Quarterly Review

March 31, 2021

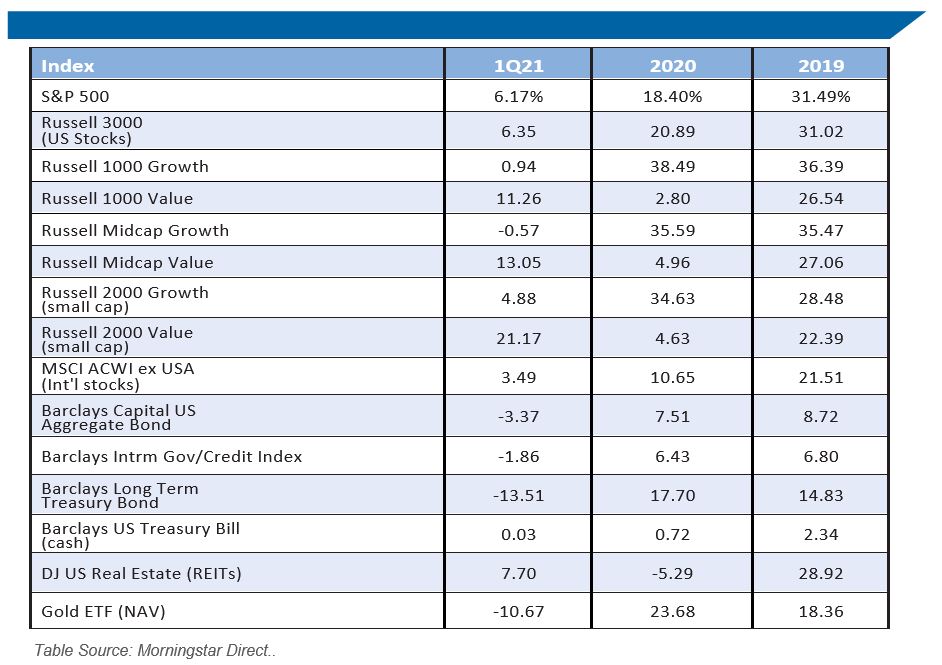

The United States equity market, broadly measured by the Russell 3000 Index, returned +6.4% in the first quarter after a robust +20.9% in 2020 and +31.0% in 2019. Notable strong performance came from the energy and financial services sectors, which, as measured by the S&P Select Services Index family, returned +30.7% and +16.0%, respectively, in the first quarter, as the yield curve steepened dramatically. All sectors posted positive returns in the quarter, but strength was not evenly distributed, with information technology up just +2.2, consumer staples +1.6%, and health care +3.2%. The divide between large- cap growth and large-cap value performance reversed dramatically with the Russell 1000 Growth and Value returning +0.9% and 11.3%, respectively.

Analyst consensus estimates reflect an expected growth in S&P 500 earnings of 23.8% for the first quarter of 2021, the highest year-over-year earnings growth rate reported by the index since Q3 2018’s +26.1%. On December 31, the estimated earnings growth rate for Q1 2021 was 15.8%. Over the last 40 quarters estimates have typically fallen over the quarter by an average of -4.2%. There is no shortage of positive guidance, suggesting corporations may be more resilient than expected to the effects of the coronavirus. And markets likely reflect this. The forward 12-month P/E ratio for the S&P 500 is 21.9. This P/E ratio is above the 5-year average (17.8) and above the 10- year average (15.9).

Outlook

As we end the first quarter of the year, it’s hard to believe all that has transpired since this same time last year. The issues remain similar, but expectations have changed dramatically. The virus is considered contained by many, notwithstanding pockets of evidence to the contrary in various places around the world.

As a result, the U.S. population can be seen in metadata returning to hotels, airplanes, restaurants, and movie theaters. Despite the fact that infection, hospitalization, and death rates are very similar to the surge of summer 2020, Americans appear ready to return to normal. Unlike their U.S. counterparts, France, Germany, and Italy, among others, have imposed or remain under various levels of restriction. Even Sweden, the longtime hold-out on enacting constraints, has recently indicated it will not ease restrictions as the third wave moves through the country. And with the highly contagious and potentially more deadly P1 variant raging in Brazil, the new

| GLOBALT’S KEY POINTS

1. Global debt levels necessitate Modern Monetary Theory. 2. Inflation is an increasing risk but now appears to be transient. 3. The United States dollar is likely to weaken relative to emerging market currencies. 4. The trajectory of rates is largely based on the path of the economy. 5. Fundamentally, risks are skewed to the downside, but unprecedented liquidity is supporting markets. 6. This is an environment well suited to active management. |

U.S. administration will have to contend with the same criticism the Trump administration bore for banning travel to and from China or risk potentially letting the virus proliferate here. It is not entirely clear that the virus and its impacts are in the rearview mirror.

United States economic growth as measured by Gross Domestic Product, or GDP, is a simple function of productivity and demographics. In order to generate longer-term, sustainably higher levels of growth, either the birth rate needs to increase by a large amount or productivity needs to keep increasing. Population growth has been on the decline for decades, the impact of which will linger for a generation. Increasing productivity requires increasing capital expenditures. Global debt is alarmingly high with U.S. debt to GDP is 129%. We sounded the alarm bells when debt exceeded 90% of GDP, which is the threshold at which debt is believed to be increasingly deleterious to growth. We feel that these levels of debt undoubtedly inject increased uncertainty into the future sustainable growth prospects for the U.S. The conditions for 1990’s era growth in the U.S. have not materialized despite unbridled monetary stimulus.

With no end to federal spending in sight and Modern Monetary Theory (MMT) closer to being in full play, it appears the only way out is through. Moving forward means the U.S. will continue printing money. Rising inflation is now a forgone conclusion to many. Incidentally, for the last 10 years, so were rising rates! The current consensus, from a contrarian perspective, is an almost perfect condition for which inflation to remain benign. We believe it is still a good practice to keep in mind the adage – “Don’t fight the Fed.” Fed Chair Powell has been resolute in his assertion that inflation is transient. Inflation stemming from shortages related to a bumpy reflation may be somewhat sticky, but competition will restore equilibrium. Wage inflation will most certainly remain contained. After all the bluster about low unemployment rates, we continue to point out that employment must always be viewed through the lens of participation. Cost-push inflation is likely to be transient and could even turn into disinflation. Without durable government support beyond COVID-19 and without a change in wage formation, demand-led inflation is likely to remain subdued.

Interest rates rose dramatically in the first quarter on expectations for reflation in the U.S. and around the world. Much of the optimism surrounding this reflationary thesis is potentially adequately reflected in current rates – especially if the expected bump up in inflation proves temporary. The structural economic underpinnings of lower U.S. rates remain as they did pre-COVID. In our estimation, the impacts of the virus should be seen as a distraction from the underlying long-term structural fundamentals rather than transformative to them. We continue to believe that slow working-age population growth, sluggish productivity, technological innovation, and very high debt levels will place downward pressure on inflation. Furthermore, high levels of debt and its accompanying servicing costs (interest) coupled with a changing economy and general company fragility have resulted in an inability to weather higher levels of rates. More succinctly, higher rates are a bad option and are unlikely to be allowed to persist.

Sentiment, as measured by almost any metric, is at all-time highs. We pay close attention in particular to hard data, rather than surveys (soft data). Rather, a measure of what people are actually doing rather than what they say they are feeling. For example, investors are utilizing more margin than ever by several orders of magnitude. The chart above shows inflation adjusted deposits in margin accounts. The chart needs little explanation.

In addition, there is no shortage of examples of excessive valuation, optimism, and speculation. Yet it seems as though we’ve been describing these conditions for several quarters, if not years. You can see from the margin chart, the U.S. moved into uncharted territory some time ago. We believe margin “doesn’t matter” until the value of the collateral falls and the collateral has to be sold immediately no matter what the price to cover the margin. Then the conditions for a downward chain reaction are in place, and margin matters very much. One simple required component of a bubble is speculation in excess of the previous bubble, assuming it was not allowed to correct itself naturally with equilibrium restored. Like the Ouroboros, these conditions feed on themselves allowing reasonable rationalization for excesses beyond prior cycles. By the time everyone has convinced themselves there is no bubble, the situation (that there is a bubble) becomes painfully obvious. The events that end periods such as this are necessarily always unanticipated. Markets tend to remain reasonably “orderly” with well-telegraphed developments while the unanticipated generally wreaks havoc. Those who have reached outside of their risk tolerance for reward will be inordinately panicked. The unwinding of the excess proves to be more damaging than the gains from the inflation of the bubble. Discipline will be rewarded as will diversification.

This is not to say we are in a bubble, the deflation of which is inevitable. We are highlighting conditions upon which we are very focused. We have always maintained we aim to win by not losing and that requires being vigilant, focused, and disciplined. For every market, there is a portfolio positioning that protects and participates at the margin. With proper diversification and risk mitigation, bear markets can yield alpha. One only needs to look to bond performance in 2008.

