By Jonathan Bernstein, Stringer Asset Management

According to ThinkAdvisor, between 2007 and September of 2016, the number of CFP professionals in the United States grew more than 34% to 75,467*.

In a recent June 2018 report from the CFP Board, that number is now 81,109**. The financial services industry is constantly evolving and the focus of a full service financial advisor is clearly on planning. Many broker-dealers are investing in software integration, platforms and training to enhance this evolution.

As more firms adopt a financial planning model, the competition requires a greater level of sophistication for financial advisors. Risk-tolerance questionnaires are still standard and required for getting a baseline before investing, but the financial plan takes it to another level. Just about every firm offers comprehensive financial planning for their clients to some degree.

What used to be a differentiating factor is now the norm. If everyone is now providing planning, the real differentiation comes in the execution. The plan is just the beginning; the execution of a sound, flexible investment plan is where the science gives way to skill, experience and access to investments.

EXECUTION IS EVERYTHING

Planning is a process that requires time, hard work and expertise. It’s an iterative process and never truly complete, but if done well it can provide a foundation and a framework for managing one’s financial life. Most seasoned planners understand that once the initial baseline is done, the equally-as-challenging implementation and investment management begins.

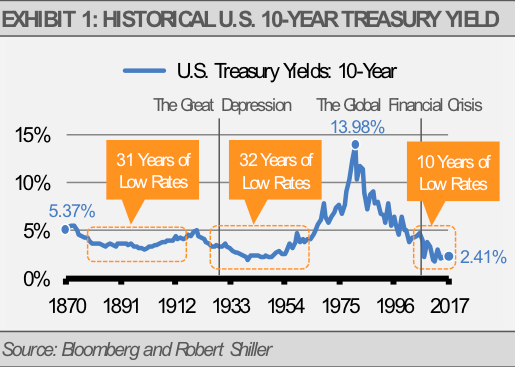

Valuations change, markets move and there is always a fluidity to the financial plan. In most cases, the plan develops a return on investment for a pre-retirement plan and a sustainable distribution rate post-retirement. The investment choices used to appropriately fulfill the plan are highly dependent on markets and more specifically interest rates. Looking across the past few decades one can see how the implementation phase has changed (exhibit 1).

![]()

IMPLEMENTATION MISTAKES TO AVOID

Don’t chase yield. Education is extremely important as investors come to grips with the idea that solving for X cannot be achieved using only fixed income in most cases. The prior chart illustrates how things have changed. Consider the drastic differences in the implementation and investment decisions from year to year, along with how a plan might be adjusted over time. When an investor asks for a yield that is more than the current market offers, there needs to be a conversation about what can reasonably be expected given the current rate environment. Attempting to chase a higher and higher yield often adds a component of risk that is well beyond the tolerance of most fixed income investors (exhibit 2). As rates have fallen, investors now must consider a total return approach. What was achievable with high-quality fixed income 20 years ago may now only achievable with a diversified portfolio of fixed income, alternatives and equity to support the plan assumptions.

Concentration creates risk. When yield is scarce, there are ways to diversify into areas that can increase yield for incrementally more risk. However, concentrating into narrow categories of investments or chasing the hot dot can lead to unintended risk. Simply selecting the investment with the highest yield is tempting and easy. It’s certainly more complicated to create a diversified basket of investments that focuses on income generation, but doing so can be well worth the time, effort and potential cost. Unfortunately, investors that gravitate toward higher yielding/return investments risk unintended concentrations and the associated consequences. These choices seem to make sense until the bubble bursts. Examples over the past two decades are very easy to find and an experienced financial advisor can provide some guidance through first-hand knowledge. Vehicles such as MLPs, REITs, junk bonds, or mortgage securities – just to name a few – have contributed to some of the best plans being derailed and sending folks back to the drawing board and in many cases back to work. Learning from history is the key. Consider instead a diversified basket of various types of securities and understand the correlations, valuations and risk of each to determine the weightings.

Plan for good and bad markets. Planning for a targeted return is typical, but it’s also important to stress-test each plan to understand how various ranges of returns will impact the plan and what might be done in the event of a downturn. Consistency of return is key but hard to come by in volatile global markets. It’s good trivia to know that the S&P 500 Index from 1928 through 2017 returned approximately 10% on average, but important to understand that there are often times when that return does not happen. In fact, there have been 28 years when the S&P 500 Index had a negative return and 19 of those were double-digit negative returns. Today, there are all sorts of products and investments that offer income guarantees and many offer processes for downside protection.

As stated earlier, diversification is critical. Investors might want to consider investments that have the ability to raise cash and potentially offer more consistent returns. It’s important to always make sure all the risks of the chosen investment plan are understood, including liquidity risk. A good advisor will explain the pros and cons of every investment in the plan. Most importantly, have a plan.

Stringer Asset Management’s Cash Indicator is a process for identifying outlier markets and offers the ability to raise up to 50% cash in diversified allocation portfolios. For more information please contact your financial advisor or email [email protected].

This article was written by Jonathan Bernstein, director of sales and marketing at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES