A Democratic sweep would be decidedly bullish for municipal bonds. If the Democrats are able to take majority in both the House and the Senate, full attention would be given to rolling back the Tax Cuts and Jobs Act, which lowered the top tax rates for both individuals and corporations. This would bring banks and insurance companies back into the tax-exempt market, thus increasing demand as well as making the tax-exemption more valuable to individual investors as they are again exposed to higher taxes.

The most bearish case for municipals would come with a “red wave”, with Republicans maintaining a majority in both the House and the Senate. With a huge political win for President Trump, the potential to push forward with Tax Cuts 2.0 is something that cannot be fully ignored, yet it is something we are taking very little stock in at this time. Any further reduction in tax rates could have the ability to dampen demand for tax-exempts on the margin.

The discussion surrounding a further 10% tax cut seems to be aimed at helping the middle class, who have felt less of a tailwind from the Tax Cuts and Jobs Act compared to top tax filers and corporations, yet they are not key buyers of municipal bonds. Details are virtually nonexistent on who would actually be defined as “middle class” as well as how these further tax cuts would be structured. With so many of the GOP hopping on board to support this plan so close to mid-terms, it has the feel of a gambit to get voters out to the polls more than any piece of real legislation at this point.

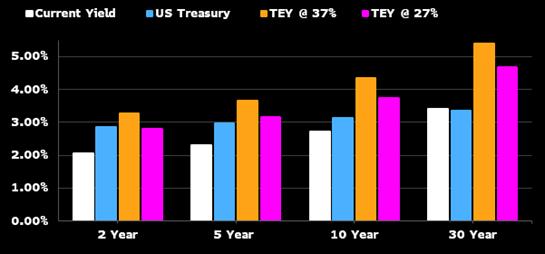

The silver lining is that the value of the tax-exemption should still be able to weather another round of tax cuts. For individuals, even with a worst-case scenario of an assumed reduction of the top tax rate from 37% to 27%, we believe this would have a muted effect with AAA rated municipal tax equivalent yields holding their relative value over U.S. Treasuries with the same duration.

Source: Bloomberg; as of October 25, 2018. Current Yield is represented by Bloomberg Barclays Municipal AAA-rated Muni Indices. The example provided does not reflect the deduction of investment advisory fees and expenses which would reduce an investor’s return. It is not possible to invest directly in an unmanaged index.

While a surprise sweep by the GOP may be initially considered “bearish” for municipals, we think the likelihood of any further tax cuts is remote and may create more attractive entry points for buyers. We believe that municipals will continue to outperform as we progress through the Fed tightening cycle and think there may even be an opportunity to add municipals at more attractive levels should selling pick up as investors focus on upcoming elections.