By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Our signals suggest that the recent volatility in the market has a lot to do with the downshift in the pace of global economic growth. Headlines about trade wars and other hot topics are not a fundamental risk to the long-term stability of the financial markets in our view.

For example, global leading economic indicators (LEIs) suggest that U.S. economic growth remains solid, while the pace of growth in other major economies, such as the euro zone, Japan, China, and other emerging markets, may be softening.

![]()

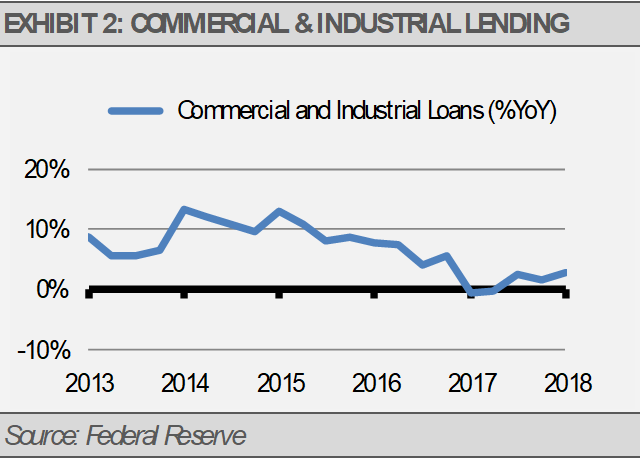

Many signals from the U.S. economy bode well for industry and the labor market. For example, commercial and industrial lending has finally picked up speed after stagnating since early 2017 (exhibit 2). The rise in lending suggests to us that businesses are beginning to find growth opportunities worth investing in and banks are willing to lend capital to finance these opportunities.

Additionally, the U.S. labor market looks as strong as ever. Though we may see monthly jobs creation slip from its recent strength, the labor market still looks rather solid. For example, the number of open jobs recently spiked to an all-time high according to the Labor Department’s Job Openings and Labor Turnover Survey report (JOLTS). Meanwhile, weekly jobless claims are at their lowest levels in 45 years, which suggests that employers continue to see strong demand for workers and will continue to do so.

Though a trade war would likely be a significant policy blunder, we think that the risk and impact of a trade war to the U.S. is relatively muted. While trade is certainly beneficial, it is just not as impactful to our economy as it is to many other countries. For example, trade as a percentage of U.S. GDP is roughly half the global average.

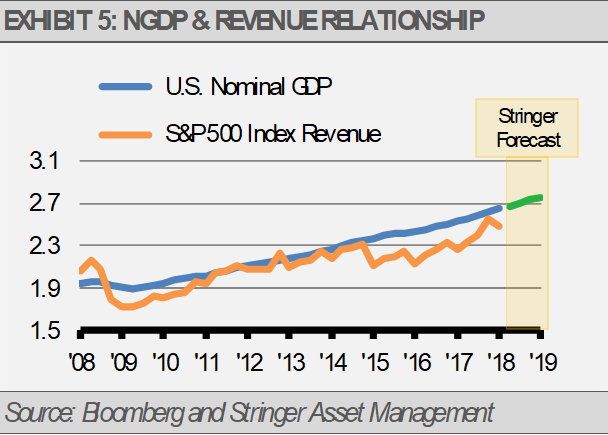

There are many probable causes for the downshift in the pace global economic growth. However, economic growth, even more sluggish growth, leads to higher corporate revenues and earnings, which ultimately can support higher equity prices, so discipline during these volatile times is key.

As the following chart suggests, there is a strong relationship between economic growth and corporate revenue growth, which should translate into earnings and stock price appreciation.

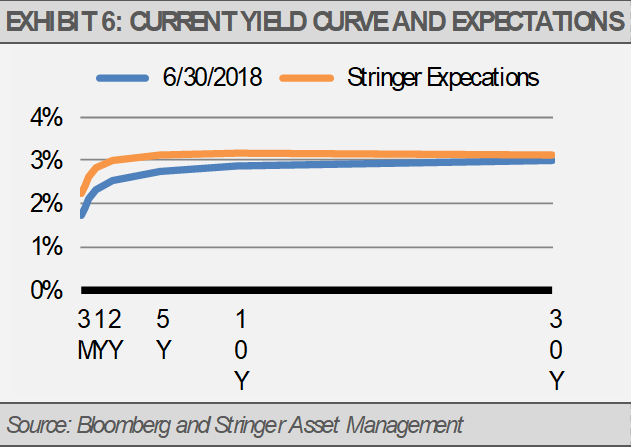

We think that slow global economic growth will keep long-term interest rates range bound for the time being. Meanwhile, the U.S. Federal Reserve (Fed) seems intent on raising interest rates each quarter for the remainder of 2018 and into 2019, which may limit inflationary pressure.

Stable or decreasing long-term interest rates, combined with rising short-term rates, should cause the yield curve to continue to flatten, but we expect the Fed to stop before they choke off liquidity and invert the yield curve. An inverted yield curve has been a consistent indicator of a looming recession and equity market decline. Our base-case scenario is that the Fed will not make this mistake.

INVESTMENT IMPLICATIONS

In this environment where the U.S. is likely to lead economic growth in the near-term, investors may want to pivot their exposures away from areas that are more vulnerable and emphasize areas that should benefit.

For instance, we recently made some changes in our tactical equity allocation to focus more on U.S. led revenue and earnings growth by adding an allocation to internet-related equities, health care equipment, as well as aerospace and defense.