By Kostya Etus, CFA – Portfolio Manager

ETFs are a modern marvel, allowing investors to allocate to exposures such as individual countries of all shapes and sizes, including Turkey, through the iShares MSCI Turkey ETF (TUR). Turkey has been beaten up, no question about it, but is the time right to be adding exposure? Let’s try and evaluate that without any discussion about geopolitics, just by looking at the data.

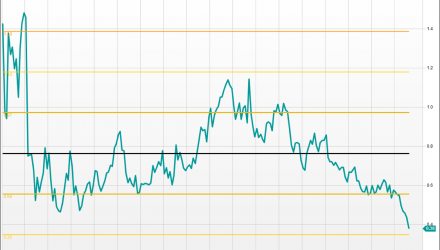

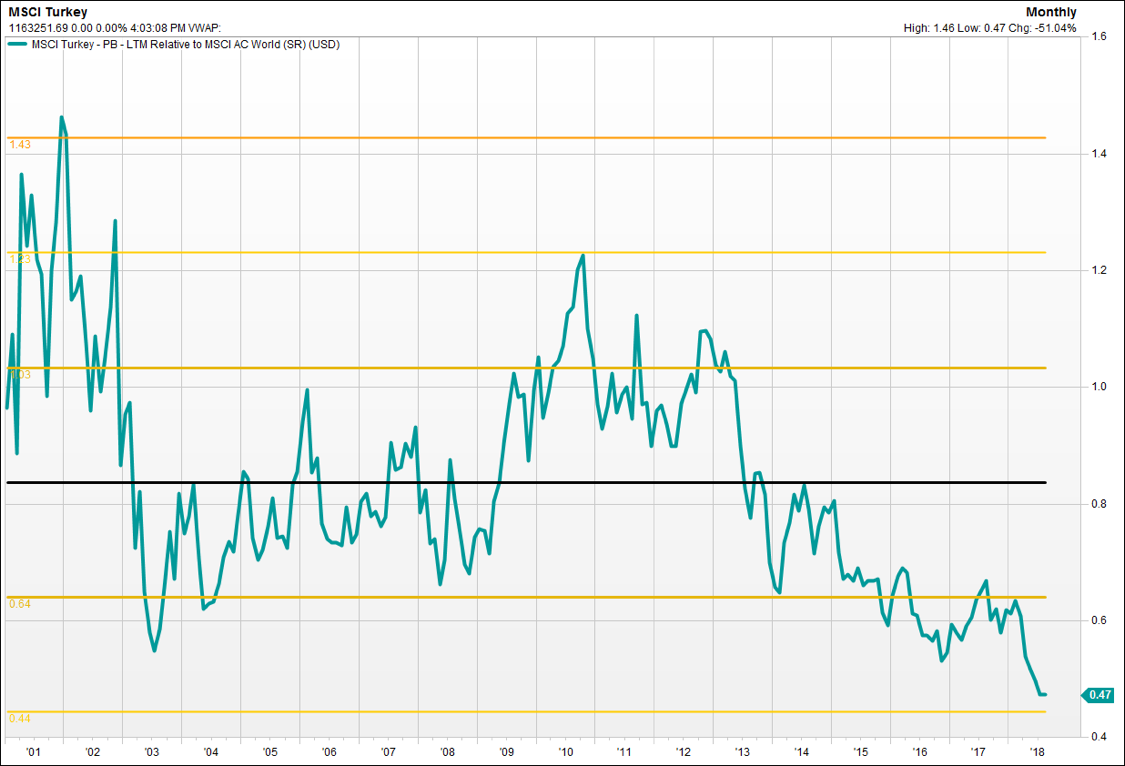

Are valuations attractive?

Of course they are, price-to-sales and price-to-book relative to MSCI ACWI and compared to the historic average since 2001 would suggest that this is the most attractive opportunity we have seen. The yellow lines mark standard deviations away from the average.

All data from FactSet:

Relative Price/Sales

![]()

