![]()

Most definitely, fixed income investors should be watching closely. Howard Schultz has expressed great concern about the $400 billion in interest required to maintain the country’s $21 trillion in debt as well as the fact that 45% of Americans have not saved $400 for a rainy day. To that point, we think ETF investors will be looking beyond the 60/40 type of allocation and look closely at the alternative space. A fund like Eventshares U.S. Alpha Policy ETF (PLCY) offers an opportunity to capitalize on policy change. This fund is actively managed and holds long and short positions in about 50 to 100 companies that have exposure to US government policy and regulation themes identified by the fund’s active manager.

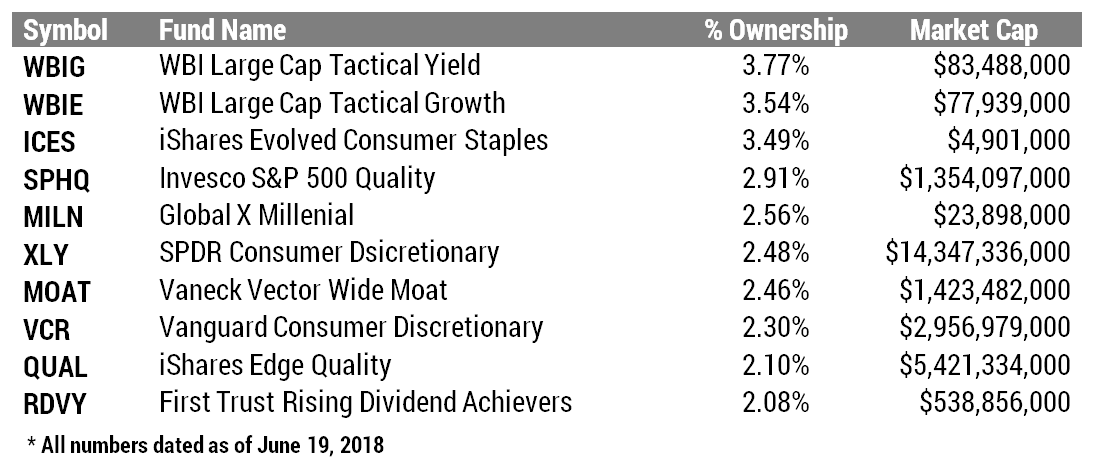

Howard Schultz once said “The hardest thing about being a leader is demonstrating or showing vulnerability… When the leader demonstrates vulnerability and sensibility and brings people together, the team wins.” Howard Schultz and his willingness for self-sacrifice, vulnerability, and sensibilities leads by example, and at 64 years old will remain a leader to watch in the future. We hope that the shareholders of Starbucks don’t take on too much idiosyncratic risk with his departure, but if they do, our list of ETFs could be another way to buy into the Starbucks’ investment approach without as much risk. Thank you Howard Schultz – at Toroso – we will be watching, learning and cheering for your success!

Quote comes from to the following source.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.