By Nick Cerbone

Forward-Looking Views on Upcoming CPI/PPI

- The market will continue to shift the narrative as to whether or not we have reached peak inflation. At Astoria, we believe the more important narrative is that inflation will be stickier than normal and will remain high for structural reasons in the years to come (supply chain issues, corporates have pricing power, end of globalization, etc.).

- As a surge in gas prices in March helped drive CPI to its highest annual reading since December of 1981, some are cautioning that May CPI could see a similar outcome as gasoline prices hit a new record high in the month of May.

- Our view is that a higher-than-expected CPI print will not be good for the overall stock market. The PPI ETF has demonstrated inverse correlation YTD versus the S&P 500 and the bond market, but if CPI surprises to the upside, correlations may increase.

- To put it bluntly, we don’t want the S&P 500 to fall 25-30% as this will impact other asset classes. And if CPI readings increase, the probability of this large S&P 500 decline will increase.

- Per consensus expectations, year over year CPI for May is expected to come in at 8.2%, slightly below April’s reading of 8.3%. Wall Street banks anticipate this steady rate to keep the Fed on pace to increase interest rates by 50 basis points at its next two meetings.

Data Statistics and Time Series Charts

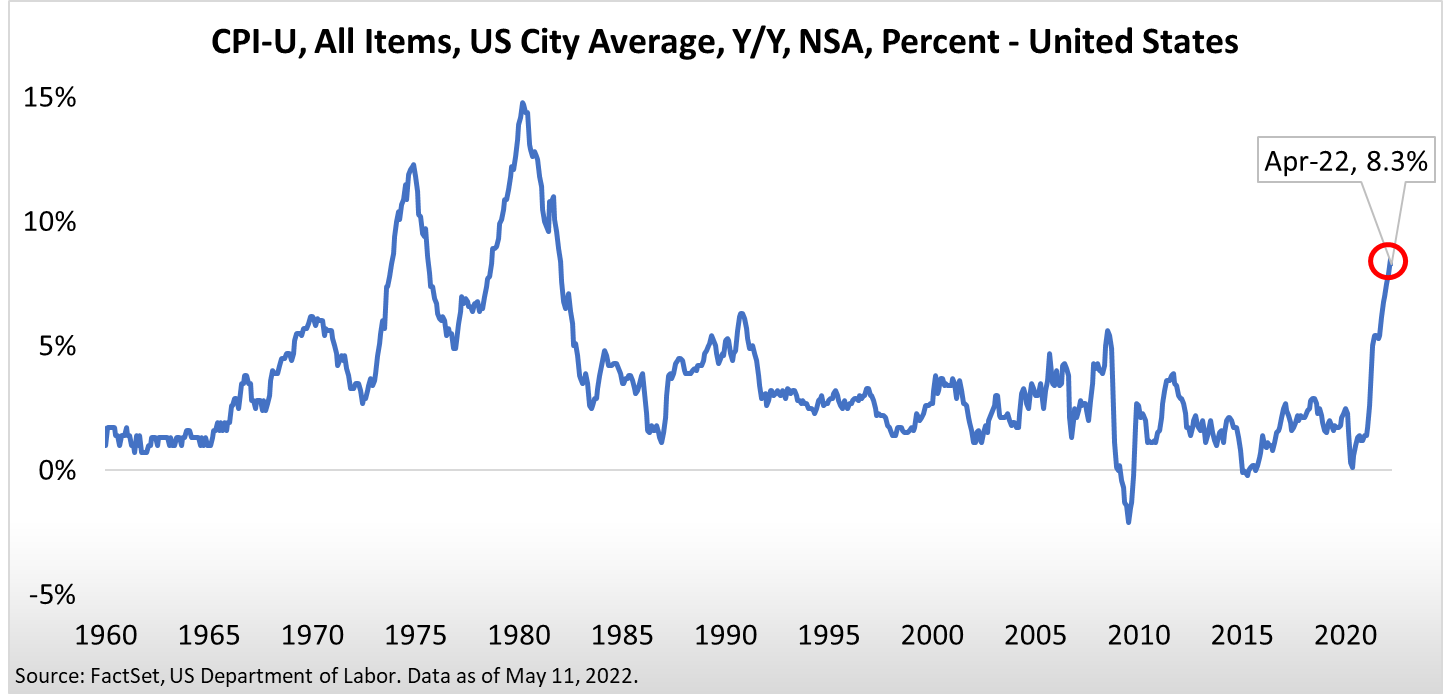

- May 2022 CPI (Consumer Price Index) data are scheduled to be released on Friday, June 10 at 8:30 A.M. As shown in the chart below, April’s CPI rose 8.3% year over year.

Exhibit 1

United States CPI

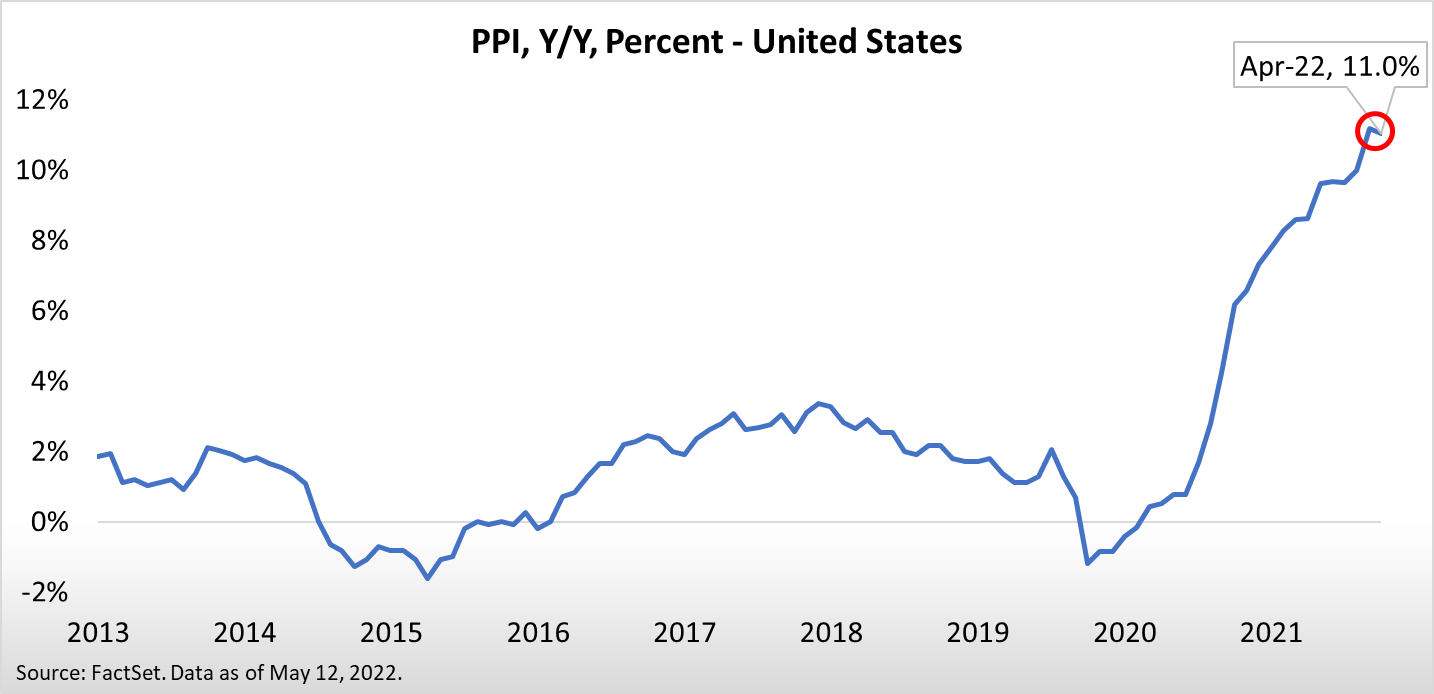

- May 2022 PPI (Producer Price Index) data are scheduled to be released on Tuesday, June 14 at 8:30 A.M. In terms of next week’s PPI measure, expectations point to a 10.7% year over year increase which would fall slightly below the prior month’s measure of 11% as seen in the chart below.

Exhibit 2

United States PPI

Astoria Portfolio Advisors Disclosure: Past performance is not indicative of future performance. Any third-party websites provided on www.astoriaadvisors.com are strictly for informational purposes and for convenience. These third-party websites are publicly available and do not belong to Astoria Portfolio Advisors LLC. We do not administer the content or control it. We cannot be held liable for the accuracy, time-sensitive nature, or viability of any information shown on these sites. The material in these links is not intended to be relied upon as a forecast or investment advice by Astoria Portfolio Advisors LLC and does not constitute a recommendation, offer, or solicitation for any security or investment strategy. The appearance of such third-party material on our website does not imply our endorsement of the third-party website. We are not responsible for your use of the linked site or its content. Once you leave Astoria Portfolio Advisors LLC’s website, you will be subject to the terms of use and privacy policies of the third-party website. Refer here for more details.