By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Coming off the December correction, the broad equity market has quickly and significantly improved. At this point, we would not be surprised to see the market take a pause to rationalize economic growth expectations, which have been steadily declining. While our signals do not suggest a high risk of recession in the near term, this rationalization may take time given the pace of the stock market recovery.

The U.S. Federal Reserve has effectively shifted from a tightening monetary policy to a neutral policy. Additionally, China seems to also be moving to a more stimulative regulatory environment, and the decline in the pace of economic growth in these regions may be bottoming. In fact, the pace of global economic growth accelerated in February. According to the J.P. Morgan Global Composite Output Index, while manufacturing is showing signs of weakness, other areas, such as financial services, business services, and capital goods, are strengthening.

With the U.S. Federal Reserve’s pivot to a neutral policy, we may have seen a peak in the U.S. dollar exchange rate. A weakening U.S. dollar combined with a decline in bank reserve requirement ratios in China supports an optimistic view for China and emerging Asia more broadly. These factors build on fundamental strength coming from rising U.S. employment and wages coupled with tame inflationary pressure as measured by the 10-year Treasury Inflation Protected Securities (TIPS) spread.

Our view is that economic growth in the U.S. and China will stabilize at more sustainable and constructive rates. This growth should push corporate revenues, earnings, and stock prices higher over time. Any positive developments on U.S.-China trade negotiations would be a bonus to this view.

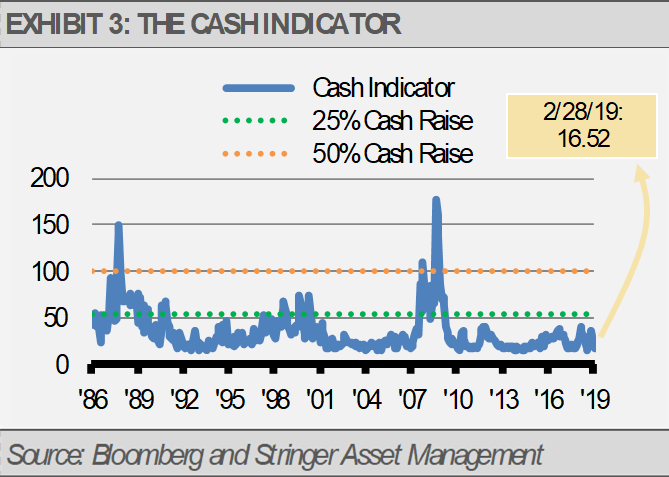

THE CASH INDICATOR

The Cash Indicator (CI) has fallen precipitously since December’s volatility. From these low levels, volatility is likely to return as markets do not move in a straight line. This expectation is consistent with our fundamental view that the global equity markets are due for a pause. Still, the CI is far from suggesting significant risks in the near term.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.