The financial services industry has operated in a falling interest rate environment for decades, which made it relatively easy for financial professionals to find high quality yield sufficient to meet income goals. Everything changed in mid-2020 with a historic spike in rates that hammered valuations and created a more difficult environment for buy and hold fixed income investors. As the smoke cleared, bond investors saw a brief window where bond inventories were again flush with high quality issuance and attractive yields, but that window seems to have recently closed leaving many investors scratching their heads regarding their next steps.

So, what’s the solution? We think one option is to take a more tactical approach to fixed income that can match your positioning with your interest rate and credit outlook. Looking back to late 2020 and into 2021, it was obvious to many that the historically low yield on the 10-year Treasury was a temporary phenomenon. The U.S. Federal Reserve was embarking on an unprecedented rate rise to battle inflation, and the entire yield curve was getting ready to rise significantly.

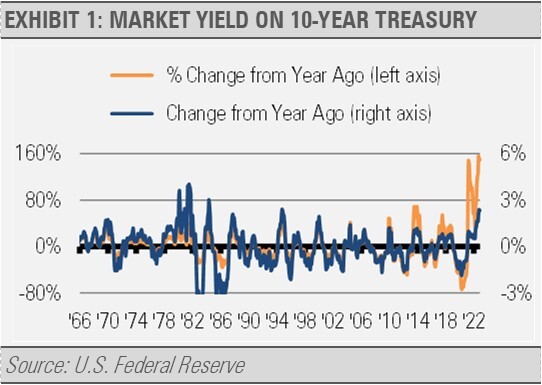

In that environment, it made a lot of sense to own things like Treasury Inflation Protected Securities (TIPS), asset-backed securities, and short term bank loans whose floating rate could benefit from the increase in interest rates. In simple terms, taking advantage of floating rate bonds, reducing your duration, and not worrying as much about your credit risk worked well as the move in rates turned out to be one of the largest percentage changes in yields going back to the late 1960s. These huge interest rate moves were very difficult to navigate if you stuck to using individual bonds in some laddered strategy.

To add onto that tactical approach, using very liquid ETFs can make actively managing and adjusting to exposures and durations much simpler. Our work suggests that we are on the other side of that large interest rate move, and long-term rates have already begun to come down as inflationary pressures decrease, and recessionary risks increase. With ETFs, investors can easily and efficiently move from an underweight in Treasuries to an overweight, while also increasing duration and interest rate risk and decreasing credit risk, which can be more appropriate in a recessionary environment. These moves would be very difficult to manage with individual bonds, especially if you’re trying to diversify across different fixed income types to take advantage of where you are seeing the best value.

We think the flexibility that ETFs afford investors in these volatile markets makes a lot of sense. That is not to say that individual bond investors and advisers who specialize in that area should abandon what they are doing. Quite the opposite, actually. For many investors, finding good quality bonds at a discount with more attractive yields still makes tremendous sense. Innovations in the ETF landscape now provide many excellent options for investors to compliment and tweak a bond strategy to help them better match the environment.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.