The Challenger, Gray & Christmas layoffs report specifically for September showed that job cut announcements surged 43.7% from August to 55,285. This figure is also a 70.9% year over year increase from September of 2017. However, nearly half of the announced cuts are a result of Wells Fargo’s plans to cut between 5 and 10% of its 265,000 person workforce over the next three years (assuming they cut the higher percentage). So, the report may not as bad as it looks at first glance.

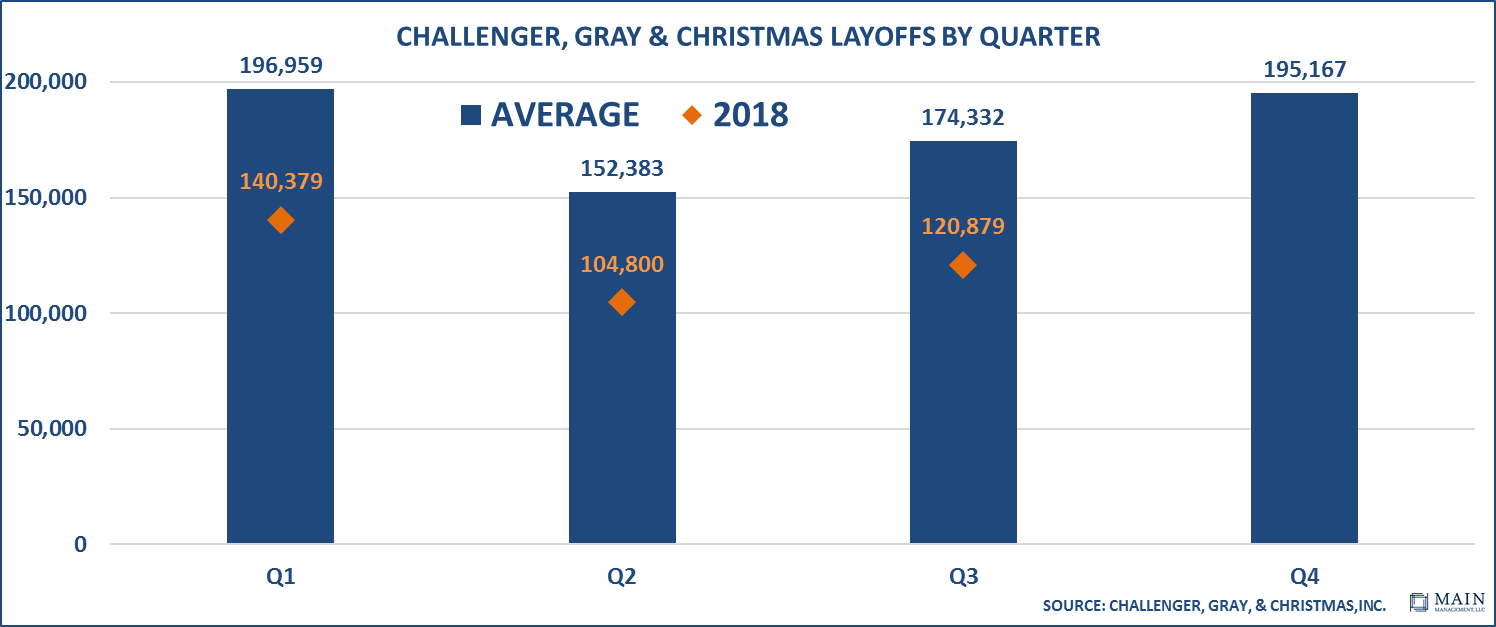

Another way of looking at the data is to examine how the three quarters of 2018 that we’ve had so far look against the longer-term quarterly averages for job cuts dating back to 1989. Thus far, 2018 has seen markedly lower levels, with each quarter coming in around 30% lower than its long-term average. Accordingly, businesses appear reluctant to cut jobs.

However, one concerning point in the layoffs report came in the section where companies disclose their plans for future hiring. The third quarter is typically when firms announce their seasonal hiring plans heading into the holiday season. The third quarter of 2018 saw hiring plans of 207,698, well below the long-term average of 466,581.

