% driven by consumer spending. That number has nowhere to go but up. Alibaba, Ten-Cent and JD.com are direct beneficiaries of consumer spending and e-commerce growth.

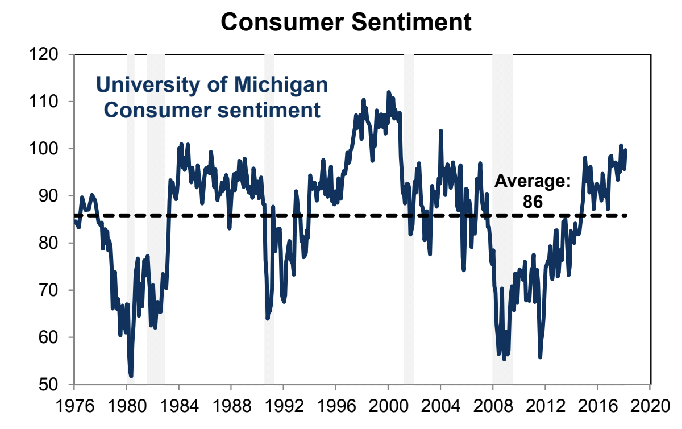

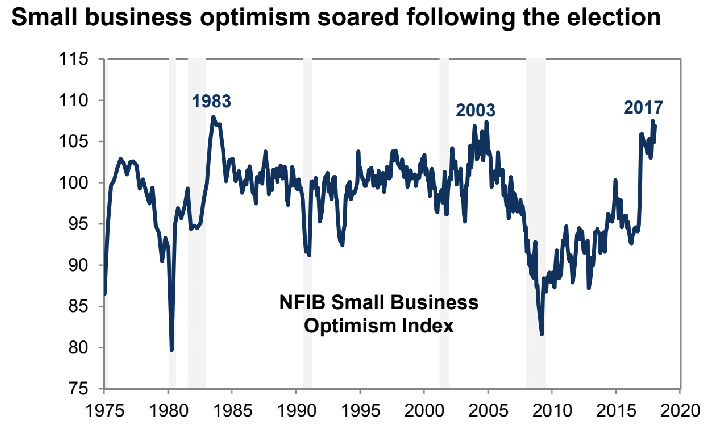

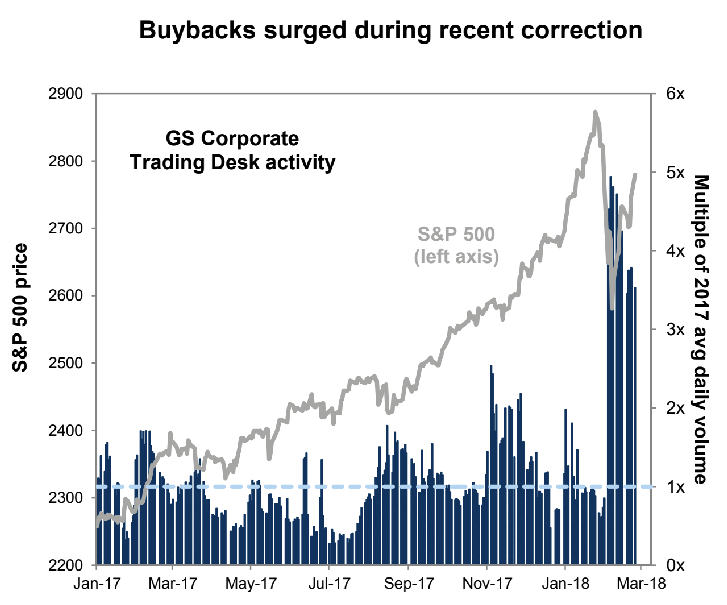

A few positive charts for perspective:(source: Goldman Sachs Research)

![]()

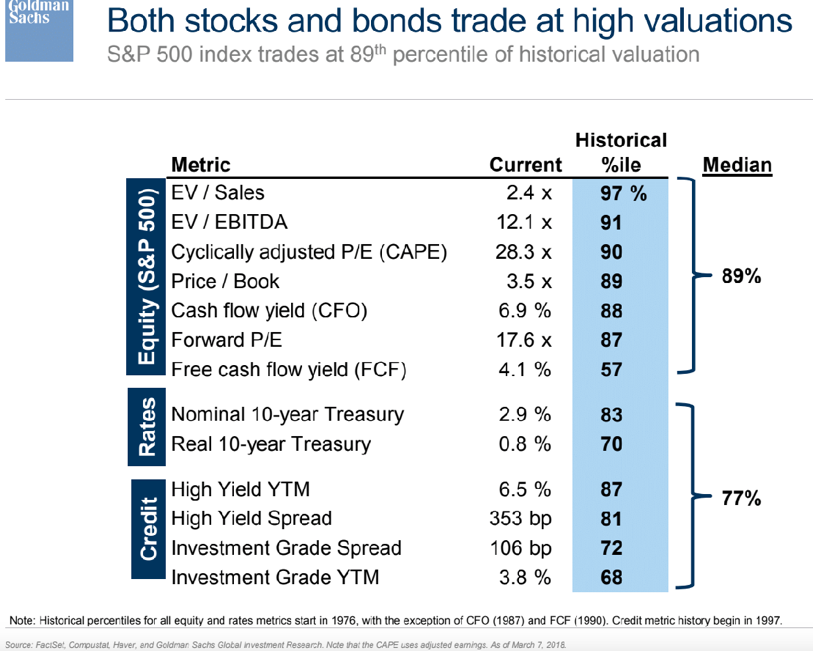

A caution sign that reinforces why one might consider dynamic equity strategies:

Bottom line. We invest in the markets we have NOT the one we want. Today we have fear, uncertainty, and doubt. Hurricanes do not last for very long however, and the economy and consumer spending is what really matters. High volatility & short-term draw-downs never feel good but volatility is often the friend of the tactical allocator and strategic investor. Most funds are not managed by tactically-minded investors. This differentiates our team and the Brands strategies from our large cap equity peers.

How? Our industry peers manage money largely the same way: With a perpetual bull market mentality. As we know from living through 2000, 2008/2009, bull markets don’t last forever. The business cycle still matters so we watch it closely. Sometimes the market is volatile and goes nowhere and other times it has large corrections and/or goes into bear markets. Dynamic Brands was created to offer a more common-sense approach that includes being willing to adapt to changing markets. We are now in “tactical-mode” versus a fully invested, “bull market mode” meaning we will hold our favorite core brands and trade around the core when we encounter max oversold conditions while holding higher levels of cash than normal.

That’s all for now. Remember this: we have seen this movie before and have the tools & experience to manage through different market environments. I’m always here to chat markets, brands, technicals. My email is [email protected].

This article was written by Eric M. Clark, Portfolio Manager – Brands suite of investments at Accuvest, a participant in the ETF Strategist Channel.