Astoria Portfolio Advisors been vocal about sticking with high quality stocks and bonds, diversifying across factors, and including alternatives to help navigate the deteriorating macro economy. While it may seem trivial to pick a high-quality stock or bond ETF, we often see investors select the wrong product.

As ETF strategists, we conduct extensive research before investing in ETFs. We apply a ‘surgical approach’ by looking under the hood of each ETF. Specifically, we stress test each ETF through a variety of portfolio construction tools and risk models.

Using Bloomberg’s portfolio risk model, we identify a range of detailed risk characteristics on our holdings. We’ve taken a closer look at several of our US Equity, International Equity, and Fixed Income ETFs. The content below is a summary of a larger report we recently released (For the complete report, please click here).

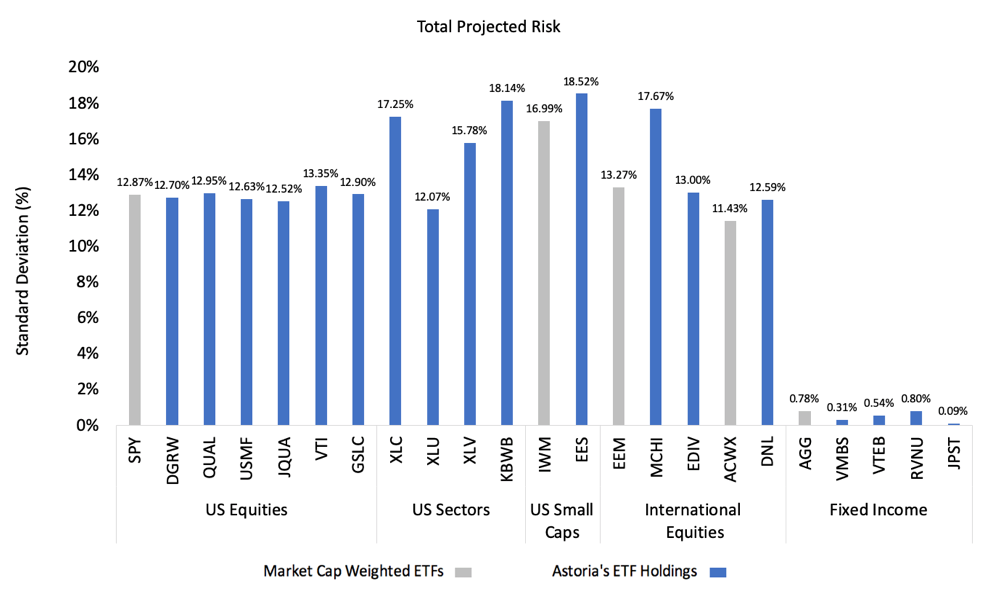

Total Projected Risks

Both our US Equity ETFs (DGRW, QUAL, USMF, JQUA, VTI, & GSLC) and US Sector ETFs (XLC, XLU, XLV, & KBWB) were compared with SPY. Our Small Cap ETF (EES) was compared with IWM and our International Equity ETFs (MCHI & EDIV; DNL) were compared with EEM & ACWX (respectively). For our Fixed Income ETFs (VMBS, VTEB, RVNU, & JPST), we’ve compared them with AGG.

We observe the following:

- Several of Astoria’s US Equity ETF holdings (DGRW, USMF, JQUA) have lower projected total risks.

- Several of Astoria’s US Sector ETF holdings (XLC, XLV, KBWB) have higher projected total risks.

- Astoria’s US Small Cap ETF holding (EES) has a higher projected total risk.

- Our Fixed Income ETF holdings (VMBS, VTEB, JPST) generally have lower projected total risks.

Source: Bloomberg. Astoria’s ETF holdings as of July 25, 2019.

