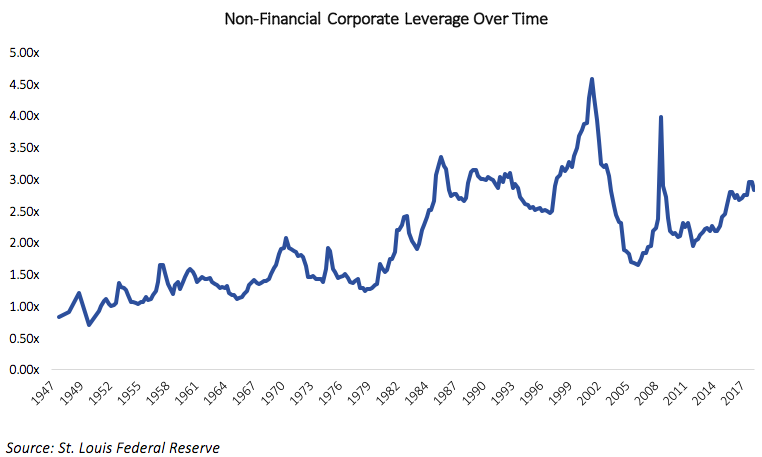

Non-Financial Corporate Leverage is Increasing

As several market observers have written, corporate leverage continues to increase. Specifically, leverage, or the ratio of a company’s debt to cash flow, has increased noticeably among non-financial corporate bond issuers since 2010. Investment grade issuers in this cohort have increased their debt/EBITDA ratios from 2x to nearly 3x in this time frame, according to data from the St. Louis Federal Reserve (see below).

The reasons for this increase in corporate debt are manifold.

Some companies have increased their borrowings in order to accelerate stock buyback programs. Stock buybacks have become increasingly popular with corporate management teams as a way to manage earnings per share and appease activist equity holders, particularly at companies with tepid revenue growth.

Other companies have used the proceeds from large debt issuances to engage in M&A activity, often for the same purpose of ginning up top-line growth.

Regardless of the ultimate use of funds, the simplest reason why corporations have increased borrowing is also the most likely: because they can. Companies are more comfortable than ever with higher leverage and lower credit ratings because the market has not yet punished them for it. Over decade ago, only 25% of investment grade issuers carried a credit rating below “A.” Now, nearly 50% of the Bloomberg Barclay’s Corporate index is rated “BBB.” In addition, the extra spread demanded by investors for investing in BBB-rated credit vs. A-rated credit has hovered in the 40-to-70 basis point range for most of the time period following the 2008-2009 financial crisis. Many CFOs figure that paying an additional 0.50% of coupon yield for lower ratings and another turn or two of leverage is worth the gamble — if it allows them keep equity prices high, since equity returns are often correlated with management compensation.

Strong Equity Performance Has Helped

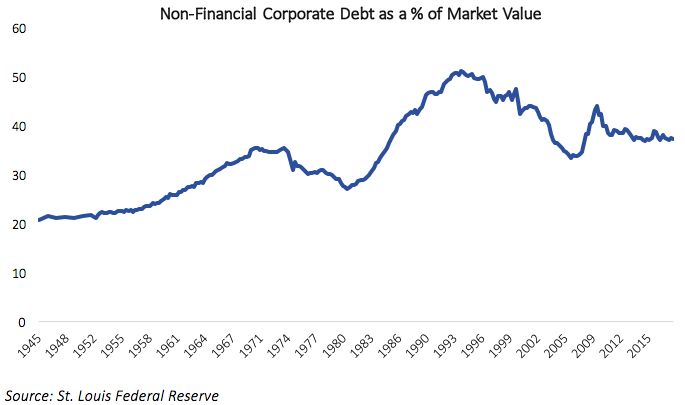

This conflict of interest between management teams and bondholders also drives another self-fulfilling prophecy: borrowing money to help improve equity returns at the expense of credit quality leads to higher equity returns, which leads to more complacency amongst bondholders. Bondholders often look at “equity cushion” as a mitigating factor against increased leverage. They reason that if equity investors are willing to pour money into the capital structure at a level junior in priority to unsecured bondholders, then bondholders should feel relatively more comfortable with the risk of lending to the entity. The strong equity market returns of the past nine years has made the increase in leverage seem less significant to the capital structures of most companies than it actually has been.