![]() By Rusty Vanneman, CFA, CMT, and Michael Hadden, CLS Investments

By Rusty Vanneman, CFA, CMT, and Michael Hadden, CLS Investments

Baron Rothschild is credited with some timeless advice. “The time to buy is when there is blood in the streets.” As volatility returned this year, it brought shaky investor sentiment back into play. Coming into 2018, U.S. valuations were extremely high, and that didn’t change after a period of strong earnings. Meanwhile, international valuations have been much more attractive. But through the first half of the year, the U.S. has continued its outperformance. That seemed to be amplified during the second quarter as the S&P 500 outperformed the MSCI ACWX by more than 6%.

Digging a little deeper uncovers some interesting prospects. Individual countries followed the S&P much more closely, and some outperformed it. Two countries in a great position for further outperformance are Canada and the United Kingdom. The iShares single-country ETFs (EWC and EWU) give broad exposure to their equity markets. We believe negative sentiment has investors missing the train on some extremely attractive investment opportunities with these two ETFs.

Relative Performance: More than Meets the Eye

The U.S. dollar rallied in the second quarter after extended losses against foreign currencies. This had a large effect on foreign investments. An extreme example was the iShares South Africa single-country ETF, EZA. The fund had a total return of nearly -15% over the second quarter. Without the effect of the U.S. dollar, the ETF’s return was just over -1%. More than 90% of the country’s negative return was due to a weakening local currency. It is important to consider both sides of a single-country ETF’s return: the local stock market performance and the local currency performance against the U.S. dollar.

Of course, this can go both ways. When the dollar weakens, such as it did in 2017, foreign ETFs receive a performance boost from the added strength of the local currency. Both EWC and EWU suffered from dollar strength hurting their second quarter returns. EWC saw about 200 bps of negative performance attributable to currency performance, while EWU saw more than 600 bps. So not only have their stock markets been beaten up, their currencies have taken it on the chin, setting up multiple opportunities for outperformance in the future.

So why is there so much angst toward foreign companies? It could come back to a home bias. With talk of trade tensions and higher volatility, investors commonly view the U.S. as the safer place to invest funds. But with valuations extremely stretched, we believe the U.S. may be hit harder if worldwide economic growth slows and we enter a bear market – another reason EWC and EWU are attractive.

Divergence in Valuations

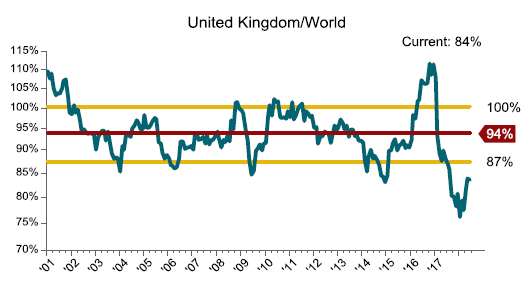

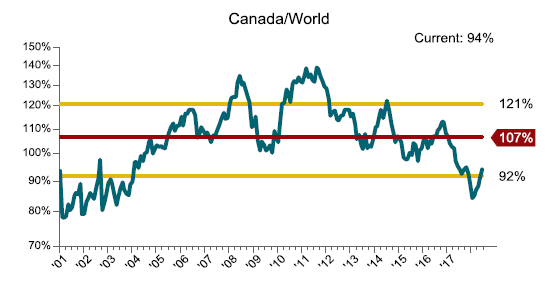

Undervalued securities tend to outperform in the long run. This is why we, at CLS, keep valuations at the forefront of our decision-making process. Both the U.K. and Canada are far below their historical relative valuations to global markets as shown in the first charts below. With the U.K. more than one standard deviation below and Canada right at one standard deviation below, both areas look like great bargains compared to the rest of the world.

Looking a little deeper provides another interesting story. Although relative prices in both countries have continued to plummet, the EPS of each country has rebounded nicely. This can be seen in the second group of charts below. The top chart for each country shows the country’s index price relative to ACWI, while the second chart shows EPS for the country relative to ACWI. This combination even further compresses the price-to-earnings ratios, causing the countries to appear undervalued when fundamentals have indeed improved.