Remember the warning by John Bogle during the now infamous interview with Morningstar’s Christine Benz where he said “I think we need to fix the index… My ultimate hope, if you will, is to have an improved let’s say all total bond market index fund for U.S. investors.” [2]

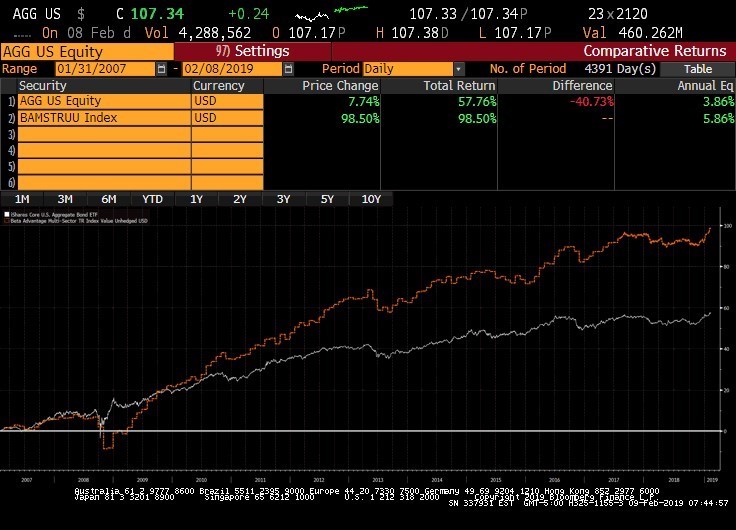

Financial professionals often warn clients “that past performance is not indicative of future results,” so why do so many take comfort in allocating capital to this index? Alternatively, they can search out active or certain rules-based models. Index back tests are always suspect, but for comparison purposes, how is the logic of past performance from a “flawed index” better than evidence from results that validate Mr. Bogle’s viewpoint? Note that the Columbia Diversified Fixed Income ETF (DIAL) follows this index which has outperformed AGG since Mr. Bogle was quoted and even since 2007 shown below. Of course, other active fixed income ETF’s such as PIMCO Total Return ETF (BOND) and the SPDR DoubleLine Total Return Tactical ETF (TOTL) also offer interesting alternative solutions.

“In U.S. We Trust”

Investors and their financial advisors should not be passive about their investment decisions; especially when treasury debt is increasing and is the largest allocation in the Bloomberg Barclays U.S. Aggregate Bond Index. United States Treasury debt in this index is about 38%, but total U.S. Government debt amounts to about 70%. In 2018, the Treasury announced that it issued $1.586 trillion in debt, the largest annual total since 2010. If credit matters and duration carries risk, why do investors not look at actively managed ETFs like the High Yield ETF (HYLD) as part of their alternative bucket. Advisors, investors, and ETF Strategists need to think in a forward manner or run the risk of robotically not adjusting the program to new circumstances. Robotics work when they are run by artificial intelligence which arguably provides long-term adaptive solutions. Thematically, of course, we are strong believers in this trend as defined by Robo Global & AI (ROBO) and its rules-based diversified adaptive approach to index construction. Of course, fixing the Bloomberg Barclays U.S. Agg index may be complicated, but a passive approach to a problem with billions or even trillions of capital at stake simply does not make any sense.

Click here to see disclosures.