Related: The Countries Most at Risk of a Trade War

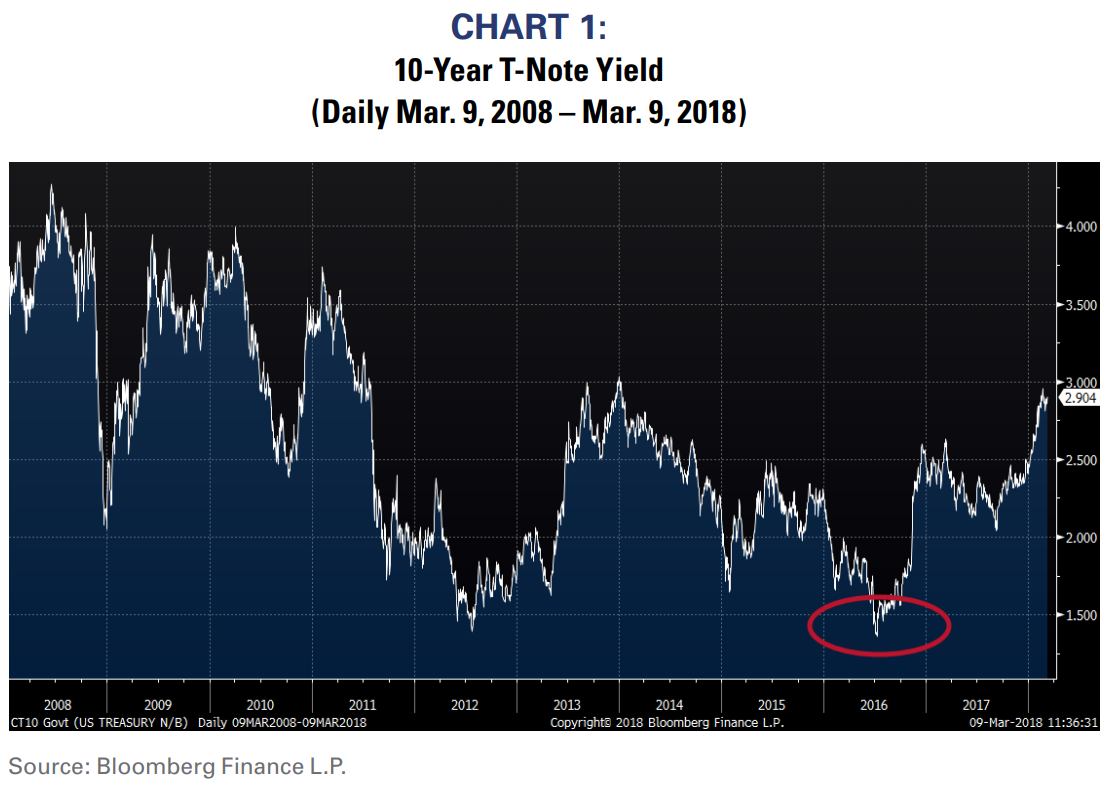

The backup in interest rates has been fundamentally-based. As is typical in a late-cycle environment, inflation pressures begin to grow and interest rates increase. Instituting tariffs on top of these normal late-cycle developments suggests that income-oriented investors should be much more concerned about inflation than they are currently.

![]()

Putting fuel on normal late-cycle pricing power The global economy has significantly changed during the past nine years. As there would be during any economic cycle, there have been early-, mid-, and late-cycle periods. It is RBA’s contention that the US is currently entering a very traditional late-cycle period, and late-cycle periods are often characterized by production bottlenecks and rising inflation. That fundamental backdrop is well underway.

Tariffs could be the fuel on the pricing power fire. There are already production bottlenecks forming within the economy, and pricing power is returning to corporate America. Tariffs are likely to cause prices to increase more than they might normally.

