By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Factor investing has gained in popularity over the past several years with the emergence of smart beta ETFs. The concept, however, is not new. For decades, active managers have favored different factors and employed them within their investment processes in an attempt to add value. As demand for less expensive index strategies has grown, smart beta ETFs fill a spot somewhere between just pure indexing and active management. Taking a market index and applying a screen to tilt toward factors, such as value, size, momentum, and quality, can add value over time when used correctly. However, the different factors have some degree of cyclicality making it a good idea to diversify your exposures. Multifactor ETFs, which provide several different factor exposures in one product, can be a good option for diversifying the exposure.

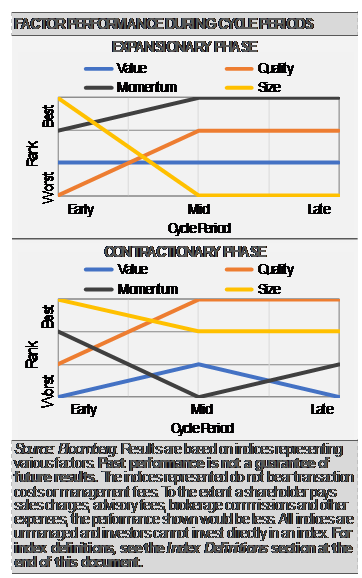

Just as value stocks fall in and out of favor relative to growth stocks, different factors will move in and out of favor relative to each other based largely on the macroeconomic environment. This makes a strong case for diversification across factors. While no two business cycles are the same, when looking at factor performance over several past cycles (April 1991 through June 2009) there are some patterns that can be seen where certain factors tend to outperform or underperform at different stages. This suggests that there may be value in tilting heavier to one factor relative to another depending on the environment, however, the results overall suggest a more diversified approach.

For example, momentum proved to be a clear leader during cycle expansions. Results during contractions were more mixed, which suggests in a stronger macroeconomic environment with generally positive equity performance a tilt toward momentum equities could add value. Another interesting pattern was that smaller sized companies experienced better relative performance in the early and late stages of contractions, even leading into the early stages of expansions.

The data also shows that value seems to be the worst performer during contractions, suggesting an underweight to value during most stages of contractions. However, this may be the result of stress in the financial sector during the periods under review. Conversely, quality often leads momentum during contractions with the majority of its stronger relative performance during the late stage.

Factor exposure has been shown to add value over the general market over time, however, in our opinion it is just as challenging to time factor exposure as it is anything else. At this point there is limited data which creates even more of a case in support of a multifactor approach. Multifactor ETFs can provide a diversified approach to allocating a part of the portfolio to factor exposure. The universe has grown significantly lately and many multifactor products have a static mix of several factors. More recently, we are seeing additional products with a greater active approach which may underweight or overweight factors based on top down views. Regardless of the approach, there is a strong case for diversifying factor exposure due to the difficulty in timing factors.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES