1. Slowing U.S. data and risks abroad, particularly trade, give the Fed the green light to cut rates. The market has priced in this expectation, with 4 cuts expected in the next 12 months.

2. The demand for U.S. fixed income is supported by the lack of high-quality yield globally.

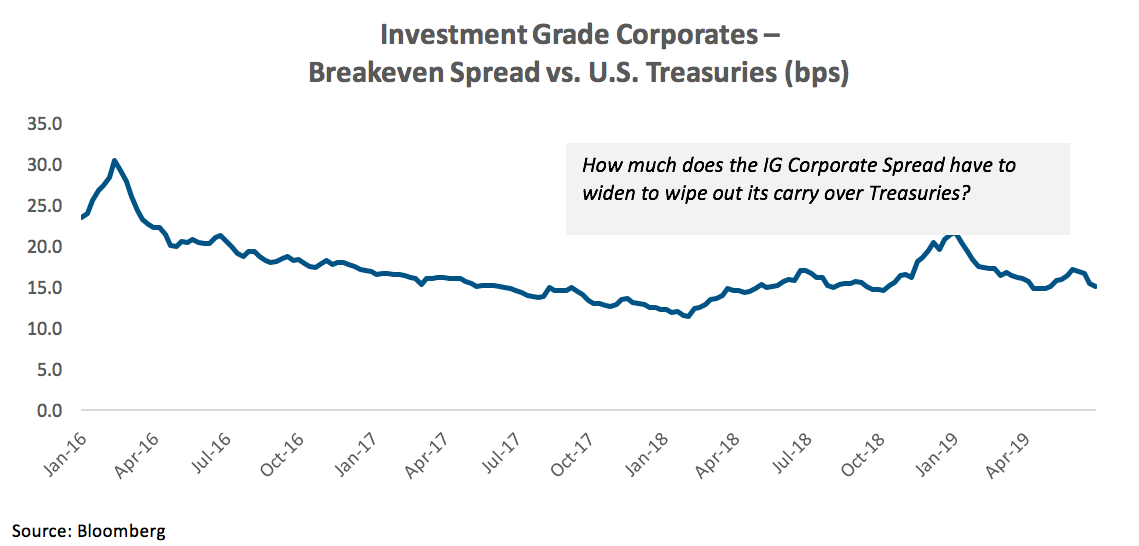

3. Central bank support and fixed income demand should result in stable credit spreads and positive yield carry. Given that spreads are at historic low levels and we’re in the late stage of the business cycle, our strategy is to earn yield carry rather than position for a major spread compression.

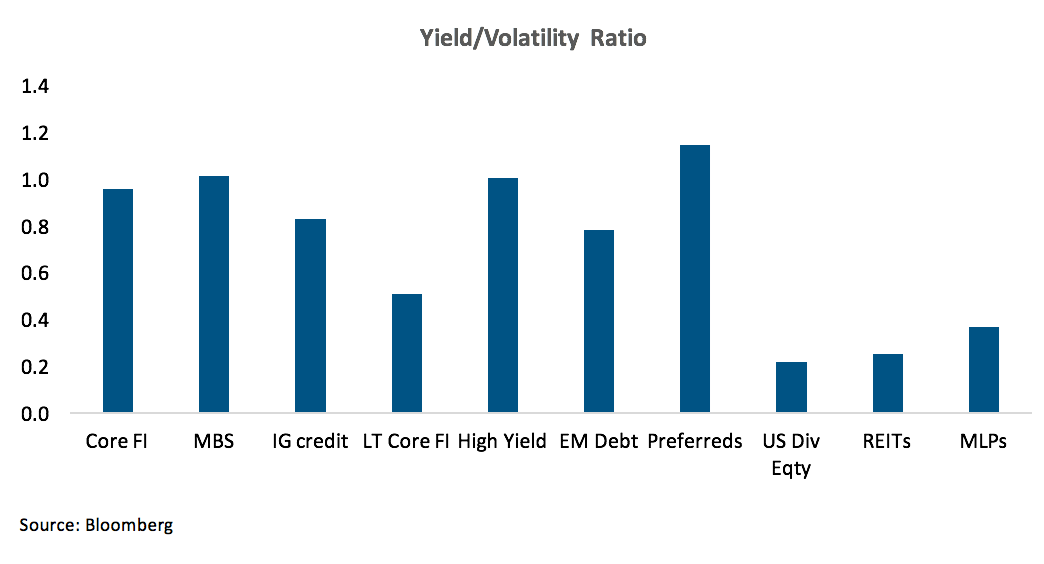

4. Both declining rates and tighter credit spreads have made yield more difficult to find. While the MBS sector has absorbed the brunt of the rally in rates, it still looks attractive from a carry perspective.

5. Within non-core fixed income, preferred stocks and high yield have the best yield-to-volatility ratio, or risk/reward profile, in our view.

For Sage’s Equities Outlook in 5 Charts, click here.

This article was written by the team at Sage Advisory, a participant in the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.