By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

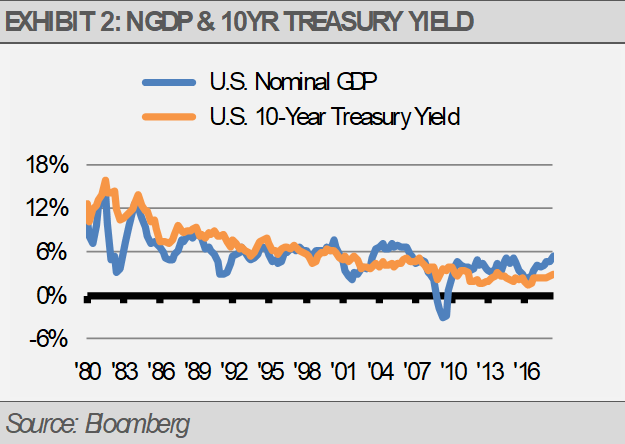

U.S. economic growth will likely moderate as the Fed raises short-term interest rates to curtail inflationary pressure. Manufacturing accounts for more than one-third of our economy and the most recent ISM Manufacturing PMI Index reached its highest level in 14 years (exhibit 1). Based on the latest survey data, we think that the U.S. economy is growing at roughly twice the pace of the Fed’s estimate for our economic growth potential.

To understand where we might go from here, it is important to understand the Fed’s general intentions during the business cycle. Early in a business cycle, the Fed encourages above potential growth in order to repair the damage caused by the previous recession.

![]()

Later in a business cycle, the Fed tends to lean against economic growth by tightening monetary policy, including raising short-term interest rates, to keep inflation in check. While it is difficult to accurately gauge where we are currently in the business cycle, we certainly are in a long cycle compared to the average since 1945. We are probably somewhere in the late expansion part of the cycle and nearing the peak, but we will not know when we hit the peak until we enter a contractionary phase.

We think that economic growth that has been persistently well above the Fed’s estimated potential growth rate is the primary reason that the Fed expects to continue to raise short-term interest rates well into 2019.

DON’T FIGHT THE FED

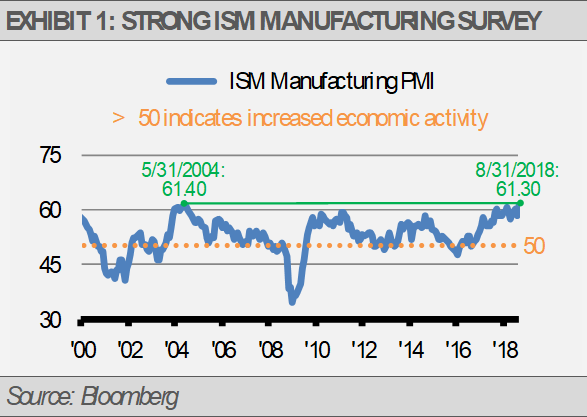

With the Fed continuing to temper economic growth with ever tighter policy, we expect the pace of NGDP growth to slow, but not tip into a recession in the next 12 months. This has important implications for investors. For example, there has been a strong relationship historically between NGDP and long-term interest rates, such as the 10-year Treasury yield. Since 1980, the correlation between NGDP and the 10-year Treasury yield has been 0.70 with an average difference between the NGDP percentage growth rate and the Treasury yield of about zero. As you can see in the following graph, NGDP is currently running well ahead of the Treasury yield (exhibit 2). We expect that gap to close, and given the current Fed policy, the gap will likely close as a result of the NGDP growth rate declining rather than long-term interest rates rising.