![]()

Sentiment: A Short-Term Driver

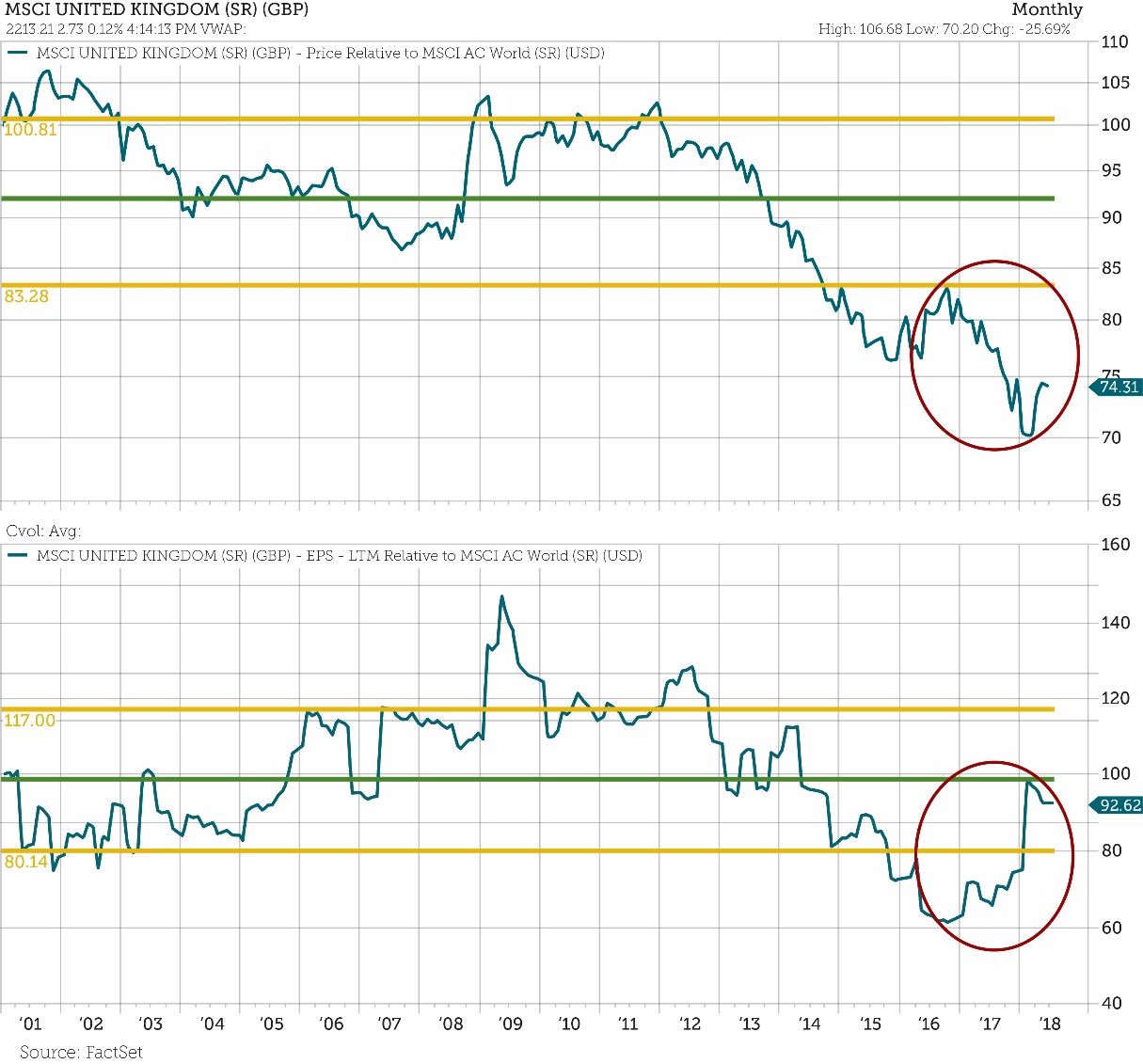

In both breakdowns, prices continued to sell off even though EPS has improved and now steadied near historical averages. We believe investor sentiment is a likely culprit. The U.K. has experienced ongoing unease due to Brexit concerns, and various geopolitical risks have dominated headlines this year. But while geopolitical news may drive prices in the short term, investors must remember fundamentals drive stock market performance in the long term, and fundamentals have been improving in the U.K. It is only a matter of time that the negative headlines will fade and favorable market fundamentals will again drive performance.

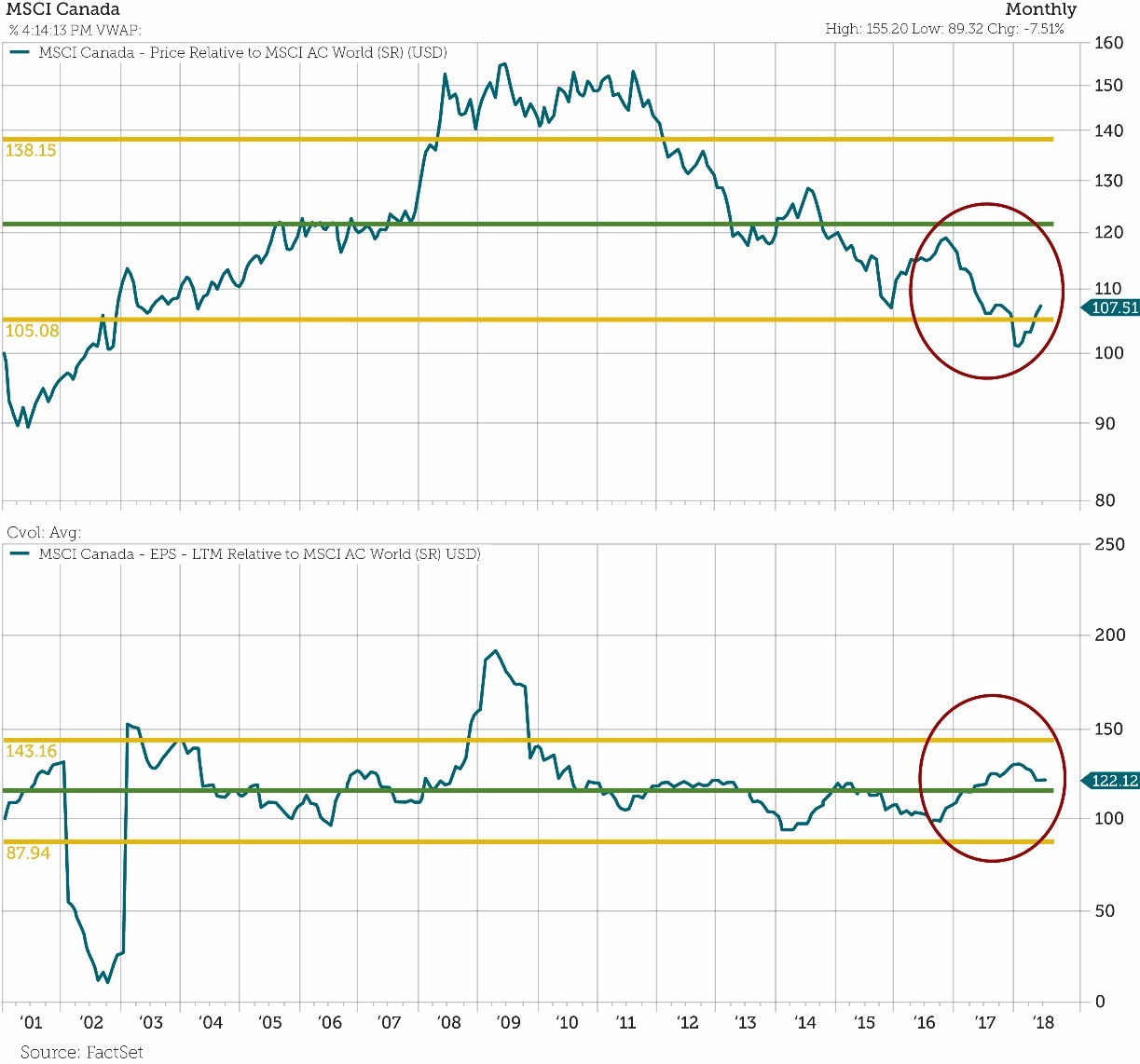

Canada is seeing a similar situation that is more focused on the energy industry, which is a big driver of the Canadian economy. Energy companies had been beaten up as oil prices dropped significantly over the last couple of years and they were forced to take heavy losses. But the lower oil prices prompted many to become leaner and more efficient to survive in the changing environment. Now that oil prices have risen by 50% this year, energy companies are positioned to have outstanding earnings. They have not yet seen the same boost as oil, but this could be due to the lingering negative sentiment toward the sector.

Investors Rejoice When Blood is in the Street

When many markets are overvalued, it can be difficult to find attractive valuations. But negative sentiment has opened the door to an opportunity in EWC and EWU. The combinations of beat-up stock markets, beat-up local currencies, negative sentiment, and rebounding earnings has set the stage for future outperformance.

Not only do these countries appear to be on sale, but they have improving fundamentals that could drive future returns. Scared investors can stay on the sidelines or hold tight to their domestic securities as volatility shakes out the markets. But as active managers, (to paraphrase Mr. Rothschild) we should rejoice when blood is in the streets.

This article was written by Rusty Vanneman, Chief Investment Officer, and Michael Hadden, Investment Research Analyst. at CLS Investments, a participant in the ETF Strategist Channel. Rusty can be reached at [email protected].

Disclosure Information

The views expressed herein are exclusively those of CLS Investments, LLC, and are not meant as investment advice and are subject to change. No part of this report may be reproduced in any manner without the express written permission of CLS Investments, LLC. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person. You should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed here and should understand that statements regarding future prospects may not be realized. You should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not a guide to future performance. Investing in any security involves certain systematic risks including, but not limited to, market risk, interest-rate risk, inflation risk, and event risk. These risks are in addition to any unsystematic risks associated with particular investment styles or strategies. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing. 1749-CLS-7/27/2018