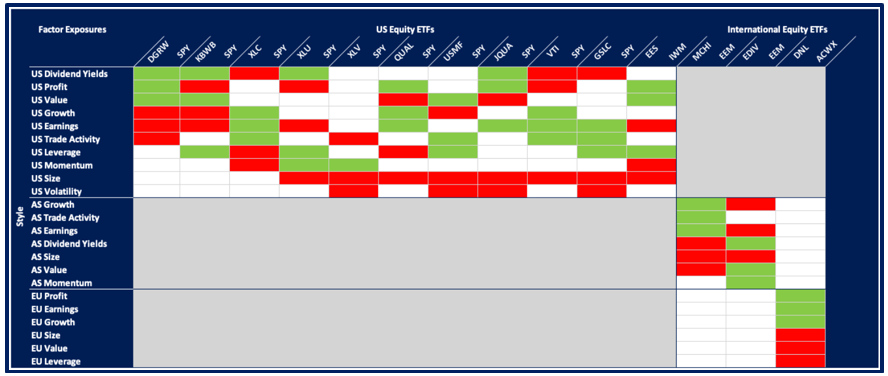

Style & Industry Factor Tilts

- Relative to SPY, DGRW is tilted more towards US Dividend Yield, US Profit, & US Value, and away from US Growth, US Earnings, & US Trade Activity (see table below).

Source: Bloomberg. Astoria’s ETF holdings as of July 25, 2019. Astoria’s ETF holdings as of July 25, 2019. Green boxes indicate that Astoria’s ETF holdings are tilted towards a particular factor exposure compared to their comparable market cap weighted ETFs. Red boxes indicate that Astoria’s ETF holdings are tilted away from a particular factor exposure compared to their comparable market cap weighted ETFs.

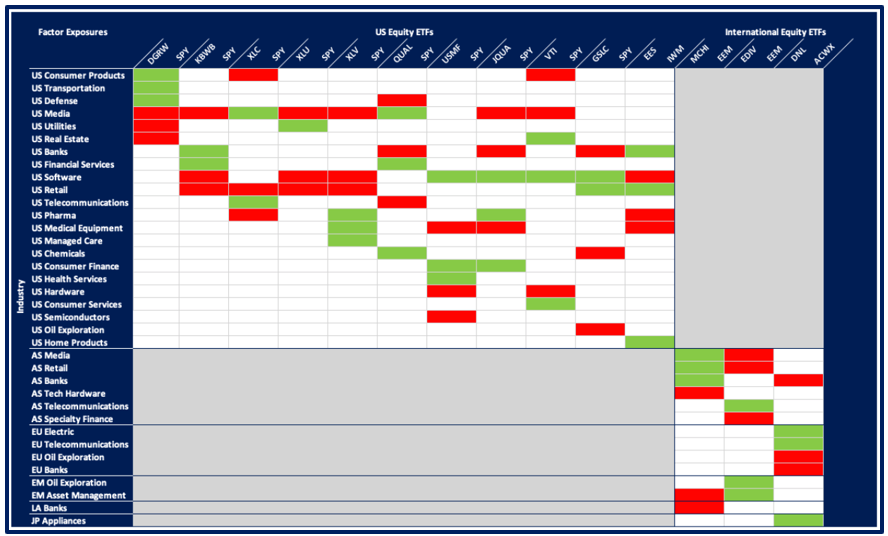

- Relative to SPY, QUAL is tilted more towards US Media, US Financial Services, & US Chemicals, and away from US Defense, US Banks, & US Telecommunications (see table below).

Source: Bloomberg. Astoria’s ETF holdings as of July 25, 2019. Green boxes indicate that Astoria’s ETF holdings are tilted towards a particular factor exposure compared to their comparable market cap weighted ETFs. Red boxes indicate that Astoria’s ETF holdings are tilted away from a particular factor exposure compared to their comparable market cap weighted ETFs.

In aggregate, we note the following:

- Astoria’s US Equity ETF holdings are generally tilted towards US Dividend Yields, US Profit, US Value, US Earnings, US Trade Activity, & US Leverage, and away from US Size & US Volatility.

- Astoria’s International Equity ETF holdings are tilted towards AS Trade Activity, AS Momentum, EU Profit, EU Earnings, & EU Growth, and away from EU Size, EU Value, & EU Leverage.

- Astoria’s US Equity ETF holdings are generally tilted slightly towards US Financial Services & US Consumer Finance, and away from US Media, US Banks, US Retail, & US Medical Equipment.

