We favor internet stocks since they reflect consumer and business preferences for internet related services, such as shopping and entertainment. Our investment in health care equipment reflects our confidence in that industry as the world’s wealthiest society ages.

Our recent addition of an investment focused on the aerospace and defense industries reflects our continuation of emphasizing companies whose sources of revenue are more closely tied to the U.S. and to relatively defensive equities.

We also have exposure to real estate, which is relatively defensive in nature. The investment we chose for this sector has significant exposure to residential REITs and office space, but also includes cellphone towers, data centers, and self-storage companies, which also stand to benefit from continued economic growth while being rather insulated from global economic risks.

Broadly speaking, our global and international equity allocations tend to favor defensive areas, such as consumer staples and health care, that are generally less susceptible to economic risks.

Our broad diversification in the fixed income space allows for a relatively attractive yield with an eye towards risk management. With the yield curve flattening, our traditional fixed income allocations tend to favor high quality, intermediate duration corporate bonds, as well as taxable municipal bonds in our more income-oriented strategies. Our short-duration floating rate fixed income holdings should benefit from continued Fed rate hikes as short-term interest rates move higher.

Other alternative investments are important as we attempt to generate returns while limiting volatility risk. Options writing, merger arbitrage, and other strategies fit this theme for us.

Overall, as the global economy and markets shift, risk management, sound diversification, and the use of alternative strategies has become increasingly important in our opinion.

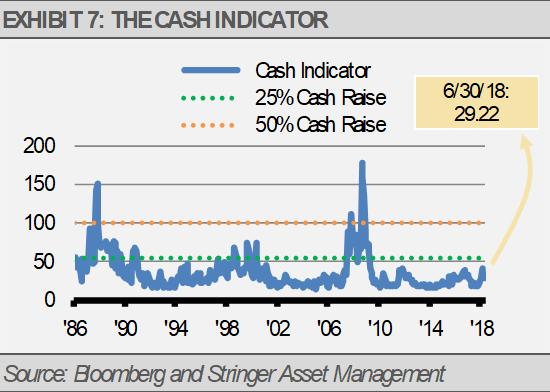

THE CASH INDICATOR

The Cash Indicator (CI) has settled into a range close to historical norms. This is consistent with our fundamental analysis that the global financial markets should be able to withstand any shocks coming from trade wars or other near-term headline risks.

![]()

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Index Definitions:

S&P 500 Index – This Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.