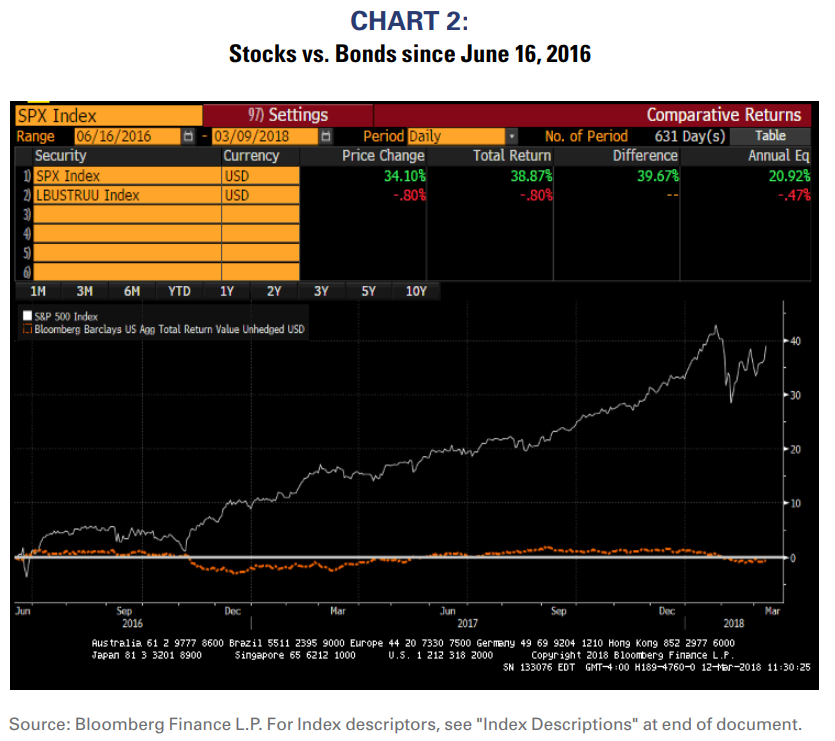

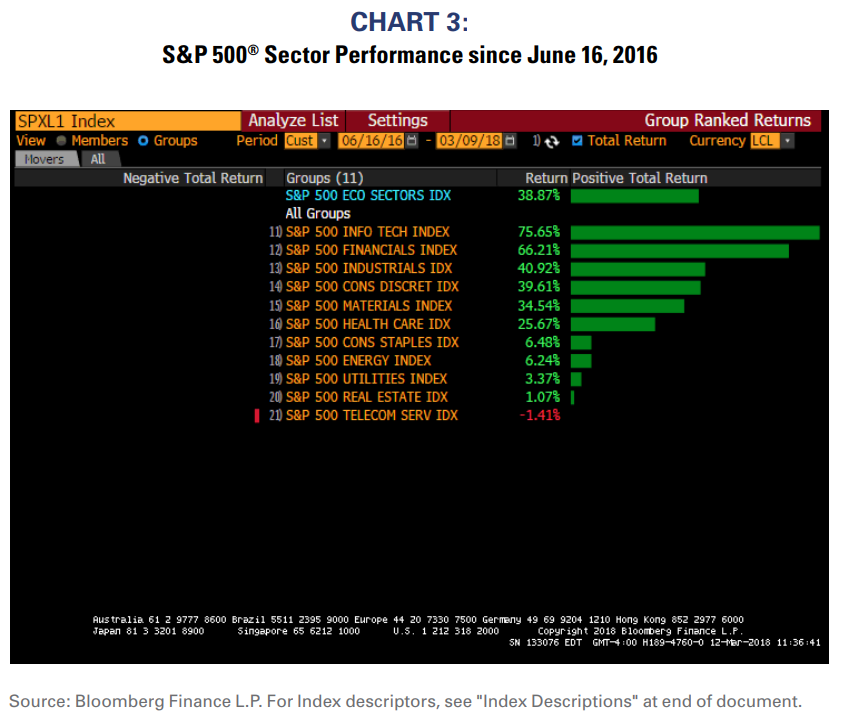

Most investors’ portfolios are not allocated for even a small increase in inflation. The performance of popular fixed-income and equity income strategies has been miserable since inflation expectations troughed in June 2016. Most important, though, is that the underperformance of these popular strategies has come before tariffs were introduced. It would be extraordinarily unique to see these strategies outperform when confronted with even more inflation prone regulation and policies.

The risks in the financial markets are not from inflation. Rather, the risk is that most investors are very poorly positioned for the changing inflation environment, which now includes tariffs.

To learn more about RBA’s disciplined approach to macro investing, please contact your local RBA representative or visit www.rbadvisors.com/images/pdfs/Portfolio_Specialist_Map.pdf.

This article was written by Richard Bernstein, Chief Executive and Chief Investment Officer of Richard Bernstein Advisors, a participant in the ETF Strategist Channel.