Relative Price/Book Value

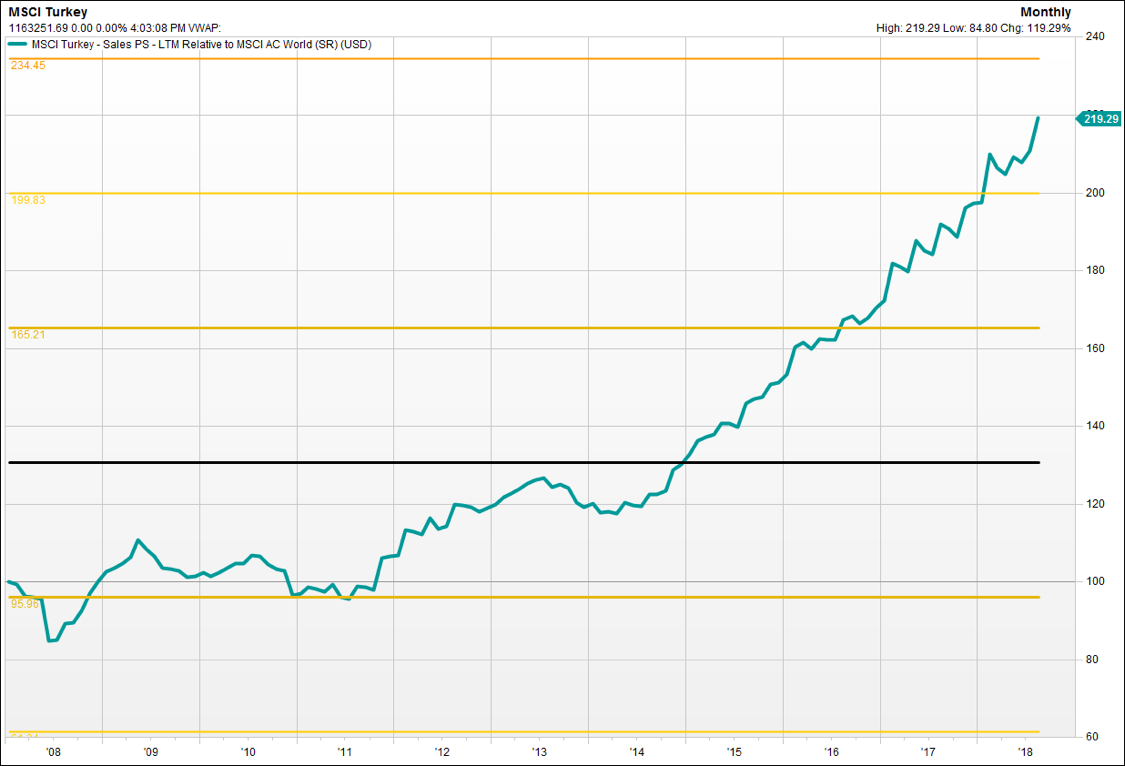

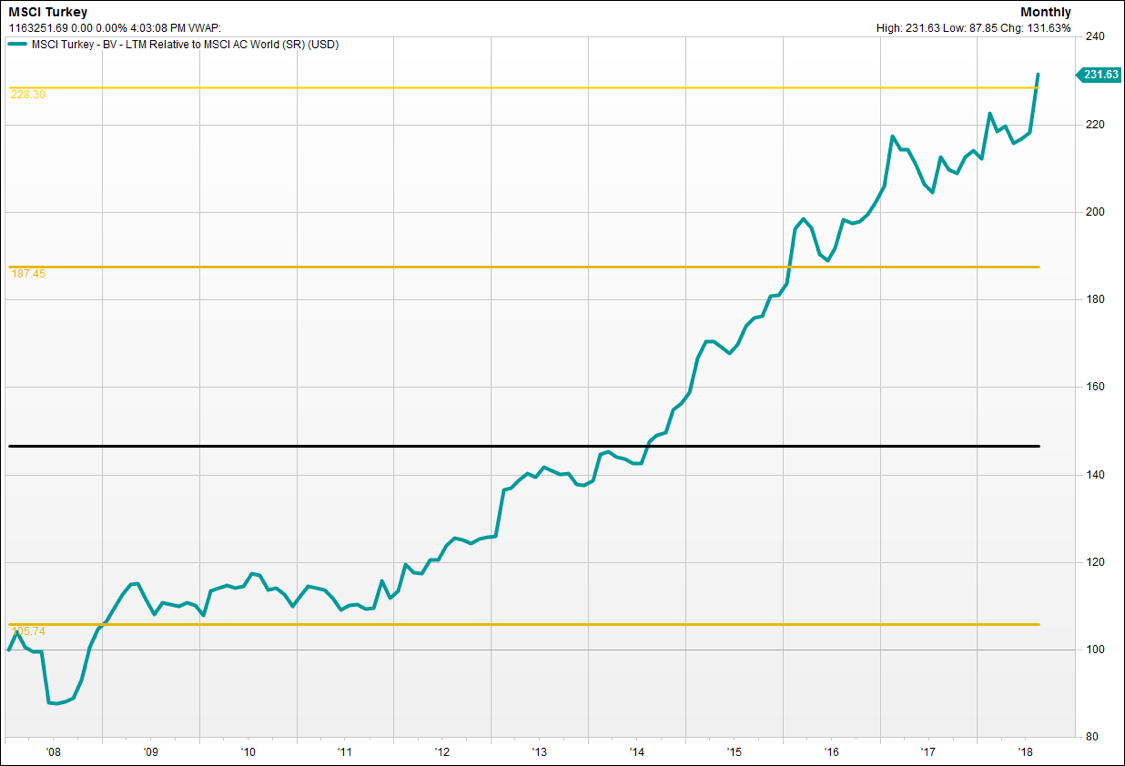

Have fundamentals deteriorated?

What is driving the valuations lower, price or fundamentals? You can see that sales-per-share and book value-per-share relative to MSCI ACWI have grown at a healthy pace over the last few years and remain at quite high levels. Thus price must be the culprit, driven down by negative sentiment (fear and noise) as opposed to corporate performance.

Relative Sales-Per-Share

Relative Book Value-Per-Share

![]()

Is the price weakness simply a function of the currency?

Well the currency (Turkish Lira / U.S. Dollar), over the last couple years did drop to over 3 standard deviations below average. But notice that the Turkish market in local currency terms (relative to MSCI ACWI) fell to over 2 standard deviations below average on its own over that time frame, making it a double whammy.

U.S. Dollar Per Turkish New Lira

Relative Price in Local Currency

I’m almost scared to ask, what does this spell for the price in U.S. Dollar terms?

It is almost a 4 standard deviation event! Something which is extremely rare (about 1 in 16,000 or a daily event that will happen every 43 years). Some investors may prefer to wait for a bottom to establish itself to avoid a falling knife, but deep value investors have to be chomping at the bit as the forces of mean reversion are drawing them in like moths to a flame. Scooping up a little Turkey may be a rare opportunity indeed and follows the old adage – “the time to buy is when there’s blood in the streets.”

Relative Price in U.S. Dollars

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing.