By Andrew Rice Partner, Portfolio Manager and Chief Operating Officer

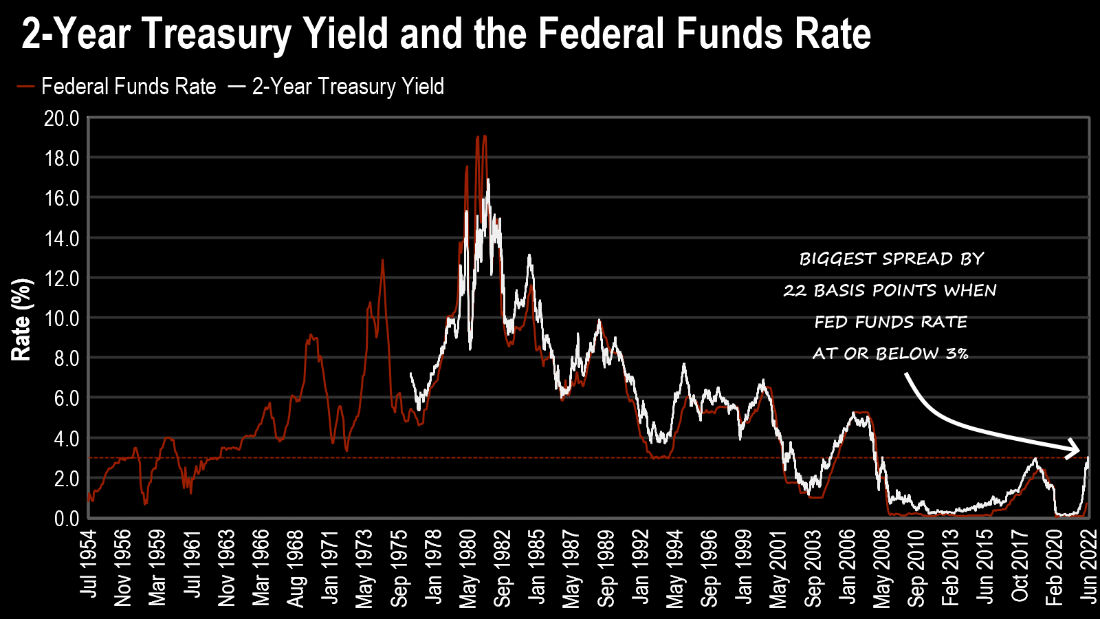

The Federal funds rate is currently targeted between 0.75 to 1.00%,[1] with an additional 50 to 75 basis points on the table this week.[2] The two-year treasury yield has been 40 basis points above the Federal funds rate on average since 1974.[3]

As of April 1, 2022, the last date for which the Fed funds data was available in FRED, the two-year yield was about 210 basis points above the Federal funds rate. Yesterday (June 13, 2022), the two-year yield soared to 260 basis points over the Federal funds rate,[4] which would be the largest spread in the dataset since June of 1976 (when FRED data is available on the 2-year yield).

The spread is especially large considering the currently low target rate, which is well under the average of 4.75% since 1954.

With the market so far ahead of the Federal Reserve’s schedule, it appears poised to absorb an additional 200 basis points of hikes to a target of 2.75 to 3.0%, near where the Federal Reserve had noted market expectations were in their May meeting (3.13%).[5]

A faster rate hike schedule, paired with clarity on where they will take a pause, seems warranted, given where the market for short-term treasuries is currently positioned.

This article was contributed by the Beaumont Capital Management (BCM), a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosures:

Copyright © 2022 Beaumont Capital Management LLC. All rights reserved.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

[1] https://www.federalreserve.gov/monetarypolicy/fomcminutes20220504.htm

[2] https://www.cnbc.com/quotes/US2Y

[3] https://www.federalreserve.gov/monetarypolicy/fomcminutes20220504.htm

[4] https://www.wsj.com/livecoverage/federal-reserve-meeting-inflation-rate-may-2022/card/fed-s-powell-quashes-talk-of-75-basis-point-rate-rise-B04gZgvExaHqd63mbxFq

[5] AIM analysis of Federal Reserve Data accessed via FRED on 6/13/2022 11pm for series DSG2 and FEDFUNDS (all charts and references to data in charts), with data available through April 2022. The FEDFUNDS series is only available monthly, with fed rates reported on the first of each month since July 1954.