By Matthew Poterba, CFA, Senior Analyst

Global liquidity has tightened dramatically this year, which may be a headwind to global equity markets. However, not all central banks are tightening because not all countries have an inflation problem. There might be opportunities in countries with accommodative, counter-cyclical monetary policies. Japan and China, two countries investors are largely ignoring, are two markets that might warrant a closer look.

High inflation still coming in hotter than expected, less so in Japan and China

Inflation that remains higher than expected for longer than anticipated has been one of the themes we have been most vocal about over the past year. In fact, inflation around much of the world is the highest it’s been in the last several decades and continues to come in higher than forecasts despite strategists and economists revising their estimates higher.

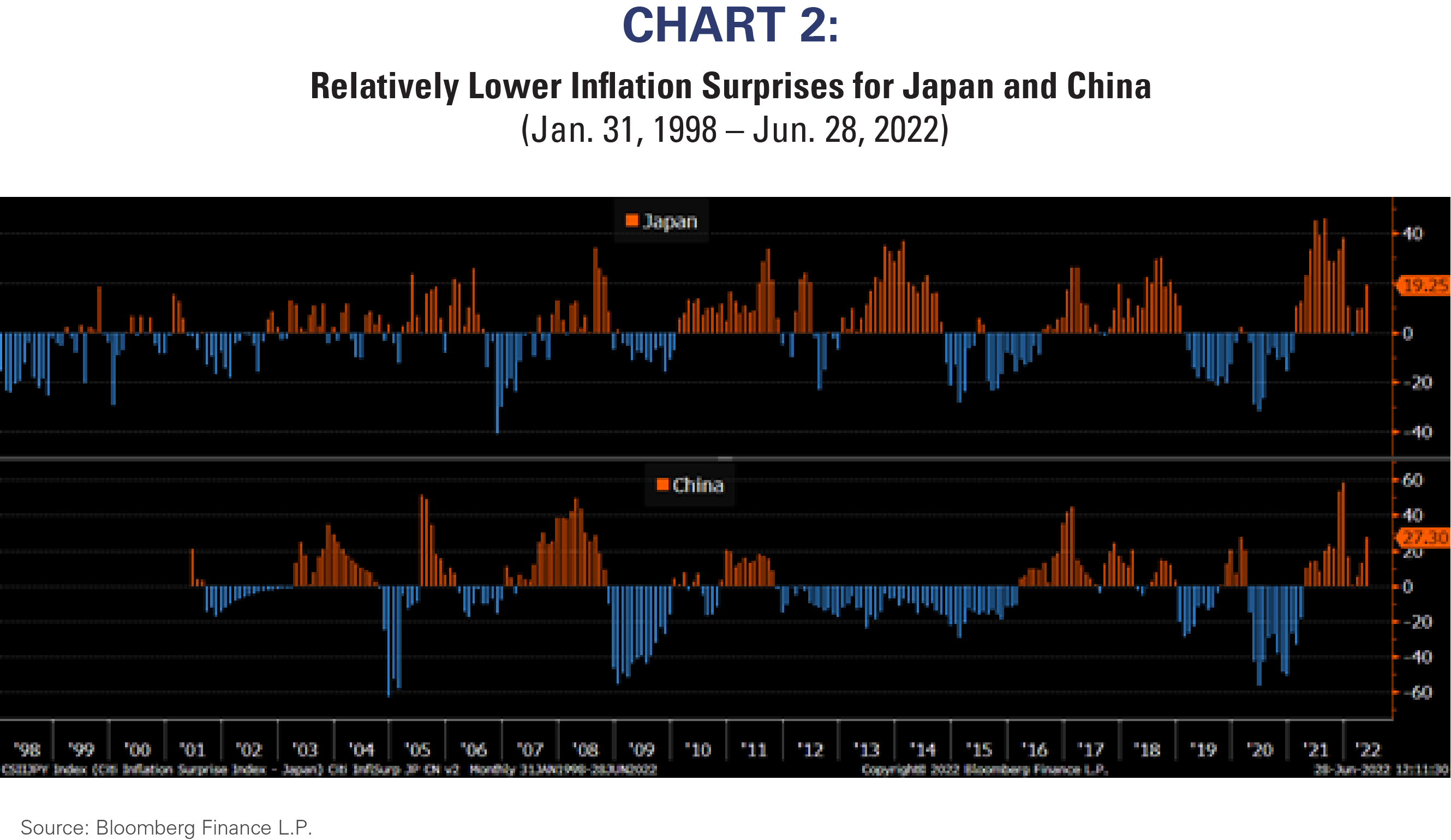

Charts 1 and 2 show Citi Inflation Surprise Indices for a set of major economies. Positive values (shown in orange) indicate actual inflation above expectations, and higher values correspond to larger magnitude of those surprises. Inflation surprises currently sit in their 99th or 100th percentile for the Eurozone, United Kingdom, Canada, and Emerging Markets.