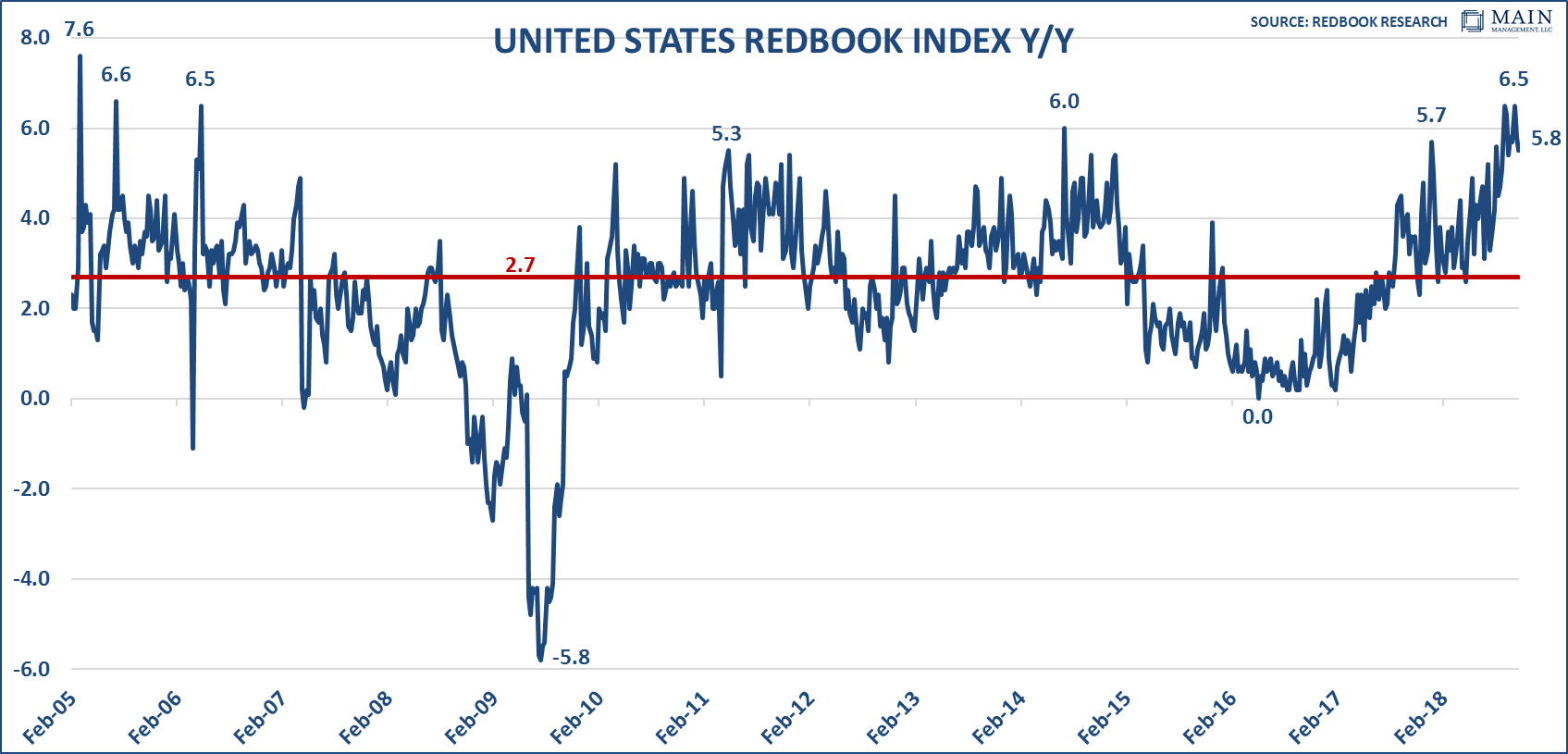

Overall, why is a strong jobs picture important to the economy? If an increasing percentage of the population are obtaining paychecks, each one of those are likely to purchase goods and services with the dollars they receive. This, in turn, helps to grow the revenues and profits of the companies providing those goods and services. One such measure is the US Redbook Index, a sales-weighted measure of the growth of sales in a store. It has been sustaining historically strong levels over the past couple months. It’s released weekly so there is some noise, but nonetheless, the weekly readings of late have been quite strong, averaging +5.6% Y/Y growth since July.

There are a number of macroeconomic risks that investors may want to be concerned about. The ratcheting up of tariffs with China, along with the potential impact on future corporate profits, seems to be the predominant ones. A resolution to the war of words and trade barriers could certainly help to ease the October jitters. However, with respect to the underlying employment picture, there still seems to be a number of reasons for optimism.

Hafeez Esmail is Chief Compliance Officer at Main Management, a participant in the ETF Strategist Channel.

A pioneer in managing all-ETF portfolios, Main Management LLC is committed to delivering liquid, transparent and cost-effective investment solutions. By combining asset allocation insights with smart implementation vehicles, Main Management offers a unique approach that translates into distinct advantages for our clients, including diversification, cost efficiency, tax awareness and transparency. http://www.mainmgt.com.