- Astoria’s International Equity ETF holdings are tilted towards AS Telecommunications, EU Electric, EU Telecommunications, EM Oil Exploration, & JP Appliances, and away from AS Tech Hardware, AS Specialty Finance, EU Oil Exploration, EU Banks, & LA Banks.

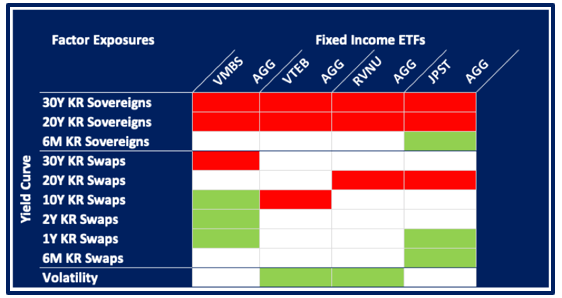

Yield Curve & Spread Factor Tilts

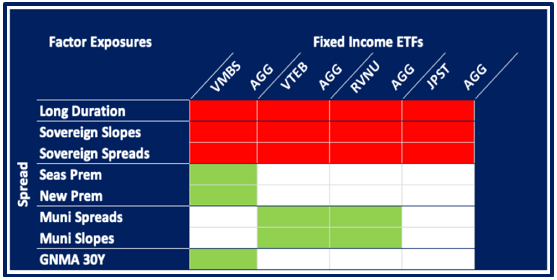

Here we display the factor tilts of our Fixed Income holdings versus their market cap weighted ETF equivalent.

- As an example, VMBS relative to AGG is tilted more towards 10 Year Key Rate Swaps, 2 Year Key Rate Swaps, & 1 Year Key Rate Swaps, and away from 30 Year Key Rate Sovereigns, 20 Year Key Rate Sovereigns, & 30 Year Key Rate Swaps (see table below).

Source: Bloomberg. Astoria’s ETF holdings as of July 25, 2019. Astoria’s ETF holdings as of July 25, 2019. Green boxes indicate that Astoria’s ETF holdings are tilted towards a particular factor exposure compared to their comparable market cap weighted ETFs. Red boxes indicate that Astoria’s ETF holdings are tilted away from a particular factor exposure compared to their comparable market cap weighted ETFs.

- Moreover, VTEB relative to AGG is tilted more towards Municipal Spreads & Municipal Slopes, and away from Long Duration, Sovereign Slopes, & Sovereign Spreads (see table below).

Source: Bloomberg. Astoria’s ETF holdings as of July 25, 2019. Astoria’s ETF holdings as of July 25, 2019. Green boxes indicate that Astoria’s ETF holdings are tilted towards a particular factor exposure compared to their comparable market cap weighted ETFs. Red boxes indicate that Astoria’s ETF holdings are tilted away from a particular factor exposure compared to their comparable market cap weighted ETFs.

Taking into account the data from both of these tables, we learn that:

- Astoria’s Fixed Income ETF holdings are tilted towards 1 Year Key Rate Swaps & Volatility, and away from 30 Year Key Rate Sovereigns, 20 Year Key Rate Sovereigns, & 20 Year Key Rate Swaps.

- Astoria’s Fixed Income ETF holdings are tilted towards Municipal Spreads & Municipal Slopes, and away from Long Duration, Sovereign Slopes, & Sovereign Spreads.

Astoria Portfolio Advisor’s goal is to be the leader in constructing multi-asset ETF portfolios with a dynamic overlay. We believe in being transparent with our aggregate portfolio risk characteristics and factor exposures. For instance, in July we published a detailed summary of our portfolios (click here). We aren’t aware of any other ETF strategist putting out a 101-page report on their aggregate portfolio characteristics.

Best,

Nick Cerbone

Astoria’s ETF holdings highlighted in this report do not constitute an aggregate portfolio. Astoria maintains a variety of strategic and dynamic ETF portfolios where the holdings vary across solutions and risk tolerances. ETF holdings are subject to change at any time. For full disclosure, please refer to our website: www.astoriaadvisors.com/disclaimer.