However, there are two major countries that appear more sheltered from this higher inflation dynamic – Japan and China. Although inflation surprises there are rising, they are nowhere as extreme (see Chart 2). Current inflation also remains more subdued in Japan and China.

Countries with higher inflationary pressures accelerate policy tightening

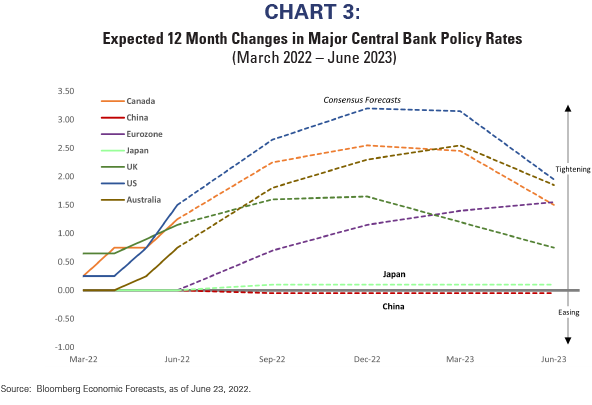

Because central banks around the world are primarily concerned with price stability, the persistence of high inflation well above their inflation targets is finally beginning to force central bankers to aggressively fight inflation by raising interest rates, even at the expense of growth. Most recent central bank announcements have contained either larger-than-expected increases in policy rates or more hawkish forward guidance, or both. As a result, the forecasts for interest rate increases continue to shift higher (Chart 3). These expectations for tighter policy are negative for equity markets.

Accommodative policy in Japan and China may present opportunity

However, not all central banks are restrictive right now because not all countries are battling high inflation. Japan and China stand out for their more dovish policies. Fewer current inflationary pressures in these countries will likely allow their central banks to maintain relatively easy policy going forward, which is more supportive of growth and equities.

In Japan, the Bank of Japan (BoJ) recently reaffirmed its 25bps upper bound for yield curve control on 10-year Japanese Government Bonds (JGBs), and opted to maintain forward guidance of no rate hikes. This indicates Japan’s ultra-easy policy stance is likely to continue for the foreseeable future.

Although China has maintained more restrictive policies in the past year, recently China has taken significant steps to ease policy and add both monetary and fiscal stimulus. The People’s Bank of China (PBoC) cut the 5yr Loan Prime Rate (LPR) – the reference rate for mortgages – by 15bps and reduced the Required Reserves Ratio (RRR) with the intention to revitalize bank lending. China also announced 33 pro-growth fiscal stimulus programs, including tax rebates and reductions, expanded credit support to businesses, and accelerated infrastructure investment. These accommodative policies are likely to support new credit creation and may help rejuvenate China’s economic and corporate profits growth.

Tighter Fed policy, echoed by other central banks around the world, seems to dominate recent news flow. However, we do not want to be geographically myopic and miss opportunities outside the US that are not as burdened by constrictive US policy. Therefore, we increased our portfolios’ exposure to Japan and China. Both Japan and China stand out for their accommodative stances, which appear decidedly counter-cyclical to policies in the US and Europe.

[1] Source: Bloomberg Economic Forecasts, as of June 23, 2022.

About Richard Bernstein Advisors

Richard Bernstein Advisors LLC is an investment manager focusing on long-only, global equity and asset allocation investment strategies. RBA runs ETF asset allocation SMA portfolios at leading wirehouses, independent broker/dealers, TAMPS and on select RIA platforms. Additionally, RBA

partners with several firms including Eaton Vance Corporation and First Trust Portfolios LP, and currently has $15.5 billion collectively under management and advisement as of March 31st, 2022. RBA acts as sub‐advisor for the Eaton Vance Richard Bernstein Equity Strategy Fund, the Eaton Vance Richard Bernstein All‐Asset Strategy Fund and also offers income and unique theme‐oriented unit trusts through First Trust. RBA is also the index provider for the First Trust RBA American Industrial Renaissance® ETF. RBA’s investment insights as well as further information about the firm and products can be found at www.RBAdvisors.com.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. The investment strategy and broad themes discussed herein may be inappropriate for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.

© Copyright 2022 Richard Bernstein Advisors LLC. All rights reserved.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS