For most single-factor smart beta ETFs, tracking errors are driven primarily by a few factors. For small-cap, value, and momentum ETFs, a combination of beta and size tend to dominate. For value and momentum ETFs, the factor is targeted as a secondary source of tracking error.

Low-volatility and quality ETFs both tend to be heavily dominated by beta as the largest sources of tracking error on average. This should intuitively make sense as low-volatility ETFs intentionally target stocks with lower risk profiles than the market, while high-quality stocks are perceived to be less risky than most other stocks due to the stable nature of their businesses.

![]()

![]()

Source: Morningstar, CLS Investments. Data based on holdings as of approximately May 31, 2018.

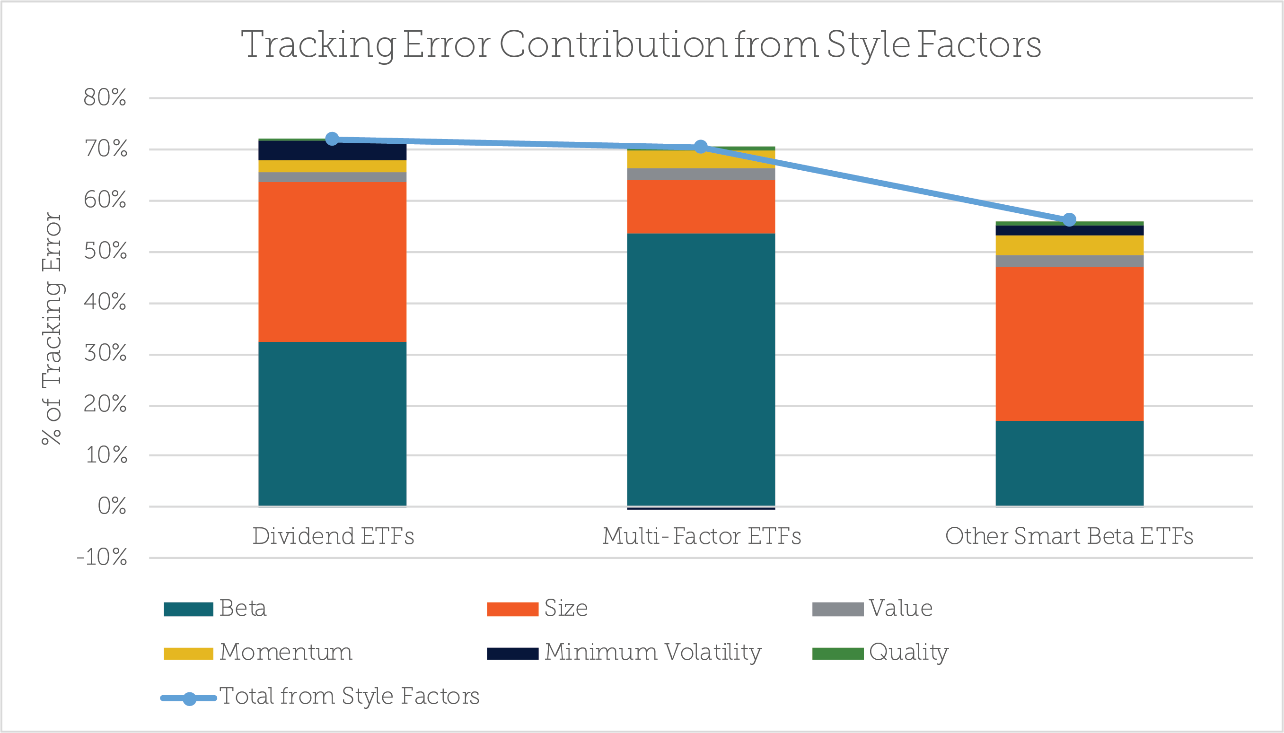

Dividend ETFs, multi-factor ETFs, and our category of other smart beta ETFs all show large sources of tracking error primarily from beta and size.

Source: Morningstar, CLS Investments. Data based on holdings as of approximately May 31, 2018.

As noted previously, dividend ETFs saw a modest positive exposure to size and a negative exposure to beta. Dividend-oriented ETFs aren’t necessarily the largest dividend-oriented stocks. They skew to higher-dividend-yielding stocks, which are sometimes smaller-cap than the overall market but with slightly lower risk profiles.

Multi-factor ETFs have higher amounts of tracking error from beta due to slightly lower risk profiles than the market and a small-cap bias. Other factors, such as value, momentum, and quality, all show up in the data, but they do not drive the overall tracking error of portfolios as much as the market.

Our other smart beta ETFs category is largely made up of risk-oriented or equal-weighted ETFs. Equal-weighted portfolios should have larger tracking errors because they inherently deemphasize large stocks in favor of small stocks

Are You Getting What You Pay For?

In short, yes. But with some caveats. Many smart beta ETFs target what their labels suggest is their intended exposure(s). But there are also unintended biases and bets embedded within them. This can be helpful or harmful depending on how much an investor cares about controlling the source of risk over time.

We continue to believe the evolution of smart beta ETFs is a net positive for investors. However, we also firmly believe that proper evaluation of smart beta ETFs requires rigorous analysis. This should include factor models as they allow investors to cut through the noise and determine whether the cost of each product is worth the intended market exposures. Investors should always be wary of new ideas and methods, but the good news is that there are more analytically sound tools becoming available for advisors to address these challenges.

Joe Smith, CFA, is a Senior Market Strategist at CLS Investments, a participant in the ETF Strategist Channel.

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing. Beta is a measure of the volatility, or systematic risk of a security or a portfolio in comparison to the market as a whole. 1708-CLS-7/16/2018.