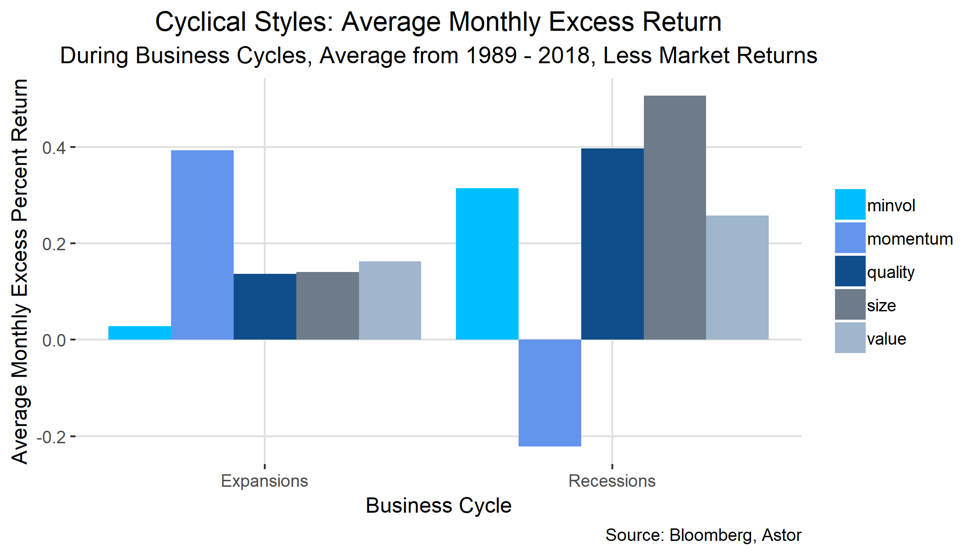

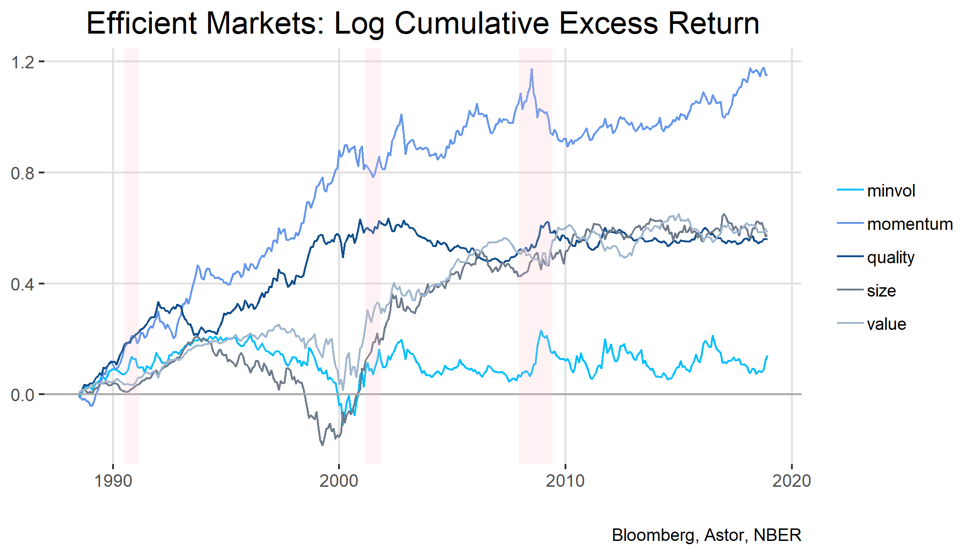

Investors should seek to understand what drives factor outperformance versus the broader market. One school of thought, conceived by Eugene Fama, posits that markets are largely efficient (the aptly named efficient-markets theory) and therefore factor returns are gained from exposure to a long-term risk premium and systematic sources of risk. The other camp, led by Robert Shiller, alleges that behavioral biases in the market (errors-in-expectations, loss aversion) lead to greater returns.

Traded Out?

Over the past decade, however, “smart beta” seems less “smart” and more “beta”. Outside of momentum, many factors (and in particular, value) have languished against the market writ large. If you tend to believe that markets are efficient, and that factor returns are driven by temporary market inefficiencies, this decay would not surprise you, as temporary inefficiencies should be arbitraged away after discovery.

The broader takeaway is that factors likely do have a role to play in a portfolio but should not be the sole determinant of asset allocation. Macro variables, like the aggregate economic outlook, should be used in concert with security level characteristics when seeking appropriate sources of alpha.

Disclosure Information

All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. Astor and its affiliates are not liable for the accuracy, usefulness or availability of any such information or liable for any trading or investing based on such information. 2019-1