With St. Patrick’s Day last weekend, we’ve been thinking about gold. More specifically, gold ETFs, of course. While today there are 31 ETPs that focus on gold, 15 years ago it was much harder to purchase this asset. In November 2004, the SPDR Gold Shares ETF (GLD) was launched and investors could easily allocate directly to gold for the first time. Today, GLD is the 20th largest ETF in AUM with over $35 Billion in assets and the iShares Gold Trust (IAU), the second highest gold ETF, is way behind at $11 Billion.

Gold Innovation in 2004

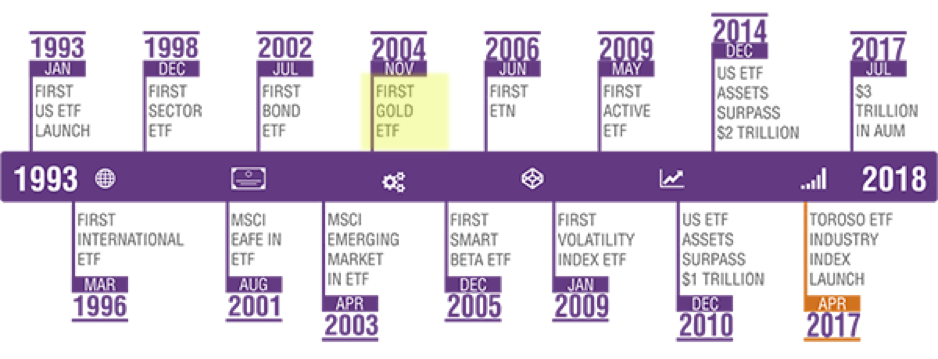

One of the clearest examples of an innovation growth factor for the ETF Industry has been the development of the Commodity ETF category due to GLD’s creation.

![]()

Many things have changed in the last 15 years. There are now 31 ETFs that focus on gold with revenue projected from them to be over $260 million. To better understand the growth, we divided these ETPs into three categories: Direct Gold Price Exposure, Gold Miner Equities, and Leveraged/Inverse/Options.

Gold Focused ETPs

Direct Gold Price Exposure is offered in 7 products. Most attempt physical replication utilizing the grantor trust structure. Although most gold products are taxed as collectibles, there are two exceptions: an ETN, ticker UBG, from UBS which is taxed like a bond and DGL from Invesco which uses Gold futures. The 7 ETPs represent 75% of the ETF assets dedicated to gold and 66% of the revenue. They have an average weighted expense ratio of 0.37%. In addition, there’s an interesting newcomer from Granite Shares, BAR, with the lowest expense ratio of the group at 0.20%.