Focus – China

In recent months, China has stepped up its military stance towards Taiwan. There are growing concerns that China may be closer to attacking the island. Beijing claims Taiwan as part of its sovereign territory. An attack on Taiwan would almost certainly warrant a response from the United States and some of its allies. The U.S. arguably is more committed to Taiwan than it had been to Kuwait when the invasion by Iraq in 1990, kicked off decades of strife.

The People’s Liberation Army has flown more regular sorties into the south-western corner of Taiwan’s air defense zone, where the Taiwan Strait meets the Bashi Channel, since last summer. This is a crucial corridor for the Chinese military into the open waters and airspace of the western Paciftc.

Elbridge Colby Wall Street Journal Op-Ed 1-27-21

Defense officials are also sounding the alarm on the possibility. If the People’s Liberation Army expanded a regular presence to the airspace east of Taiwan, it could undermine Taiwan’s security in a drastic manner. The current administration may not possess the fortitude or the appetite to go to the mat with China, as those tensions could set off geopolitical tumult that dwarfs the situation in the Middle East. China may be flexing its defensive muscle in the face of ghastly human rights developments – but what’s new? And China, having handled the virus completely differently, hasn’t suffered the kind of economic scarring seen especially in the U.S. China’s GDP has recovered and surpassed pre-pandemic levels and so is arguably in a stronger position than countries who continue to struggle to contain the impact of the virus.

Our thinking remains largely the same not due to a lack of flexibility or inertia, but rather a dearth of evidence to the contrary. We prefer high-quality, large-cap U.S. equities to international equities, but we’re on the lookout for indications for that paradigm to shift. We are waiting for more evidence.

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. GLOBALT provides professional money management to both institutional and individual investors through Equity, Fixed Income, and ETF Asset Allocation strategies. Registration of an Investment Adviser does not imply any certain level of skill or training.

Valuations in this report are based on information provided by third-party sources. Although the data gathered from third-party sources is believed to be reliable, GLOBALT Investments has not audited or verified the accuracy or completeness of the information. GLOBALT is not responsible for any damages or losses arising from any use of third- party data. Any security, allocation, or weightings described herein are subject to change without notice and no assurances are made that they will remain in a strategy or portfolio at the time you receive this information. Illustrative strategies or portfolios shown may not be representative of strategies or portfolios of existing clients. Performance numbers shown are subject to change without notice. If there are any questions regarding this report, please contact your Adviser or GLOBALT for assistance.

The performance data presented represents past performance, which does not guarantee future performance and future performance may result in a loss. No current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended/offered by the Adviser or GLOBALT), or product referenced will be profitable or equal to past performance levels. The investment return and principal value of an investment will fluctuate, thus when sold or redeemed, may be worth more or less than the original cost. There are risks, including possible loss of principal, associated with investing in securities, including but not limited to erratic or volatile market conditions, financial and debt market risk, geopolitical risk, management risk, liquidity, non-diversification risk, credit, and counterparty risk. Diversification and/or strategic asset allocation do not guarantee a profit nor protect against a loss in declining markets. Investors should carefully consider investment objectives, risks, charges and expenses. Clients are advised that their statements and individual trade confirmations, not this report, are the official records of their accounts and transactions. This and other important information are contained in GLOBALT’s Form ADV Part 2 and Part 3, which is provided by your Adviser and should be read carefully prior to investing. Report calculations and figures should not be relied upon for tax purposes. The information herein is not a substitute for professional tax advice. You should consult your tax advisor for specific questions regarding your own tax situation.

Indexes are unmanaged and it is not possible to invest directly in an index. Index returns shown do not represent the results of actual trading of investor assets. Index returns do not reflect payments of any sales charges, fees, or expenses that an investor would pay or incur to purchase or own the securities that indices represent. The imposition of such fees, charges or expenses would cause actual and back-tested performance to be lower than the performance shown for that index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. There is no assurance such investment products will accurately track index performance or provide positive investment returns.

GLOBALT claims compliance with the Global Investment Performance Standards (GIPS®).

GLOBALT has prepared this material for informational purposes only. It should not be construed as investment advice, a recommendation or solicitation to purchase and / or sell any security.

Content may not be reproduced, distributed, or transmitted in whole or in part, by any means without written permission from GLOBALT. To receive permission or obtain a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 500, Atlanta GA 30339. You can obtain additional information about GLOBALT Investments and its Advisers by accessing IAPD (Investment Advisor Public Disclosure).

NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY