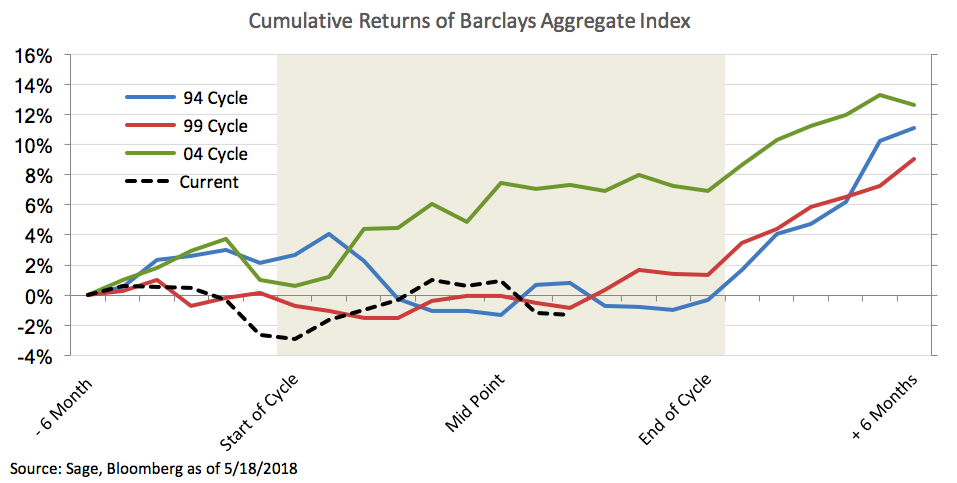

4. The Fed has communicated recently that the current level of Fed Funds is near its neutral rate, which signals to us that the current hiking cycle is in its late stages. Diversified bond returns are close to where they usually are during the Fed tightening cycle, and given the higher yield generation due to rising yields, we expect better returns over the next few quarters.

![]()

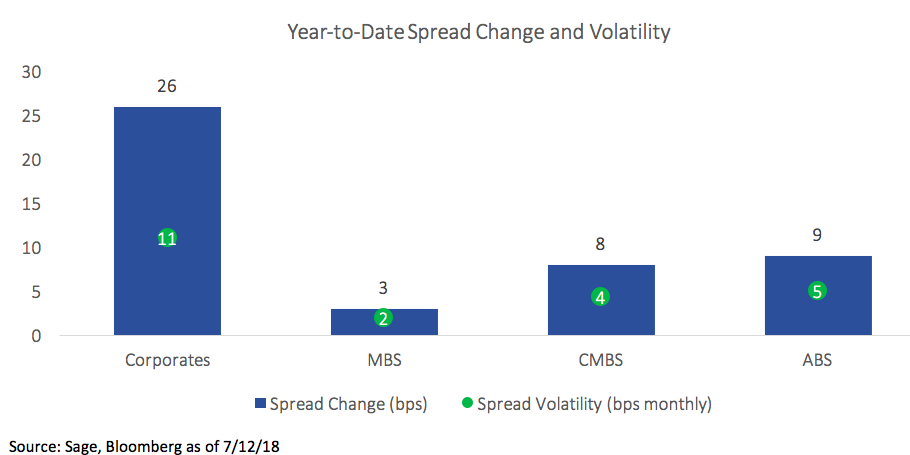

5. Securitized markets provide yield pickup with better a better risk-reward profile than investment grade corporate bonds, which have not seen spreads widen significantly.

To see Sage’s take on equities in charts, click here.

This article was written by the team at Sage Advisory, a participant in the ETF Strategist Channel.